Are you stepping into the investment world and dreaming of financial independence? If so, you might want to consider dividend stocks for passive income beginners. Dividend stocks are a fantastic way to grow your wealth while enjoying a steady stream of income. This article delves deep into 11 carefully selected dividend stocks that can help you pave your way to financial freedom.

Understanding Dividend Stocks for Passive Income Beginners

Before diving into our recommendations, let’s take a moment to understand what dividend stocks are and why they’re a suitable choice for passive income beginners. Dividend stocks are shares in companies that distribute a portion of their earnings back to shareholders. This can be an attractive option for anyone looking to generate income regularly while also benefiting from potential stock price appreciation.

The Importance of Choosing the Right Dividend Stocks for Passive Income Beginners

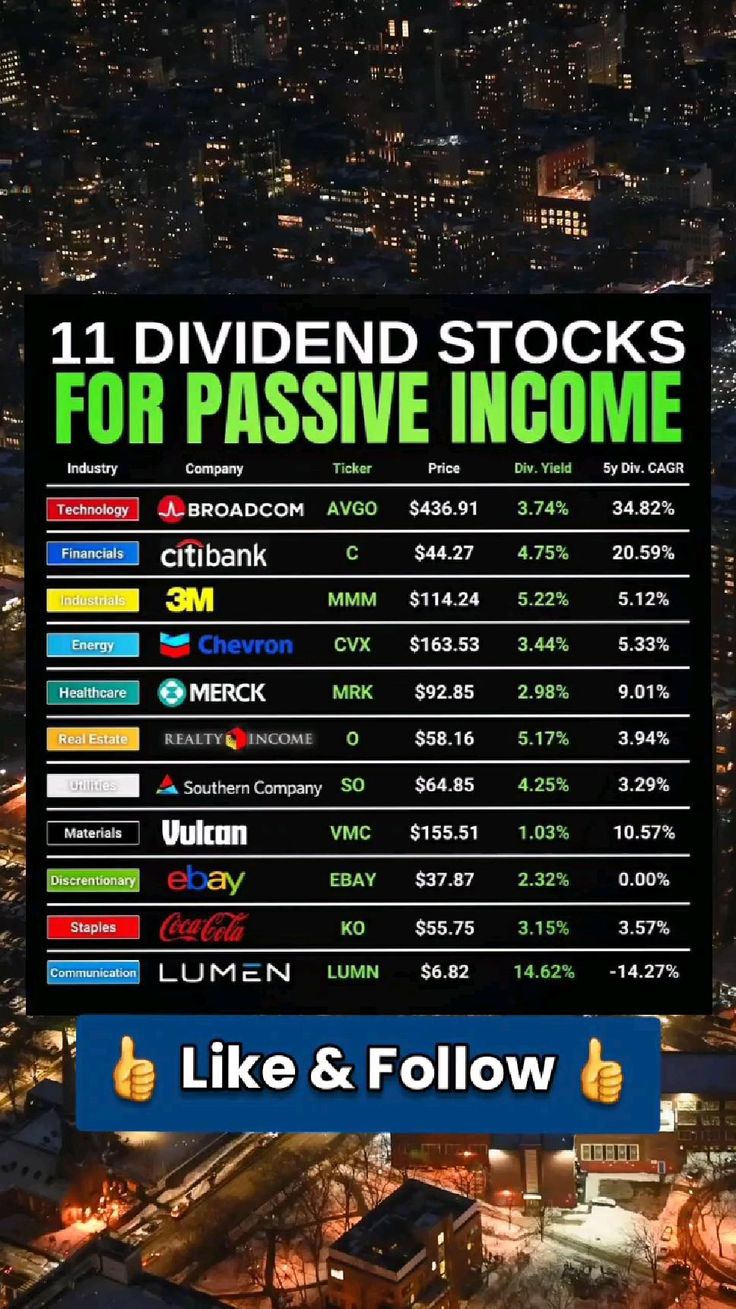

For beginners, it’s crucial to choose dividend stocks that not only offer reliable dividend payments but also have a history of stability and growth. By prioritizing these characteristics, you can position yourself for long-term success. Below, we’ve curated a list of 11 dividend stocks that stand out in 2023, designed to provide both short-term and long-term gains.

Featured Dividend Stock for Passive Income Beginners

This image showcases the essence of dividend investing with a focus on financial growth through dividends.

1. Johnson & Johnson (JNJ)

One of the largest and most stable companies in the healthcare sector, Johnson & Johnson is a prime choice for dividend stocks for passive income beginners. Not only does it have an impressive track record of dividend increases, but it also operates in a sector that tends to be resilient during economic downturns. JNJ’s current yield is attractive, making it a solid pick for those starting their journey in dividend investing.

2. Coca-Cola (KO)

Coca-Cola has been a staple in many dividend portfolios thanks to its reliable dividend payouts and long history of dividend growth. This company represents an excellent opportunity for passive income beginners looking to invest in a timeless brand. With its strong market presence and the ability to adapt to consumer trends, Coca-Cola continues to be a favorite for many investors.

3. Procter & Gamble (PG)

Another consumer staples giant, Procter & Gamble is well known for its wide array of essential products. Its status as a Dividend Aristocrat, having raised dividends for over 60 consecutive years, qualifies it as an ideal choice for those interested in dividend stocks for passive income beginners. P&G’s ability to generate consistent cash flow supports its dividend payments, reassuring investors of its reliability.

4. Realty Income (O)

Known as “The Monthly Dividend Company,” Realty Income focuses on generating income through its extensive portfolio of commercial real estate. For beginners venturing into real estate investments as a means to earn income, Realty Income can be a wonderful option. The monthly dividends make it attractive for those looking to manage their personal finance effectively.

5. PepsiCo (PEP)

PepsiCo, with its diverse range of snacks and beverages, offers stability and consistent dividend growth. The company has a strong international presence and a reputation for quality, which positions it well against competitors. For passive income beginners, PepsiCo is a solid choice due to its dependable dividend history and positive growth trajectory.

6. 3M Company (MMM)

3M is known for its innovative products spanning multiple industries, including healthcare, consumer goods, and industrial applications. This diversification helps mitigate risk, making it a prime candidate for dividend stocks for passive income beginners. With a consistent dividend growth rate, 3M presents an appealing option for those looking to grow their portfolio steadily.

7. 3M Company (MMM)

3M is renowned for its innovative products that span multiple sectors, including healthcare, consumer goods, and industrial manufacturing. This diversification reduces risks and enhances stability, making it a strong choice for beginners interested in dividend stocks for passive income. With a history of consistent growth and dividend increases, 3M holds its place among solid investment choices.

8. Cisco Systems (CSCO)

A tech giant with a history of paying steady dividends, Cisco Systems is a suitable choice for investors looking for a mix of growth and income. While traditionally viewed as a tech stock, Cisco’s strong dividends make it an attractive option for passive income beginners. The company’s commitment to returning cash to shareholders highlights its strong financial health.

9. Target Corporation (TGT)

Target has achieved remarkable growth over the years, driven by its robust online presence and strong customer loyalty. For investors, this translates into a dependable dividend policy. New investors in dividend stocks for passive income beginners will find Target appealing, especially given its consistent performance even in challenging retail environments.

10. McDonald’s Corporation (MCD)

As one of the world’s largest restaurant chains, McDonald’s has been a popular choice for dividend investors for decades. Its resilience against economic downturns makes it a strong candidate for those seeking financial security. Beginners can greatly benefit from McDonald’s solid dividend payout and the brand’s adaptability to changing consumer preferences.

11. AbbVie Inc. (ABBV)

For those interested in the pharmaceutical sector, AbbVie offers a robust portfolio of innovative drugs along with an attractive dividend yield. The company’s dedication to research and development positions it well for future growth while providing a secure income stream through dividends, making it a worthy addition for passive income beginners.

Getting Started with Dividend Stocks for Passive Income Beginners

Now that we’ve explored some reliable options, how can beginners get started with investing in dividend stocks? Here are a few key steps to consider:

- Educate Yourself: Understanding the basics of stock investment is crucial. Explore resources, attend webinars, or read books on investing to equip yourself with knowledge.

- Decide on your Budget: Determine how much capital you can allocate to dividend stocks without compromising your financial stability.

- Research and Analyze: Look into each company’s financials, dividend history, and market position. Understanding the risks and rewards is essential for making informed decisions.

- Diversify your Portfolio: Avoid putting all your eggs in one basket. Diversifying your investments can help manage risk and secure multiple streams of income.

- Monitor your Investments: Keep an eye on your dividend stocks and company performance. Regularly review your portfolio to ensure it aligns with your investment goals.

Conclusion: Your Pathway to Financial Freedom

Diving into dividend stocks for passive income beginners has the potential to provide both regular income and long-term capital appreciation. Remember, investing is a journey—start small, learn continuously, and watch your investments grow. The key to success lies in staying informed and making choices that align with your financial goals. As you embark on your investment journey, consider these 11 dividend stock selections and begin paving your way to financial freedom.