Investing can often feel like navigating a labyrinth, with numerous paths, unanticipated twists, and an overwhelming array of options. Among the myriad opportunities, mutual funds stand out as a beacon for those seeking both simplicity and the potential for significant returns. But mutual funds, how do they work? Understanding this essential question could unlock a world of financial possibilities for you.

Understanding Mutual Funds: How Do They Work?

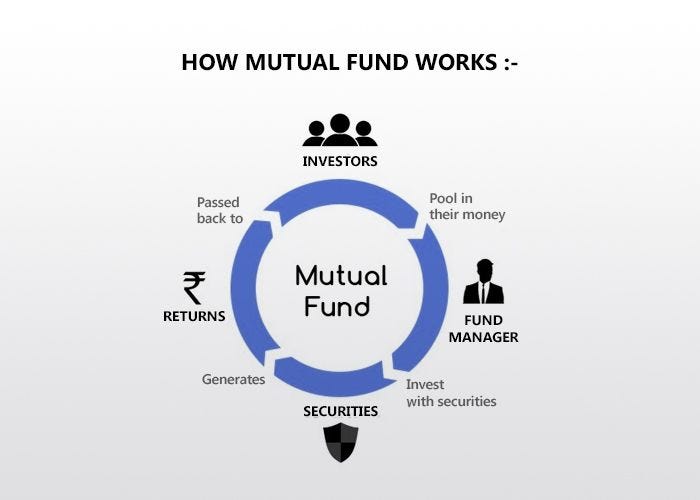

At their core, mutual funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. This collective buying power allows individual investors to access diversified portfolios that they might not be able to afford or manage on their own. But, for newcomers to investing, the concept of how mutual funds work can seem daunting. Fear not; let’s break it down into digestible parts.

Visualizing Success: The Mechanism of Mutual Funds

The central premise of mutual funds is straightforward: when you invest in a mutual fund, you’re essentially buying shares of a collective investment. The money pooled from all investors is managed by professionals who allocate it into various assets. The value of your investment fluctuates with the market performance of those assets. But, mutual funds, how do they work in terms of risk and returns? Let’s unpack this further.

Risk and Returns: The Dual Nature of Mutual Funds

Investors often wonder about the balance between risk and reward in mutual funds. Since these funds invest in a variety of securities, they inherently provide diversification. Diversification reduces the overall risk because the performance of various assets tends to fluctuate independently. Therefore, a poor-performing asset can be offset by another that is performing well. So, when people ask, mutual funds, how do they work in terms of risk? The answer lies in the diversified portfolio.

Types of Mutual Funds: Which One Fits Your Style?

Just as each investor has unique financial goals and risk appetites, there are various types of mutual funds tailored to different needs. From equity funds and bond funds to balanced funds that combine both, each type serves a specific purpose. By understanding the different mutual funds available, you can strategically choose one that aligns with your investment goals. But still, mutual funds — how do they work within each category? Each type has its distinct operational strategy and risk profile.

Equity Funds: Riding the Stock Market Waves

Equity funds invest primarily in stocks and aim for capital appreciation. They can be classified as large-cap, mid-cap, small-cap, or sectoral funds based on the companies in which they invest. While equity funds potentially offer higher returns, they also come with higher risk due to the volatility of the stock market. Understanding, mutual funds, how do they work in the realm of equities can significantly help investors assess their risk tolerance.

Bond Funds: Stability Amidst Higher Risk

On the other hand, bond funds invest in government and corporate bonds with the objective of providing income through interest payments. These funds tend to be less volatile than equity funds and can be a safe haven for conservative investors. Their stability brings a different kind of risk-reward dynamic into play. Thus, when asking mutual funds, how do they work in the context of bonds, it’s essential to consider the interest rate environment as well.

The Costs Involved: What You Need to Know

Investing in mutual funds does come with costs, including management fees, sales charges (also known as loads), and operating expenses. These costs can affect overall returns, making it imperative for investors to understand them fully. As you explore the world of mutual funds, how do they work in terms of fees? A well-informed investor knows to scrutinize the fine print and seek funds with reasonable charges.

Performance: Historical Returns and Future Potential

Another critical aspect of mutual funds is their performance history. While past performance is not indicative of future results, it can serve as a useful tool for evaluating present fund options. Various resources and platforms provide insights into fund performance, making it easier to compare and select the best funds for your portfolio. So, when asking mutual funds, how do they work regarding performance metrics, remember that continuous assessment is crucial.

Getting Started: Your First Steps into Mutual Fund Investing

If you’re ready to take the plunge into mutual fund investing, begin by determining your investment goals and risk tolerance. Research different types of mutual funds and examine their past performance, risk levels, and fee structures. Most importantly, you should consider your investment horizon — the timeframe in which you expect to grow your investment. Finally, mutual funds, how do they work for new investors? A financial advisor can help create a personalized investment strategy that suits your specific needs.

Open an Account: The Gateway to Mutual Fund Investments

Once you’ve done your homework, the next step is to open an investment account. Most mutual funds are accessible through online brokerages or financial advisors. Ensure you understand all the necessary documentation and procedures required to proceed. This knowledge will make the process smoother and less daunting. The question remains: mutual funds, how do they work when you’re ready to invest? Typically, it involves selecting your desired funds and the amount you wish to invest.

Rebalancing Your Portfolio: An Ongoing Process

Investing in mutual funds is not a one-and-done affair. As markets fluctuate and your financial situation changes, it is crucial to periodically rebalance your portfolio—redistributing investments to align with your goals. This continuous process helps ensure that your investments remain balanced and in sync with your risk tolerance. Thus, when considering mutual funds, how do they work in terms of portfolio rebalancing? Regularly reviewing your investments will guide you in making necessary adjustments.

Seek Professional Guidance: Making the Smart Move

Finally, don’t hesitate to seek professional guidance. The world of mutual funds can be intricate, and having an expert on your side can make a considerable difference. They can help you navigate through the information overload, ensuring you make the best decisions for your financial future. So, as you ponder mutual funds, how do they work under professional guidance? They provide clarity and confidence in your investing journey.

In conclusion, mutual funds present an accessible avenue of investing for those who may shy away from the complexities of direct securities trading. With an understanding of how these funds work, different types available, costs involved, and ongoing management strategies, you can effectively navigate your investment aspirations. Remember: informed investing is smart investing. So, as you step into this remarkable financial landscape, be confident, and dive deep—there’s much to gain! мутуаль фінди, як їх робиті свомй знаєте?