We all dream of having our cash work hard for us while we sip piña coladas on a beach somewhere, right? But, alas, the reality of life often pulls us back; bills need paying, groceries need buying, and the occasional coffee run can’t be ignored! Luckily, there’s a way to get closer to that dream: enter the magical world of stocks for passive income! Say goodbye to 9-to-5 drudgery and hello to a life where your money grows faster than a weed in the garden!

What Are Stocks for Passive Income?

So, what exactly are these mystical stocks for passive income that everyone’s raving about? In simple terms, these are shares of a company that can generate revenue for you without you lifting a finger! Well, maybe one finger if you count clicking your mouse to buy them. But besides that, it’s a beautiful, hands-off experience. These stocks make money while you binge-watch your latest Netflix obsession or try to remember where you left your car keys.

Stocks for Passive Income: Your New Best Friend!

If you think about it, owning a stock is kind of like adopting a pet. Initially, you invest a little – usually in the form of cash – and then after nurturing it with careful attention, you get rewarded with some serious dividends! How’s that for motivation? Of course, just like a pet, not all stocks are created equal. Some will bring you joy, while others might chew your shoes. So, let’s break it down!

Choosing the Right Stocks for Passive Income

Here’s the kicker: not every stock will lead you to financial freedom. You’ve got to look for companies with strong fundamentals (the equivalent of a well-trained dog). Look for stable growth, solid earnings, and a track record of rewarding shareholders. The more you study these attributes, the better your chances of finding those golden stocks for passive income!

Types of Stocks for Passive Income

When it comes to finding stocks for passive income, you can scout out various options. Dividends, for instance, are like quarterly treats! Some stocks hand out dividends regularly, so you can count on them for that extra dough. Here are a few types you may want to consider:

- Dividend-Paying Stocks: These beauties give you a share of the company’s profits simply for owning them. It’s like being part of an exclusive club that rewards you just for being a member!

- Real Estate Investment Trusts (REITs): Picture yourself as a landlord without the drama of yelling at tenants! REITs pay out dividends from rental income.

- Mutual Funds and ETFs: If you want to diversify your stocks for passive income but don’t know where to start, consider mutual funds or exchange-traded funds (ETFs). They bundle various stocks into one package, like a mixed snack bag with fewer calories!

Benefits of Stocks for Passive Income

Now that we’ve covered the stock landscape, let’s discuss the amazing benefits of integrating stocks for passive income into your financial plans. Seriously, it’s like adding chocolate chips to your cookie dough – it just makes everything better!

- Financial Freedom: Investing in stocks can potentially yield a steady cash flow that moves you one step closer to quitting that soul-crushing job.

- Inflation Hedge: Stocks for passive income can grow with inflation. When prices go up, so can your paycheck from dividends. Cha-ching!

- Compounding Interest: Reinvest those dividends, and watch your money grow faster than you’d believe – just like that magical beanstalk!

Getting Started with Stocks for Passive Income

Ready to dive into the wonderful world of stocks for passive income? Grab your favorite beverage and let’s break it down into bite-sized pieces.

- Educate Yourself: Know the basics of investing, stock market terms, and strategies. A little research goes a long way, and knowledge is a powerful tool!

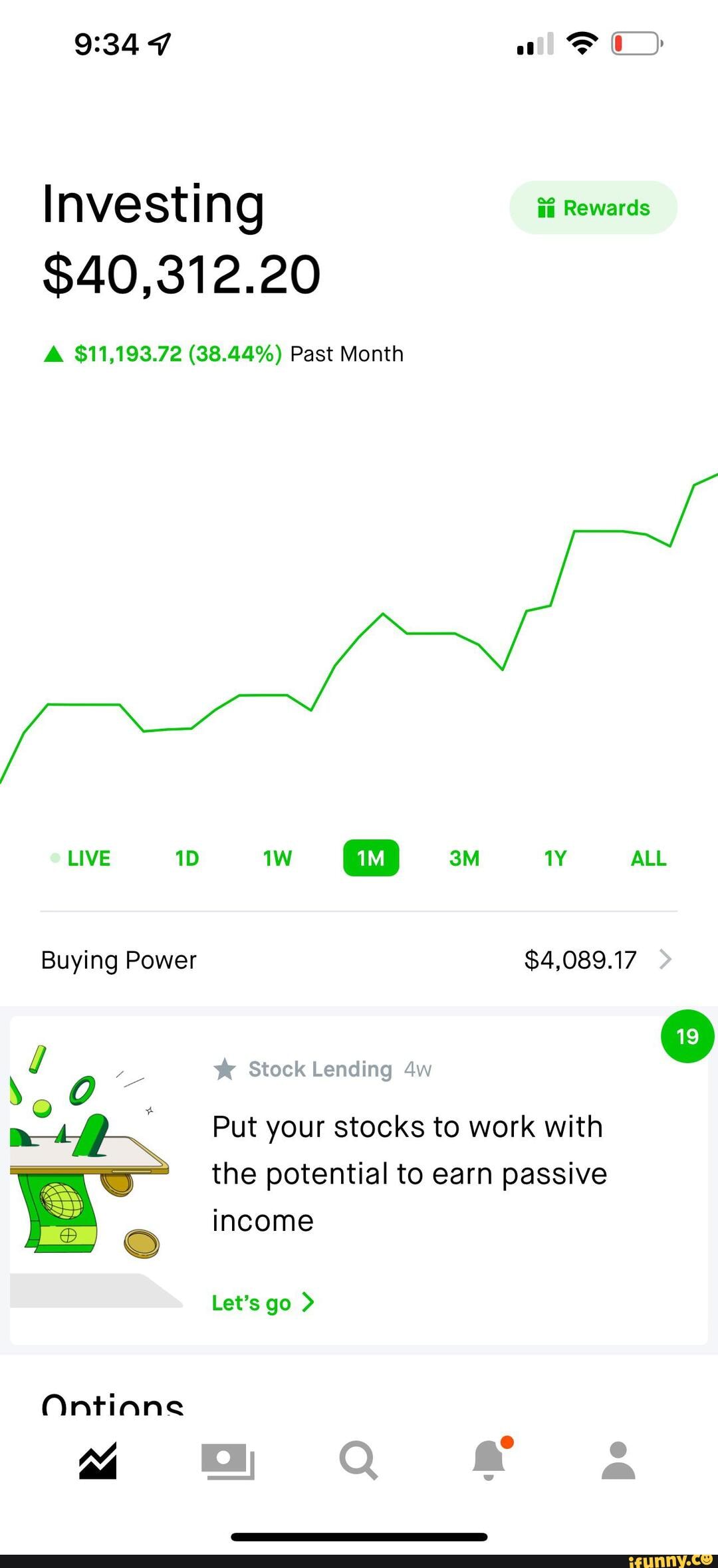

- Open a Brokerage Account: Choose a platform that suits your needs – think of it as selecting the best tool for the job!

- Make a Plan: Decide how much you want to invest, which stocks to choose, and how soon you want to see results. Set tangible goals!

- Dive In: Start small and build your way up. Remember, even the tallest oak started as a humble acorn.

Staying on Track with Your Stocks for Passive Income

Investing isn’t a “set it and forget it” type of deal. Even with stocks for passive income, it’s crucial to keep a keen eye on your investments! Regular check-ins can help ensure you stay on target to meet those goals.

- Review Performance: Track how your stocks are doing at least once a month. It’s like a health check for your financial future!

- Make Adjustments: If you notice stocks aren’t performing well, don’t be afraid to make changes.

- Stay Educated: Continue to learn about the market and investment strategies. There’s always something new to discover!

So, whether you dream about packing your bags and traveling the world or just want to build a comfy nest egg for future adventures, stocks for passive income are where it’s at! With the right knowledge, strategic planning, and a dash of patience, you’ll soon be on your way to achieving that financial freedom we all yearn for. Now, who’s ready to join the ranks of the savvy investors? Grab your mouse, and let’s get started!