Managing your personal finances can often feel overwhelming. Between tracking expenses, managing income, and planning for future investments, the task seems formidable. However, utilizing a personal financial template in Excel simplifies this process, bringing clarity and organization to your financial life. By adopting this tool, you can establish a comprehensive overview of your financial situation, helping you make informed decisions about your money.

The Benefits of Using a Personal Financial Template in Excel

In today’s fast-paced world, having a structured approach to financial management is crucial. A personal financial template in Excel offers numerous benefits that can lead to better financial health. Below are some of the key advantages:

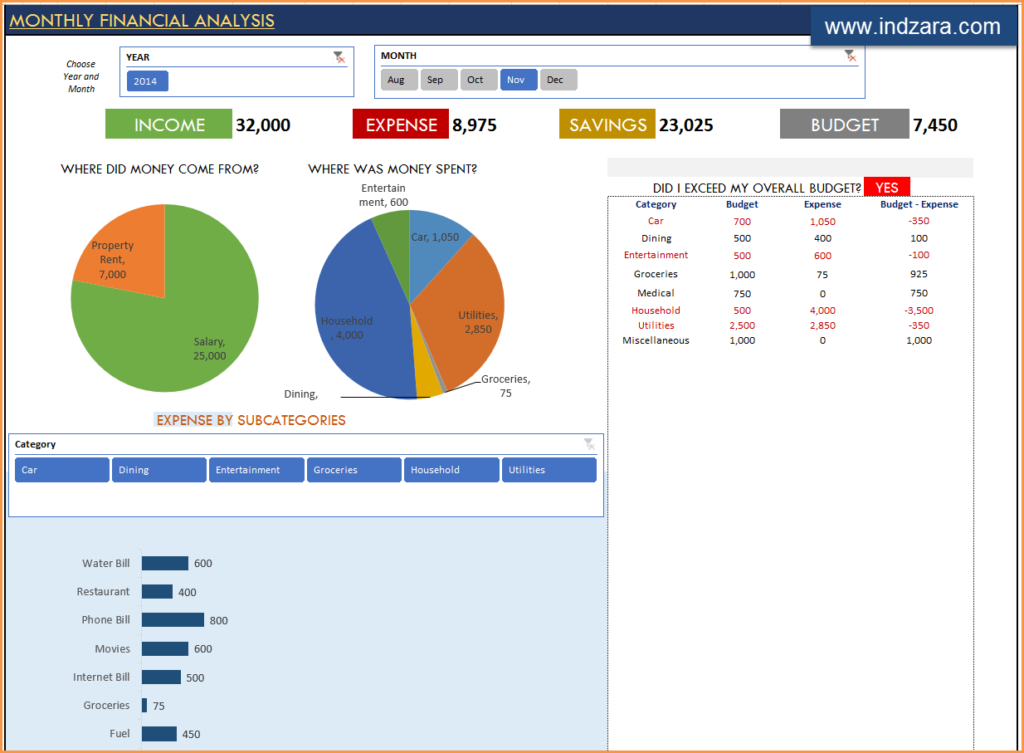

- Easier Budgeting: By entering your income and expenses into a personal financial template in Excel, you can easily see where your money goes each month, helping you stick to your budget.

- Visual Insights: Excel allows for creating charts and graphs that visually display your finances. This tool can help you identify spending patterns and areas for improvement.

- Goal Setting: A financial template helps you set and track financial goals—whether saving for a vacation or retirement—ensuring that you stay committed to your plans.

Creating Your Personal Financial Template in Excel

To harness the full potential of a personal financial template in Excel, start by creating your own or downloading a pre-made template. Let’s dive into the steps involved in crafting your personalized financial management tool.

Step 1: Setting Up Your Spreadsheet

Open a new Excel document and set up headers for your columns. You could consider including:

- Date: To track when each transaction occurs.

- Category: Such as groceries, utilities, entertainment, etc.

- Income: Record all sources of income.

- Expenses: List all expenses to get an accurate view of outflows.

- Balance: Calculate your remaining balance after tracking your income and expenses.

Step 2: Entering Your Data

Once your template is set up, it’s time to enter your financial data. This process involves inputting monthly income and listing all expenses. Make it a habit to update your personal financial template in Excel regularly to ensure it reflects your current financial status.

Utilizing Excel Functions for Enhanced Tracking

After creating your personal financial template in Excel, you should make full use of Excel’s powerful functions to streamline your financial tracking.

Formulas and Functions

Excel has a variety of functions that can assist you in tracking your finances:

- SUM: Use it to total your income and expenses easily.

- AVERAGE: Helps you understand your average monthly expenses and income.

- IF: This function allows you to perform conditional calculations that can be particularly useful in budgeting scenarios.

Conditional Formatting

Excel’s conditional formatting feature enhances your personal financial template by allowing you to visually highlight certain aspects of your finances. For example, you can configure it to automatically change the color of your income and expenses based on predefined thresholds, ensuring you can instantly pinpoint areas of concern.

Visualizing Your Finances with Graphs

Once you have clearly structured and entered your data, creating visual graphs can further illuminate your financial standing. Excel integrates smoothly with spreadsheets for visual data representation. Here’s why graphs should be part of your personal financial template in Excel:

Types of Graphs to Use

Consider these types of graphs for your template:

- Pie Charts: Ideal for visualizing expense categories, thus highlighting where you usually spend the most.

- Bar Charts: Great for comparing monthly income and expenses side by side.

- Line Graphs: Useful for tracking your net worth over time, providing a historical view of your financial progress.

Adapting Your Template to Your Lifestyle

Your financial needs are unique, and your personal financial template in Excel must cater to that uniqueness. Here are some tips for customization:

Incorporating Additional Sections

If you have specific goals, such as saving for a home or a new car, consider integrating sections that reflect these ambitions. You can add:

- Savings Tracking: To keep an eye on how much you’re saving each month.

- Debt Repayment: To manage repayment strategies, keeping track of each debt and its interest rate.

Review and Revise

Make it a habit to review your personal financial template in Excel at least once a month. This review ensures you remain on track to meet your financial goals and can adapt your budget as necessary.

Conclusion: Taking Control of Your Finances

In summary, the journey towards financial stability begins with a solid understanding of your monetary flows. A personal financial template in Excel is a powerful tool that empowers you to take control of your finances, making budgeting simpler and more effective. Whether you’re saving for a significant purchase, planning for retirement, or simply trying to get a better grasp on monthly expenses, this template is the first step in your financial improvement journey.

To Wrap It Up

By leveraging the capabilities of Excel, you are not just creating a spreadsheet; you’re laying down a foundation for financial success. Start building your personal financial template in Excel today and take the reins of your financial future.

Related Resources

For additional guidance on financial management and budgeting strategies, be sure to check out this  .

.

Taking the first step may be the most challenging part of beginning your financial journey, but with dedication and the right tools, you can navigate the path to greater financial stability and success.