Investing is often seen as a maze of choices and complexities, leaving many potential investors bewildered about how to navigate through the myriad of options. Among the most significant investment vehicles available today are mutual funds. For those who are just stepping into the world of investments or those looking to refine their strategies, understanding what are mutual funds & how do they work is crucial. In this article, we will delve deep into the fundamentals, benefits, and tips for investing smartly in mutual funds to help you harness their potential.

What Are Mutual Funds & How Do They Work?

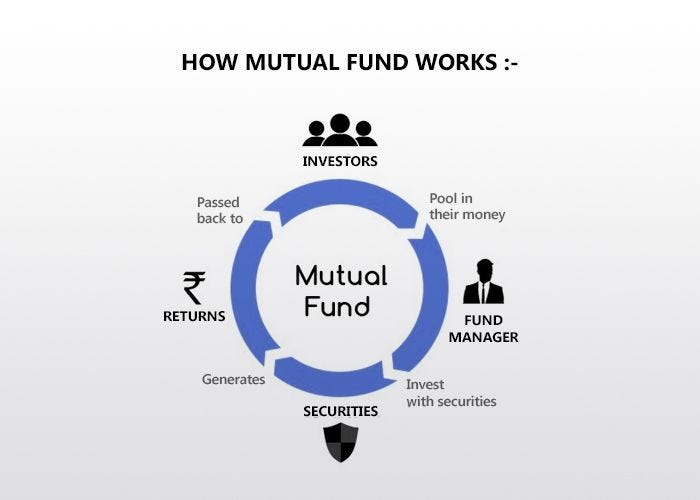

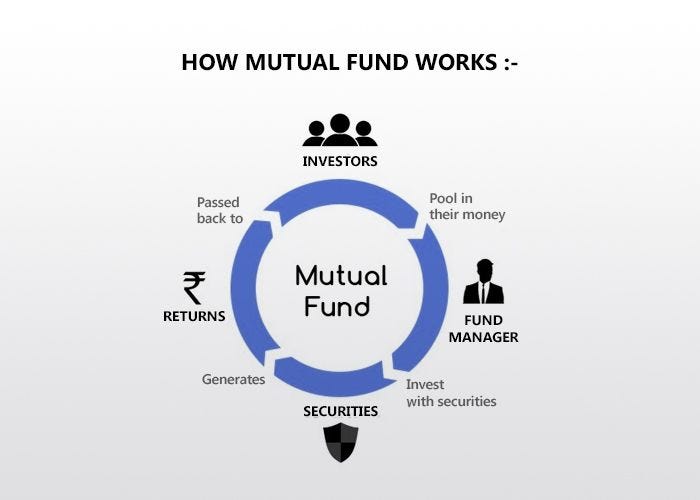

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diverse portfolio of stocks, bonds, or other securities. This collective approach allows individual investors to have access to a broader range of investments that may have been otherwise daunting or impossible to attain independently. By investing in a mutual fund, you contribute to a managed fund, where professional portfolio managers make decisions on your behalf, selecting the appropriate assets to meet the fund’s investment objectives.

Understanding the Structure of Mutual Funds

At their core, mutual funds operate on the principle of collective investment. So, what does this mean for the individual investor? When you buy shares of a mutual fund, you are essentially purchasing a small slice of a much larger set of investments, which diversifies your risk. If one area of the market declines, other investments may not be affected or may even prosper, balancing out your overall return. This risk management is a primary reason many investors are drawn to mutual funds.

Benefits of Investing in Mutual Funds

Understanding what are mutual funds & how do they work extends beyond basic definitions; it also involves recognizing the substantial benefits they offer. Here are some of the plus points that make mutual funds a popular choice among investors:

- Diversification: Mutual funds invest in a variety of securities, which decreases the potential risk of your investments.

- Professional Management: Fund managers analyze and select the best investment opportunities for you, saving you time and effort.

- Liquidity: You can easily buy or sell mutual fund shares at the end of any trading day, making them more flexible than other investment options.

- Affordability: Many mutual funds have low minimum investment requirements, making them accessible for new or small investors.

How Mutual Funds Are Structured

At the foundational level, mutual funds issue shares to investors, which represent an ownership stake in the fund’s portfolio. Depending on the type of mutual fund, the shares can vary in value according to the underlying securities. So when inquiring about what are mutual funds & how do they work, it is essential to understand the various types of funds available:

- Equity Funds: These funds invest primarily in stocks and are ideal for those looking for potential high returns over the long term.

- Fixed-Income Funds: These funds invest in bonds or other debt instruments and are more suitable for conservative investors seeking regular income.

- Balanced Funds: A mixture of stocks and bonds provides a balance between risk and return, appealing to a broad range of investors.

- Money Market Funds: These funds invest in short-term, low-risk securities, ideal for preserving capital with minimal returns.

What Are Mutual Funds & How Do They Work in Practice?

Now that we’ve set the stage with the basics, let’s pivot into the practical applications of mutual funds. Investing in mutual funds can sometimes feel like an intimidating journey, but taking informed steps can alleviate many concerns.

Consider Your Investment Goals

Before diving into mutual funds, it’s critical to assess your financial goals and risk tolerance. Different mutual funds cater to different objectives, whether you’re saving for retirement, funding your children’s education, or aiming for wealth accumulation. Clearly defined goals can guide your selection process.

Research Funds Thoroughly

Not all mutual funds are created equal. Utilizing third-party rating services and consulting performance data can provide insights into how well a fund performs relative to its peers. Always consider key metrics such as the fund’s expense ratio, historical returns, and the experience of the fund manager.

What Are Mutual Funds & How Do They Work: An Investor’s Perspective

As an investor, understanding what are mutual funds & how do they work extends beyond definitions and benefits. Participation in a mutual fund encapsulates an experience that merges trust, strategy, and, ultimately, results. With passive investing becoming increasingly popular, mutual funds give you an edge to ride market waves without needing to micromanage every decision.

The Role of Asset Allocation

Asset allocation pertains to distributing investments among various asset categories, such as stocks, bonds, and cash. The approach you adopt can significantly influence your mutual fund’s performance. A robust asset allocation can buffer against volatility while promoting long-term growth. Thus, when venturing into mutual funds, strategic diversification in your portfolio can often lead to favorable outcomes.

Maximizing Your Returns with Mutual Funds

Investment in mutual funds requires discipline and an understanding of market dynamics. Here are additional tips on how to maximize your returns while investing:

- Consistent Contributions: Regular contributions through a systematic investment plan can bolster investment growth over time.

- Stay Informed: Being updated with economic trends, market news, and insights on funds can enhance your investment decisions.

- Rebalance Regularly: Adjusting your portfolio periodically helps to maintain your desired asset allocation in response to market movements.

The Long-term View of Mutual Fund Investments

Patience and perseverance are keys when it comes to mutual funds. Market fluctuations can spark emotional reactions, but a long-term perspective often leads to rewards that align with your financial aspirations. Understanding what are mutual funds & how do they work can help configure a mindset tailored for growth rather than immediate gratification.

In essence, investing in mutual funds can serve as a bridge between complex market dynamics and the simplicity of collective investment. The seamless blend of risk management, professional guidance, and diverse asset allocation allows investors to embark on a journey toward wealth accumulation and financial security.

Final Thoughts

As you navigate the world of investment, mutual funds present a viable pathway tailored for various financial goals and risk appetites. With an understanding of what are mutual funds & how do they work, you can approach investing with greater confidence and strategic foresight. Always conduct thorough research, align choices with financial objectives, and cultivate a mindset geared toward long-term growth for the best chances of success in your investment journey.