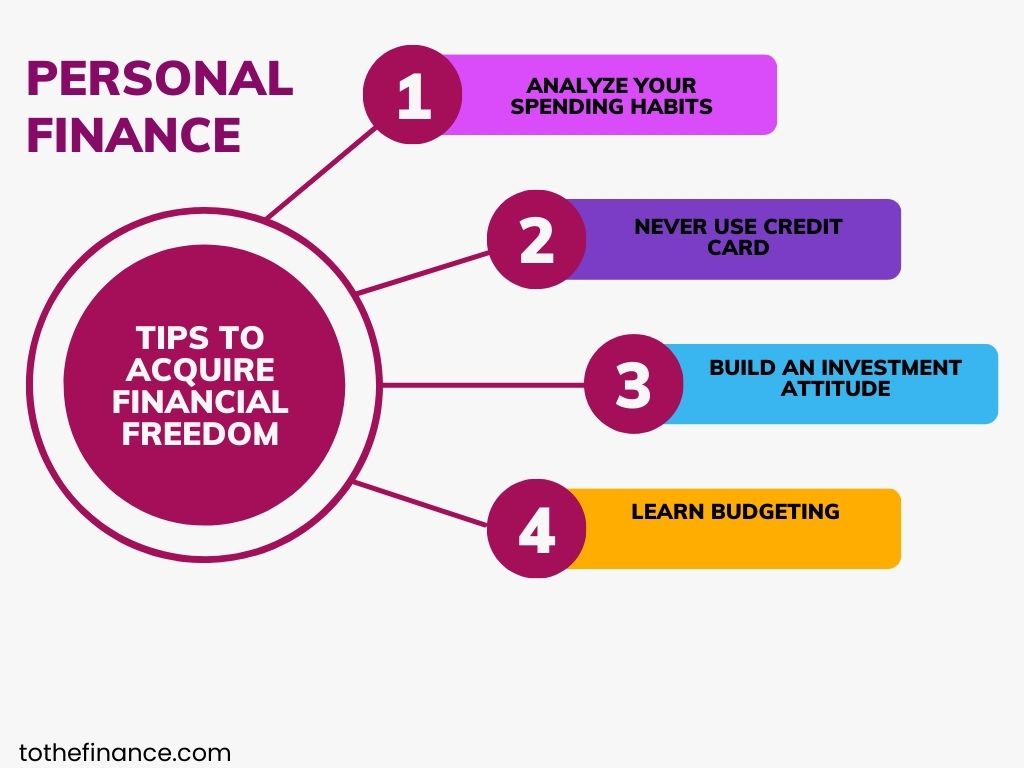

Understanding personal finance is crucial for achieving financial stability and independence. For many, the journey into managing finances starts with learning the basics. This article presents essential personal finance tips for beginners, guiding you toward smart financial decisions. Whether you’re just starting your career or aiming to improve your financial literacy, these tips will set you on the right path.

Essential Personal Finance Tips for Beginners

Starting your financial education can be overwhelming, but it’s important to break it down into manageable steps. Personal finance tips for beginners often emphasize the significance of budgeting. Knowing how to allocate your funds effectively is foundational. Begin by tracking your income and expenses to identify where your money is going. You can utilize budgeting apps or simply a spreadsheet to monitor your financial movements.

Understand Your Income

Your income is your greatest asset. It’s critical to differentiate between your net income and gross income. The gross income is your earnings before any deductions, while net income reflects what you take home after taxes and other contributions. Understanding this distinction is one of the first personal finance tips for beginners that can help you make informed decisions regarding your spending and saving.

Prioritize Your Expenses: Needs vs. Wants

One key aspect of budgeting is understanding the difference between needs and wants. Essentials like housing, food, and healthcare should take precedence over discretionary spending like dining out or entertainment. By prioritizing your expenditures, you can maintain better control over your finances. This clarity is part of the foundational personal finance tips for beginners that everyone should grasp early on.

Building a Budget that Works for You

Once you have a grasp on your income and prioritize your expenses, the next step is to create a practical budget. Aim for a budget that reflects your lifestyle yet encourages savings. Many recommend the 50/30/20 rule: devote 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Tailoring your budget to fit your specific situation is essential in implementing effective personal finance tips for beginners.

Saving for Future Goals

Strategies for Savings

Saving for future endeavors is a quintessential aspect of personal finance that cannot be overstated. Whether it’s for an emergency fund, a vacation, or retirement, having savings is an integral part of your financial baseline. One effective strategy for savings is to automate the process; set up a monthly transfer from your checking account to your savings account. This way, you’re more likely to save consistently, adhering to the personal finance tips for beginners that highlight the importance of habitual saving.

The Importance of an Emergency Fund

Emergencies are unpredictable, but being financially prepared can reduce stress immensely. An emergency fund acts as a financial safety net during unforeseen circumstances, such as job loss or medical emergencies. Experts often recommend saving three to six months’ worth of living expenses as a buffer. This not only aligns with personal finance tips for beginners but also fosters peace of mind knowing you can navigate unexpected financial demands.

Managing Debt Wisely

Debt can be a significant hurdle to achieving personal finance goals. Understanding how to manage debt is one of the critical personal finance tips for beginners that can set you up for success. Start by listing all your debts, including their interest rates. Focus on paying off high-interest debts first, as they can escalate quickly. Additionally, consider consolidating debts to reduce interest rates, making your repayment journey more manageable.

Building Your Credit Score

Your credit score plays a vital role in your financial journey, impacting your ability to borrow money, obtain favorable loan terms, and even affect your job prospects in some cases. To maintain a good credit score, pay your bills on time, keep your credit utilization low, and avoid opening too many new credit accounts simultaneously. These actions are fundamental personal finance tips for beginners that provide a strong foundation for your financial health.

Investing for the Future

Once you have a solid budgeting and saving plan in place, consider how investing can further your financial goals. Investing might seem intimidating, but understanding the basic principles can open doors to additional income and wealth building. Start by learning about different investment vehicles like stocks, bonds, or mutual funds, and begin with options that align with your risk tolerance and financial objectives.

The Power of Compound Interest

One of the most compelling reasons to invest early is the power of compound interest, which allows your investments to grow exponentially over time. Personal finance tips for beginners often stress the importance of starting as early as possible to harness the benefits of compounding. Even a small investment can lead to significant growth over several years. Investing regularly, no matter how small the amount, will yield long-term benefits.

Continuous Financial Education

The financial landscape is ever-evolving, and keeping abreast of new trends, laws, and financial tools is crucial. Books, podcasts, and online resources are abundant and can further your understanding of personal finance. This ongoing education meets another one of the core personal finance tips for beginners: never stop learning. Active engagement with your financial knowledge empowers you to make informed decisions.

Seeking Professional Advice

Sometimes, self-education may not be enough, especially for more complex financial situations. In such cases, seeking the advice of a financial advisor could be invaluable. Financial advisors can provide tailored advice based on your specific circumstances and help you navigate through financial challenges effectively. This can be a crucial step in adhering to personal finance tips for beginners and ensuring you are making the best recommendations aligned with your financial goals.

Final Thoughts on Personal Finance Tips for Beginners

Embarking on your personal finance journey requires commitment and continual effort, but the rewards are substantial. From budgeting and saving to investing and beyond, implementing these personal finance tips for beginners will equip you to build a secure financial future. Remember that every small step contributes to your overall financial health, and with time and dedication, you can achieve your financial goals. Start today, and watch your financial knowledge—and freedom—grow.