In today’s fast-paced world, understanding money management is a pivotal skill every teenager should develop. With the absence of traditional financial education in many schools, teens often find themselves lost when it comes to budgeting, saving, and investing. This article highlights essential lessons for teenagers on money management and provides insights into valuable resources, including engaging money management videos for teens.

Introduction to Money Management for Teens

Money management is an essential life skill, especially for teenagers who are beginning to earn their own money, whether through part-time jobs, allowances, or entrepreneurial ventures. Teaching these skills early on not only empowers them to make informed financial decisions but also fosters a sense of independence and responsibility.

Understanding the Basics of Money Management

The foundation of effective money management lies in understanding a few key concepts: income, expenses, budgeting, saving, and investing. By grasping these concepts, teenagers can better navigate their financial futures.

Key Concept 1: Income

Income is any form of money that comes into a teenager’s possession. This can include wages from a job, gifts, or monetary rewards for completing tasks. It’s crucial for teens to understand where their money comes from and how consistently income can change based on various factors such as hours worked or job availability.

Key Concept 2: Expenses

Expenses represent the money that goes out. Understanding needs versus wants is vital. By distinguishing between essentials (like groceries or school supplies) and discretionary spending (like entertainment or dining out), teens can manage their finances more effectively.

Key Concept 3: Budgeting

Creating a budget is perhaps the most effective way to manage money. A budget helps track income and expenses to ensure that spending doesn’t exceed earnings. Teaching teens how to build and stick to a budget lays a strong financial foundation that can benefit them throughout life.

Engaging with Money Management Videos for Teens

To further enhance their learning experience, teens can watch various money management videos tailored specifically for their age group. These engaging resources offer practical advice in a digestible format, making it easier to understand complex concepts.

Benefits of Money Management Videos for Teens

Money management videos for teens can provide relatable examples, humor, and visual demonstrations, making learning fun and memorable. Below is an engaging resource to kickstart their financial education.

Essential Money Management Lessons

Lesson 1: Saving is Key

One of the critical lessons for teens is the importance of saving. Developing the habit of saving money can have a profound impact on financial wellness. Start by encouraging teens to set aside a portion of their income for short-term goals, such as a new gadget, and long-term goals like a college fund or a car. This instills a sense of discipline and foresight.

Lesson 2: Understanding Interest and Credit

While credit cards may seem tempting, it’s essential for teens to understand how interest works and the responsibilities that come with using credit. Money management videos for teens often explain these concepts with relatable scenarios, helping to highlight the importance of maintaining a good credit score and avoiding debt.

Lesson 3: Setting Financial Goals

Encouraging teens to set achievable financial goals can empower them to take control of their financial health. Whether it’s saving for a video game or a bigger expense, having a motivating target can keep them focused and committed to their savings plans.

Lesson 4: Making Smart Spending Decisions

Teach teens to think critically about their spending habits. For instance, before making a purchase, they should ask themselves if the item is truly needed or if it’s just an impulse buy. Discussing the concept of opportunity cost can also be valuable, demonstrating that spending money in one area might mean they forego spending in another.

Lesson 5: Introduction to Investing

It’s never too early to introduce the basics of investing. While many teens may not have the capital to invest substantially, discussing the power of compound interest and how investing works can foster a long-term mindset toward money. Money management videos for teens often break down these complex ideas in a real-world context, making them accessible and engaging.

Lesson 6: Managing Unexpected Expenses

Life is unpredictable, and unforeseen expenses can arise. Whether it’s a car repair or medical bill, teaching teens to maintain an emergency fund is vital. Saving for emergencies ensures they’re prepared for the unexpected and reduces reliance on credit cards or loans.

Learning Through Real-Life Examples

One effective way to teach money management is through real-life examples. Talk to teens about financial choices that family members or friends have made and the outcomes of those choices. Discussing both successes and mistakes can provide practical insight into the importance of diligent money management.

Utilizing Online Resources and Money Management Videos for Teens

In addition to educational videos, many websites offer interactive tools, budgeting apps, and financial calculators tailored for young learners. Encouraging teens to leverage these resources can make managing money a more straightforward and engaging process.

Concluding Thoughts on Money Management for Teens

By equipping teenagers with essential money management skills, we set the stage for a financially literate generation. Whether through family discussions, online resources, or engaging money management videos for teens, fostering this knowledge can significantly enhance their confidence and competence in handling finances. As we dive into an ever-evolving financial landscape, it’s imperative that young people learn to navigate money matters wisely, ensuring their future success.

Investing in their financial education today means they’re prepared for any financial challenges tomorrow may bring.

Resources for Money Management Videos for Teens

As a final note, consider compiling a list of trusted resources where teens can find valuable financial education. Whether these are channels on social media, dedicated financial literacy platforms, or informative websites, making knowledge readily available is crucial to supporting their financial journey.

Let’s Empower Our Teens

By embracing the principles of money management and utilizing the wealth of resources available, we can help guide teens toward achieving financial independence. Remember, the journey to financial literacy begins with the first lesson learned today.

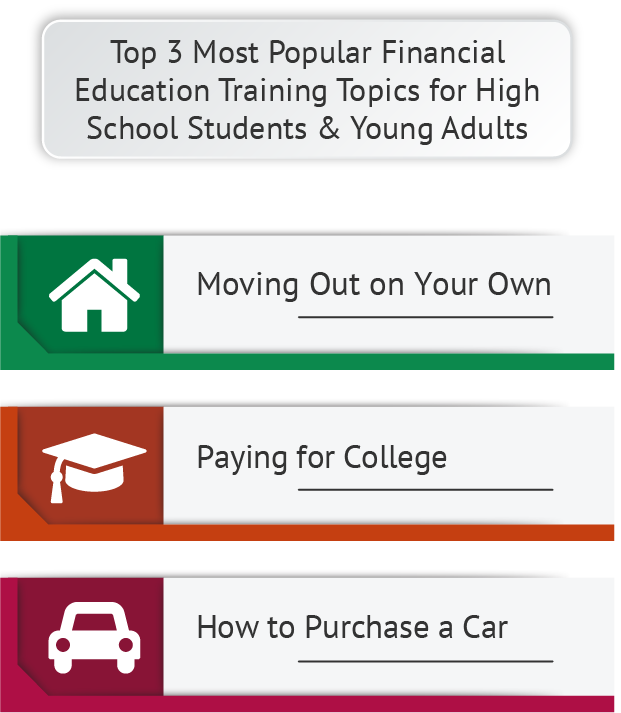

Visual Learning on Money Management for Teens

Using visual aids can effectively enhance a teen’s understanding of financial concepts, reinforcing what they’ve learned through videos and discussions. So encourage your teens to explore, ask questions, and never stop learning!