Options trading is an exciting opportunity for those interested in the stock market, especially for beginners in India looking to expand their financial horizons. With an increasing number of resources and platforms available, it is becoming easier to learn the essential concepts of trading options. This article will guide you through the fundamentals of options trading, ensuring you have a solid foundation as you embark on your trading journey.

Understanding Options Trading for Beginners in India

Before diving into the specifics, it’s important to grasp what options trading entails. At its core, options trading is a financial instrument that gives you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. This unique feature allows traders to leverage their investment and manage risk effectively.

The Basics of Options Trading for Beginners in India

For beginners, options can seem intimidating, but breaking it down into simpler concepts can help. Here are the key components you need to familiarize yourself with:

- Call Options: This gives the holder the right to buy the underlying asset at a specified price. If the market price exceeds this strike price, the call option becomes profitable.

- Put Options: This provides the holder with the right to sell the underlying asset at a specified price. If the market price drops below the strike price, the put option can yield profits.

- Strike Price: This is the price at which you can buy or sell the underlying asset. Understanding the significance of the strike price is crucial for making informed decisions.

- Expiration Date: Options have a limited lifespan, with expiration dates determining the timeframe in which you can exercise your option.

Key Strategies in Options Trading for Beginners in India

As you learn the basics, it’s also vital to explore effective trading strategies. Different approaches can help you achieve various financial goals while managing risk.

1. Covered Calls

This strategy involves owning the underlying stock while selling call options against that stock. It’s a way to generate additional income from an asset you already own. For beginners, this can be a lower-risk strategy, as it provides a buffer against potential losses.

2. Protective Puts

If you are concerned about the downside risk of an asset you own, consider buying put options as insurance. This strategy is particularly useful for beginners looking to safeguard their investments from market volatility.

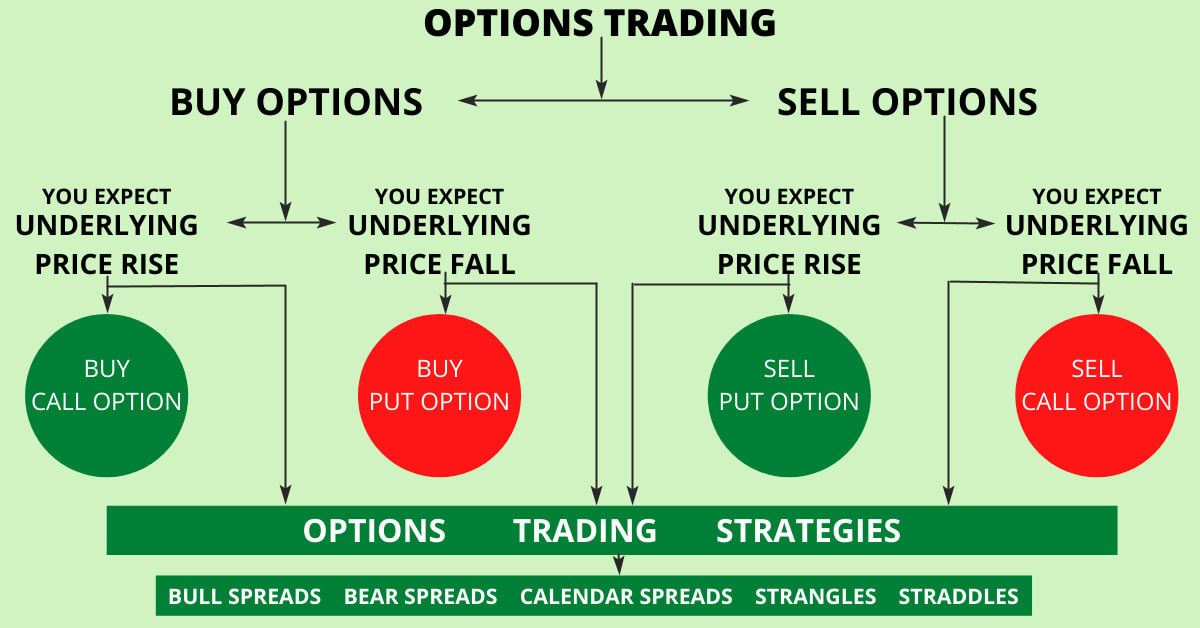

Visualizing Options Trading for Beginners in India

To enhance your understanding, here’s a visual representation of options trading concepts that can aid beginners:

Options Trading Visual Aid

This image illustrates the fundamental concepts of options trading, making it easier for beginners to visualize their journey into this exciting financial arena.

Advanced Concepts for Options Trading for Beginners in India

Once you have a good grasp of the basics and some preliminary strategies, consider delving into more advanced topics. Understanding these concepts will help you make more informed decisions and improve your trading acumen.

Volatility and Its Impact

Market volatility is a significant aspect of options trading. Prices can fluctuate based on market sentiments or unexpected news. Learning how to gauge volatility can give beginners an edge in determining potential price movements. Traders often use indicators like the VIX index to measure market volatility.

Greeks: The Building Blocks of Options Pricing

The Greeks—Delta, Gamma, Theta, and Vega—are important metrics that help traders understand the risks associated with options trading. For beginners, grasping these concepts can dramatically improve your trading strategy and risk management. Each ‘Greek’ reflects how sensitive the option’s price might be to certain factors:

- Delta: Measures the rate of change in an option’s price concerning changes in the underlying asset’s price.

- Gamma: Indicates the rate of change in Delta over time.

- Theta: Represents the time decay of options, highlighting how much value an option loses as it approaches expiration.

- Vega: Shows the sensitivity of an option’s price to changes in the volatility of the underlying asset.

Building a Trading Plan: A Guide for Options Trading for Beginners in India

Creating a well-structured trading plan is paramount for success. Your plan should outline your financial goals, risk tolerance, and specific strategies tailored to the options trading landscape in India.

Steps to Formulate Your Trading Plan

- Define Your Goals: Be clear about what you want to achieve. Are you aiming for supplemental income or long-term investment?

- Assess Your Risk Tolerance: Understanding how much risk you are willing to take on will help you select the right strategies and assets.

- Choose Your Trading Strategies: Pick strategies that resonate with your knowledge level and risk appetite.

- Review and Adjust: The markets are constantly changing; review your trading plan regularly to ensure it aligns with market conditions and your financial goals.

Resources for Options Trading for Beginners in India

To bolster your knowledge, utilize various resources tailored for beginners:

- Online Courses: Platforms like Udemy and Coursera offer courses that can help lay the foundation in options trading.

- Books: Titles such as “Options Trading for Dummies” provide an excellent starting point.

- Online Communities: Joining forums and social media groups where traders share experiences can enhance your learning process.

As you explore the world of trading, remember that being informed and methodical can set you apart as a successful options trader. Understanding the nuances of options trading for beginners in India will empower you to navigate the market’s complexities with confidence.

Time and dedication are vital. With a foundation built on knowledge, practical experience, and a solid trading plan, you can foster a promising future in options trading.