In today’s fast-paced world, managing personal finances has become increasingly crucial. With a myriad of expenses and income sources, understanding where your money goes is essential for achieving financial stability. This is where Personal Finance Excel Templates come into play, allowing individuals to organize, track, and plan their finances more effectively. In this article, we will delve into the benefits of using these templates, the different types available, and how they can significantly improve your financial management skills.

Discovering Excel Finance Templates Personal Benefits

Using Excel finance templates personal enables users to customize their budgets according to their unique lifestyles. Whether you’re a student managing tuition fees, a young professional saving for a home, or a family planning for retirement, these templates cater to various financial needs.

Why Choose Excel Finance Templates Personal?

One of the primary advantages of using Excel finance templates personal is their user-friendly nature. Excel is accessible and familiar to most individuals, making it an excellent platform for financial planning. Moreover, these templates come with built-in formulas that simplify calculations, enabling you to focus more on strategizing your financial future rather than performing complex math.

Visual Aid for Financial Management

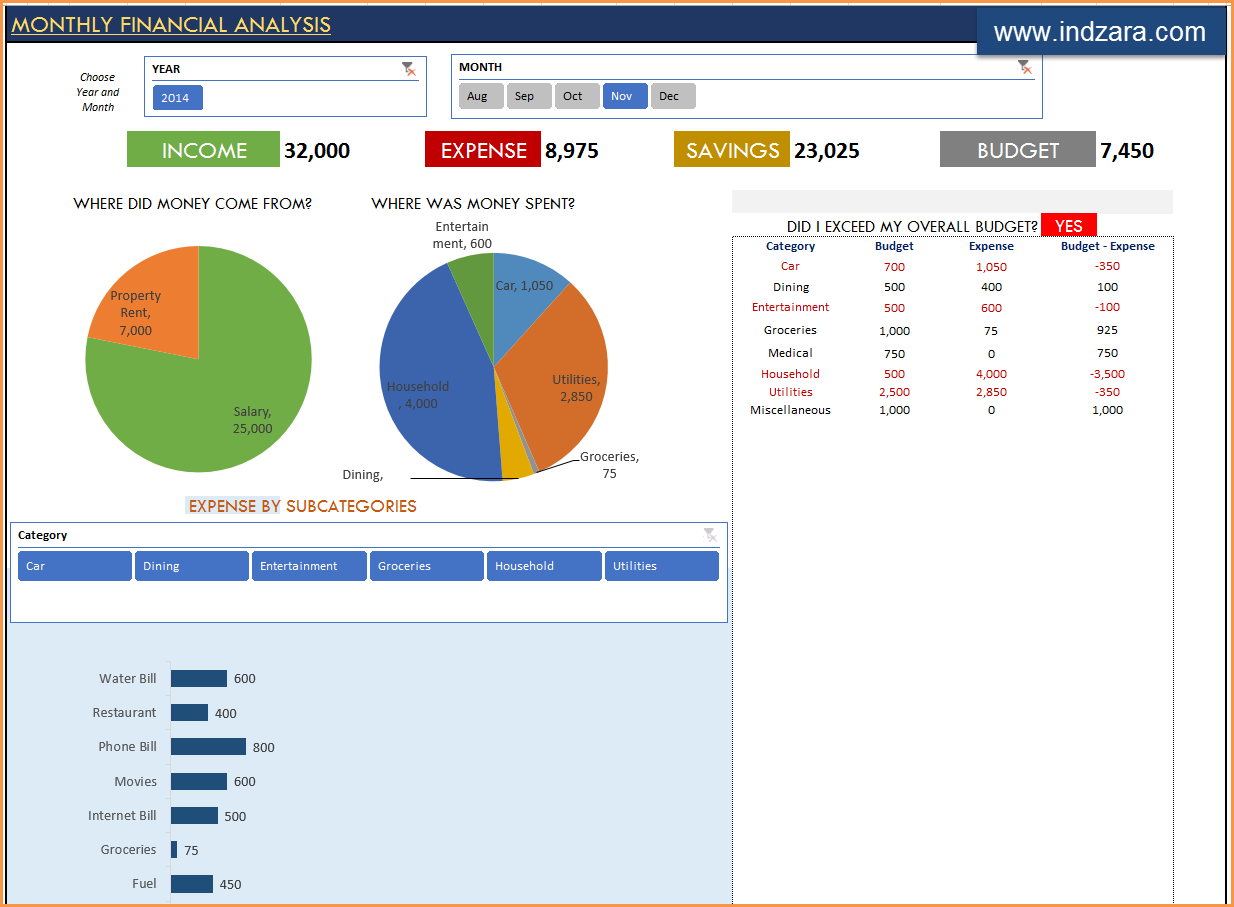

The above image illustrates how Personal Finance Excel Templates can streamline your financial data management. With visually appealing layouts, these templates present your data in an organized manner, making it easier to pinpoint areas where you can save money and improve your financial habits.

Types of Excel Finance Templates Personal Use

There are various types of Excel finance templates personal users can employ, depending on their financial objectives. Here are some popular options:

- Budget Planner: This template allows you to track your monthly income and expenses, enabling you to allocate funds appropriately to different spending categories.

- Expense Tracker: Keep an eye on where your money goes each month by documenting your daily expenditures and identifying potential areas to cut back.

- Debt Repayment Plan: A structured payment plan can help you manage and eliminate debt more efficiently. The template provides a timeline and visualization of your repayment progress.

- Savings Goal Tracker: This template helps you set and monitor savings goals, allowing you to visualize your progress and adjust as necessary to achieve your financial aspirations.

Excel Finance Templates Personal for Everyone

The flexibility of Excel finance templates personal makes them suitable for individuals at all financial literacy levels. Even if you are just starting to learn about managing finances, these templates can serve as a comprehensive guide. They are perfect for anyone looking to take control of their finances, no matter their previous experience.

Customizing Your Excel Finance Templates Personal

Customization is another significant advantage of Excel finance templates personal. Users can modify categories, adjust formulas, and fine-tune the structure to better suit their preferences and financial situations. This level of personalization ensures that the template remains relevant and useful as your financial needs evolve over time.

Getting Started with Excel Finance Templates Personal

If you are looking to dive into personal finance management, starting with an Excel finance template personal is a great first step. To begin, consider your financial objectives. What do you hope to achieve by managing your finances better? Whether it’s reducing your spending, saving for a major purchase, or planning for retirement, there is an Excel template that can help you reach your goals.

Once you’ve identified your objectives, choose a template that aligns with your needs. Many websites offer free or affordable download options. Upon acquiring your chosen template, take time to familiarize yourself with its layout and functionalities.

Integrating Excel Finance Templates Personal into Daily Life

To maximize the benefits of your Excel finance templates personal, try to integrate them into your daily life. Regularly updating your financial data ensures that you stay on top of your expenses, income, and savings. Make it a habit to check your financial status weekly or monthly. This practice can prevent overspending and help you stay focused on your financial goals.

Common Challenges When Using Excel Finance Templates Personal

Another challenge is navigating complex formulas, especially for those who may not be proficient in Excel. However, many templates come with easy-to-follow instructions and support, empowering users to overcome these hurdles.

Further Resources for Excel Finance Templates Personal

Many websites and online communities support users in their financial management journey. Explore forums, blogs, and videos that provide guidance on enhancing your financial skills with Excel templates. Moreover, consider engaging with financial advisors or consulting experts for personalized advice.

The Future of Personal Finance Management

As technology continues to advance, the tools available for personal finance management are becoming increasingly sophisticated. Integrating features from apps and software into Excel finance templates personal can elevate your financial planning experience. The possibilities for further customization, automation, and real-time updates promise a bright future for personal finance management.

Conclusion on Excel Finance Templates Personal

Incorporating Excel finance templates personal into your financial management routine can be transformative. With accessible tools and resources at your fingertips, taking charge of your finances and achieving your goals becomes a tangible reality. By navigating the various types of templates, customizing them to your needs, and staying consistent with updates, you can pave the way toward a more secure financial future. Embrace the opportunity to take control of your personal finances today, and experience the positive changes that come with informed financial planning.