In the ever-changing landscape of personal finance, one investment vehicle that stands out for its potential to generate wealth for everyday investors is mutual funds. But what are mutual funds and how do they work? Understanding this financial instrument can be your first step toward smart investing. Whether you’re a seasoned investor looking to diversify your portfolio or a complete novice trying to figure out where to put your hard-earned money, mutual funds could provide the opportunities you’re searching for.

What Are Mutual Funds and How Do They Work?

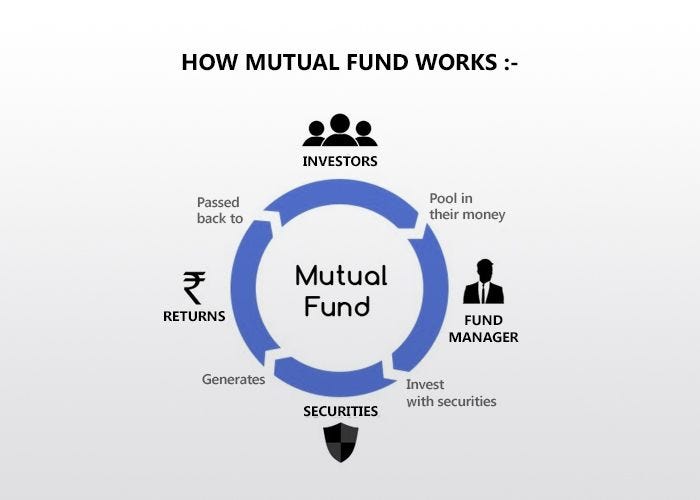

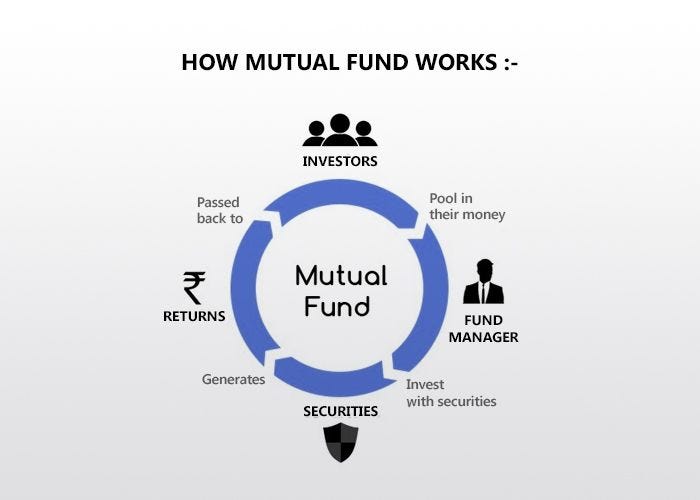

To put it simply, mutual funds pool money from various investors to purchase a diversified portfolio of stocks, bonds, or other securities. When you invest in a mutual fund, your money is combined with that of other investors and managed by a professional fund manager. This collective investment structure is what enables investors to buy a share of a much more diversified portfolio than they could typically afford individually.

The Mechanics Behind Mutual Funds

So, what are mutual funds and how do they work in practice? When you invest in a mutual fund, you buy shares of the fund itself. The price of one share, known as the Net Asset Value (NAV), changes daily based on the performance of the underlying investments. NAV is calculated by dividing the total net assets of the fund by the total number of shares outstanding. This means if the assets held by the fund perform well, then the NAV will increase, and vice versa.

Types of Mutual Funds

Understanding the types of mutual funds available can also clarify “what are mutual funds and how do they work.” There are several categories—including equity funds, bond funds, index funds, and balanced funds. Each type serves a different purpose and caters to varying investment goals.

Equity Mutual Funds

Equity mutual funds invest primarily in stocks and are designed for long-term growth. While they can be riskier due to market fluctuations, their potential for higher returns makes them appealing if you’re willing to endure the volatility. If you’re curious about how equity funds operate, consider this: when you invest $1000 in an equity mutual fund, that amount will be invested in a range of stocks, spreading the risk over multiple companies rather than relying solely on a single stock’s performance.

Bond Mutual Funds

On the other side of the spectrum, we have bond mutual funds, which invest mainly in fixed-income securities. They tend to be less risky and can provide a stable cash flow, making them suitable for conservative investors or those seeking regular income. So, what are mutual funds and how do they work when it comes to bonds? Essentially, by investing in a bond mutual fund, you are lending money to governments or corporations that agree to pay you interest over time.

Index Mutual Funds

For those who wish to mirror a specific market index, index mutual funds could be a perfect fit. These funds are passive investments that aim to replicate the performance of a benchmark index like the S&P 500. What are mutual funds and how do they work in this context? The beauty of index funds lies in their low management fees and the ability to gain exposure to a diverse array of stocks without actively picking them. This makes them particularly appealing for long-term investors.

Why Should You Consider Investing in Mutual Funds?

The question now is, why should you choose mutual funds as your investment vehicle? Here are some compelling reasons:

- Diversification: By investing in a mutual fund, you gain exposure to numerous stocks and or bonds, effectively reducing the risk associated with individual securities.

- Professional Management: Fund managers are usually experts in their field and conduct extensive research to make informed investment decisions.

- Accessibility: Mutual funds often have lower minimum investment requirements compared to other investments, making them accessible for new investors.

- Liquidity: Most mutual funds allow you to sell your shares at any time, providing quick access to your money when needed.

Risks Involved in Mutual Fund Investing

While mutual funds offer numerous advantages, it is important to consider the risks involved. What are mutual funds and how do they work with respect to risk? Understanding the risk profile of the specific mutual fund you are considering is essential. Market risk, credit risk, and management risk are all factors you must weigh before investing. Always be sure to read through a fund’s prospectus, which outlines its objectives, risks, and fees.

Understanding Fees: Important for Investors

Fees can eat into your investment returns over time. Common fees associated with mutual funds include:

- Expense Ratio: This includes management fees, administrative costs, and other expenses.

- Sales Loads: Some mutual funds charge fees when you buy or sell shares, usually expressed as a percentage of the investment.

- Redemption Fees: Some funds may charge you a fee for selling your shares within a specific timeframe.

Getting Started with Mutual Funds

Now that you grasp what are mutual funds and how do they work, you’re ready to consider your first investment. To begin:

- Define your investment goals—ask yourself what you’re looking to achieve.

- Assess your risk tolerance—determine whether you’re a conservative or aggressive investor.

- Look into different funds and analyze their performance metrics.

- Consult a financial advisor if needed to tailor a plan suited for you.

Final Thoughts on Mutual Funds

In conclusion, mutual funds can serve as a fantastic investment option for both new and experienced investors alike. They offer a unique blend of diversification, professional management, and accessibility that can lead to financial growth. So, what are mutual funds and how do they work? At their core, they’re your gateway to potential wealth-building opportunities.

Discover More About Mutual Funds

Explore More Resources

For an in-depth understanding, check out  . Visual aids can significantly help in reinforcing your understanding of complex financial topics.

. Visual aids can significantly help in reinforcing your understanding of complex financial topics.

Ultimately, taking the first step into mutual funds could be the gateway to building a prosperous financial future. Start today, and embrace the journey of smart investing!