When it comes to effective financial management, having a comprehensive financial planning document checklist is vital. This checklist serves as a roadmap that guides individuals in organizing their finances, identifying their financial goals, and preparing for both short-term and long-term needs. Whether you are managing a household budget or planning for retirement, having a clear and organized approach to your finances can greatly impact your peace of mind and overall success.

Why You Need a Financial Planning Document Checklist

In our fast-paced world, we often find ourselves juggling multiple responsibilities, making it easy to overlook meticulous financial planning. A financial planning document checklist acts like a safety net, capturing essential actions you need to take to safeguard your financial wellbeing. It encompasses various critical elements, including income, expenses, savings, investments, and debts, ensuring that you have a holistic view of your financial status.

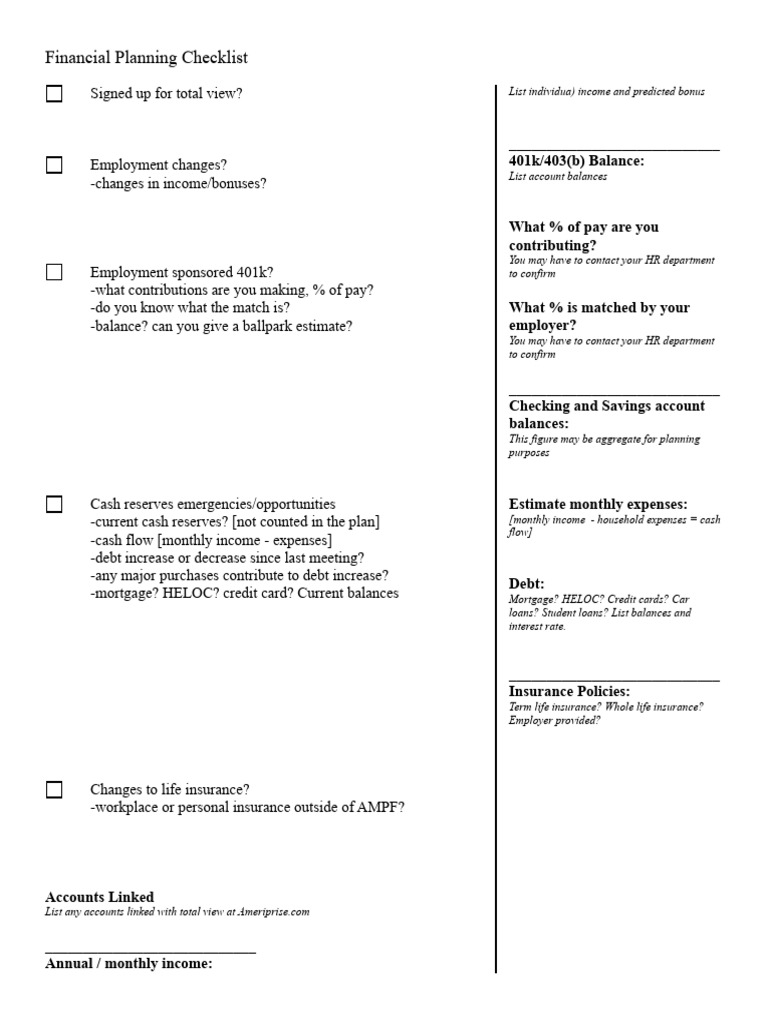

This visual representation of a financial planning document checklist can help you better understand the components at play as you navigate your financial journey. Each item serves as a prompt to ensure no critical aspect is overlooked.

Components of a Comprehensive Financial Planning Document Checklist

Creating an effective financial planning document checklist requires a thorough understanding of its essential components. Here are the major elements you should include:

1. Income Overview

Understanding your income is the first step in your financial planning document checklist. Begin by listing all sources of income, including wages, bonuses, rental income, and any side hustles. This gives you clarity on your cash flow and helps set the foundation for your budgeting efforts.

2. Budgeting and Expense Tracking

A successful financial plan is built on a solid budget. Allocate portions of your income to various categories such as housing, utilities, food, transportation, and entertainment. Regularly track these expenses to ensure harmony with your budget.

3. Emergency Fund

No financial plan is complete without an emergency fund. Aim to save at least three to six months’ worth of living expenses. This fund will act as a financial buffer during unexpected situations, such as job loss or medical emergencies.

4. Debt Management

Including a debt overview in your financial planning document checklist is crucial. List all debts, their respective interest rates, and payment due dates. Create a strategy for paying down debts, focusing on high-interest debts first to save money in the long run.

5. Savings and Investment Strategies

Your financial planning document checklist should include savings goals and an investment strategy. Set specific targets for short-term savings, retirement accounts, and other investments to help achieve your financial goals.

How to Stay on Track with Your Financial Planning Document Checklist

Creating your checklist is only the beginning; staying on track is where the real challenge lies. Here are strategies to help you maintain momentum:

1. Regular Review and Adjustments

Set aside time monthly or quarterly to review your financial planning document checklist. Look for changes in income or expenses, and adjust your budget accordingly. This constant evaluation helps you remain adaptable to changes in your financial landscape.

2. Utilize Financial Tools

Take advantage of technology to streamline your financial planning efforts. Many apps and online platforms can help track income, expenses, and savings goals. Utilizing such tools can simplify the management of your finances, ensuring you stick to your checklist.

3. Seek Professional Advice

If you find yourself overwhelmed, consider engaging a financial advisor. They can provide personalized insights and suggestions tailored to your specific financial situation, ensuring that your financial planning document checklist is comprehensive and actionable.

The Benefits of a Financial Planning Document Checklist

Investing time in creating and adhering to a financial planning document checklist can yield significant long-term benefits:

1. Clarity and Focus

By having a definitive checklist, you maintain clarity and focus regarding your financial situation. You gain insights into your current financial standing, aiding better decision-making for your future.

2. Future Goals Achievement

Whether you aim to buy a home, save for education, or retire comfortably, a financial planning document checklist ensures you have a plan in place to achieve these goals. Breaking down longer-term aspirations into smaller, attainable actions keeps the drive alive.

3. Peace of Mind

With a comprehensive checklist at your disposal, you can approach each financial decision with confidence. Knowing that you have a robust plan in place reduces anxiety and fosters a healthy approach toward managing your finances.

Wrapping Up Your Financial Planning Document Checklist

A financial planning document checklist empowers you to take control of your financial life. By including key financial elements such as income, expenses, savings, investment strategies, and debt management, you build a pathway to success. Regular reviews and updates will ensure your checklist adapts to your evolving financial needs. Embrace this holistic approach to achieve your financial aspirations and enjoy the peace of mind that comes with being prepared.

In conclusion, now that you have a comprehensive understanding of what constitutes an effective financial planning document checklist, it’s time to create your own and start taking actionable steps towards securing your financial future. Prioritize, strategize, and maintain focus, and you’ll find that managing your finances is not only attainable but rewarding as well.