Investing in the stock market can be both exciting and overwhelming. With numerous options available, understanding the potential returns on your investments is crucial. One practical tool that can assist in this process is the stock market interest calculator. This article will delve into the significance of this calculator, how to use it effectively, and the benefits it offers to investors at every level.

Understanding the Stock Market Interest Calculator

Before we dive into the details of how to use the stock market interest calculator, it’s essential to comprehend what it is and why it’s beneficial. Essentially, a stock market interest calculator is a tool designed to help investors estimate the potential gains or losses from their investments over a specified period. It factors in various elements, including initial investment, expected annual returns, and the length of time the money will be invested.

How the Stock Market Interest Calculator Works

The functioning of the stock market interest calculator is relatively straightforward. At its core, it employs a formula to project future earnings based on the data inputted by the user. Generally, the calculator requires information such as:

- Your initial investment amount

- Expected interest rate (annual return)

- Duration of the investment (in years)

Once you fill in these details, the calculator does the rest, providing you with an estimated future value of your investment. This enables you to make informed decisions and adjust your strategies accordingly.

A Practical Example of Using the Stock Market Interest Calculator

To further illustrate how the stock market interest calculator works, let’s explore a hypothetical scenario. Suppose you’re considering investing $10,000 in a stock with an expected annual return of 8% over a period of 5 years. By inputting these values into the calculator, you would find that:

After 5 years, your investment could potentially grow to approximately $14,693. This projection gives you a clearer idea of how your initial investment might perform, allowing you to weigh your options better.

Benefits of Using the Stock Market Interest Calculator

Utilizing a stock market interest calculator can yield numerous advantages. Here are a few key benefits:

- Forecasting Potential Returns: One of the most significant advantages of this tool is its ability to provide a forecast of potential investment returns. Investors can visualize how their money could grow over time.

- Setting Realistic Goals: The projections made by the calculator can help investors set realistic financial goals. Understanding the returns expected from certain stocks aids in financial planning.

- Comparative Analysis: Investors can use the calculator to compare different investment options, allowing them to make informed decisions based on potential returns.

Utilizing the Stock Market Interest Calculator for Different Investment Strategies

Regardless of your investment strategy, the stock market interest calculator can help enhance your approach. Here are a few ways you can leverage the calculator:

Long-term Investments

If you are focused on long-term investment strategies, understanding how your investments might grow over several years is crucial. The stock market interest calculator assists in visualizing these long-term gains, motivating investors to commit to sustained investment strategies.

Short-term Trading

For those engaged in short-term trading, the flexibility of the stock market interest calculator allows for quick calculations. By entering different figures, traders can see potential returns and adjust their strategies swiftly, optimizing their trading activities.

The Role of Compound Interest in Investing

When utilizing the stock market interest calculator, it’s essential to understand the concept of compound interest. This principle refers to earning interest on previous interest earned, thus exponentially increasing your potential returns. The calculator will often show projections based on annual compounding, emphasizing the benefits of starting your investment journey early.

Why Early Investment Is Important

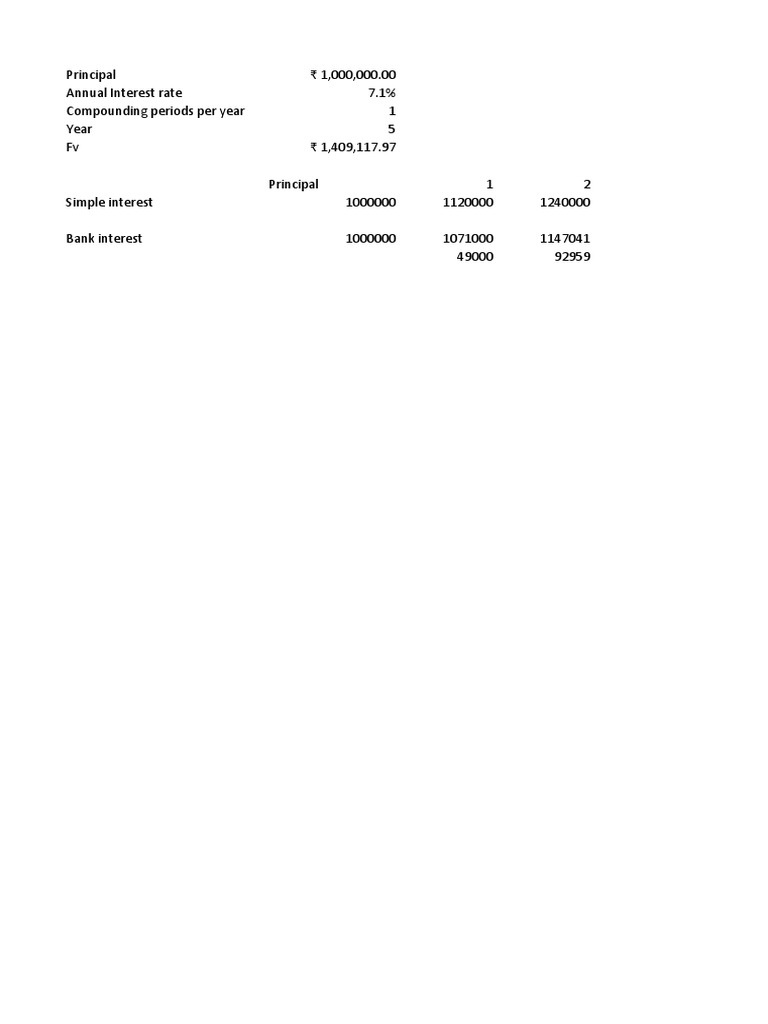

Investing early allows your investments to grow over time, creating wealth that may not be possible with smaller or late contributions. By viewing the projections made by the stock market interest calculator, you can grasp the value of time in investment. Take a look at the following chart:

Visualizing Growth: The Power of Stock Market Interest Calculator

This graph illustrates potential investment growth over time using various interest rates and timeframes. As you can see, the difference between compounding annual interest significantly impacts the long-term outcome of your investments. It serves as a powerful reminder of why one should be mindful of choosing their investment duration wisely.

Choosing the Right Investment Vehicle

Beyond understanding how to utilize the stock market interest calculator, it’s crucial to choose the right investment vehicle. Various options, such as stocks, bonds, mutual funds, and ETFs, all come with different levels of risk and return potential.

Risk Assessment and the Stock Market Interest Calculator

Another advantage of the stock market interest calculator is its ability to assist with risk assessment. By plugging in various hypothetical scenarios regarding interest rates or investment length, investors can gauge the level of risk they are comfortable with. A better understanding of potential outcomes enables more strategic decision-making when selecting investment vehicles.

Conclusion: Empowering Your Investment Journey

In conclusion, the stock market interest calculator is an invaluable tool that can empower investors of all levels. By providing projections of potential returns, assisting in goal setting, and enhancing your understanding of compound interest, this calculator can help you navigate the complexities of investing with more confidence and clarity.

Whether you’re an experienced investor or just starting, leveraging a stock market interest calculator is a step towards informed decision-making and achieving your financial goals. Embrace the power of this tool, and you’ll find yourself better equipped to tackle the stock market and grow your wealth over time.