Managing personal finances can often feel overwhelming, particularly in our fast-paced modern world. Yet, effectively organizing your finances is essential for a secure future. The right tools can empower you to take charge of your budgeting, spending habits, and savings strategies, all while minimizing stress. In this article, we will explore the best personal finance management tool that can help you streamline your financial activities and reach your goals. Let’s delve into this tool and uncover how it can transform your financial life.

The Best Personal Finance Management Tool: A Comprehensive Overview

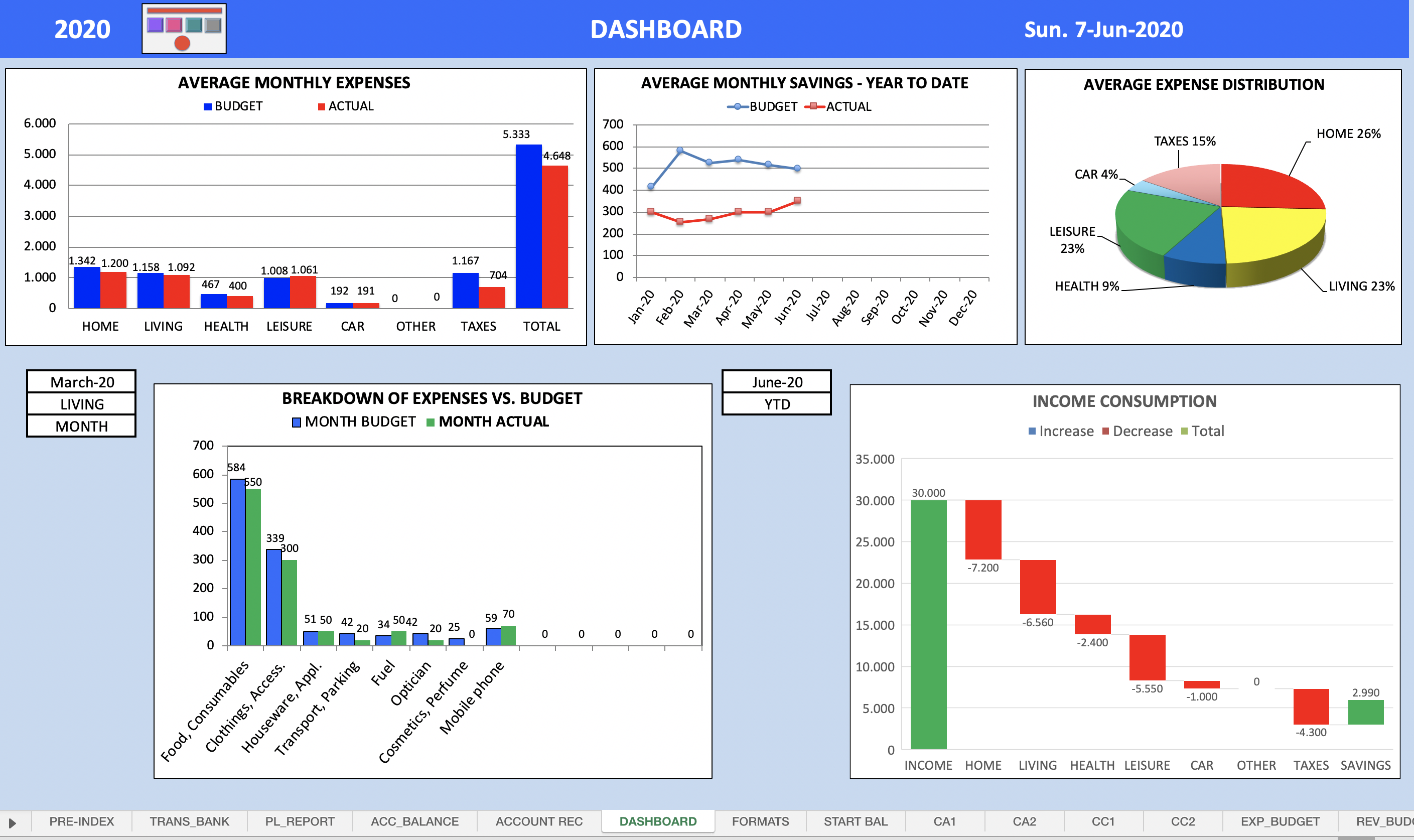

This image illustrates the sophisticated interface of the best personal finance management tool available. This innovative resource is designed to cater to individuals seeking clarity and control over their financial landscape.

Why Choose a Personal Finance Management Tool?

When you embark on a financial journey, having the best personal finance management tool by your side can set you on a path towards success. This tool provides various features designed to help you keep track of your income, expenditure, savings, and investment goals. Not only does it offer a clear overview of where your money goes, but it also equips you with the insights necessary to make informed decisions.

**Key Benefits of Using a Personal Finance Management Tool:**

1. **Budgeting Made Easy:** Budgeting is a fundamental component of personal finance. With the best personal finance management tool, you can effortlessly create budgets tailored to your spending habits and income.

2. **Automated Tracking:** Gone are the days of manually tracking every transaction. The best personal finance management tool allows for automated tracking, linking to your bank accounts and credit cards, giving you an accurate reflection of your financial standing.

3. **Goal Setting:** Have you ever dreamt of owning your own home, taking a luxurious vacation, or saving for retirement? This tool aids in setting and managing these goals, helping you visualize your progress and stay motivated.

4. **Expense Analysis:** Understanding your expenses is crucial for financial wisdom. The insights derived from the best personal finance management tool will provide clarity on trends in your spending, enabling you to make adjustments as needed.

5. **Time-Savings:** Time is money, and a good personal finance tool saves you both. Automating your financial data collection and organization means more time to focus on your strategies for growth.

Features to Look for in the Best Personal Finance Management Tool

Choosing the best personal finance management tool requires discernment. Here are key features to consider that will maximize your financial visibility:

1. **User-Friendly Interface:** A clean, straightforward interface allows for easy navigation and efficient usage. Compatibility with multiple devices can enhance accessibility.

2. **Flexibility:** Your personal finance needs may change over time, so the tool should accommodate various scenarios—from managing irregular income sources to investment tracking.

3. **Robust Security:** Your financial data is sensitive information. Opt for a tool that prioritizes data security and offers strong encryption measures to keep your information safe.

4. **Comprehensive Reporting Systems:** Advanced tools offer insightful reports and analytics that can help you visualize your financial health over time.

5. **Customer Support:** Reliable customer support can make a world of difference. Whether you’re facing technical difficulties or need guidance on effective usage, having access to responsive support is invaluable.

Getting Started with the Best Personal Finance Management Tool

Embracing a new tool can sometimes be daunting. However, getting started with the best personal finance management tool involves a few straightforward steps:

1. **Sign-Up Process:** Typically, you’ll start with a straightforward registration process where you’ll create an account and customize your profile according to your financial goals.

2. **Link Your Accounts:** For maximum efficiency, link your bank and investment accounts, allowing the tool to gather and analyze your financial data.

3. **Set Your Budget:** Identify your income and expenditures. With your account linked, the tool can give realistic suggestions for budgeting based on historical data.

4. **Track Progress:** Monitor your finances regularly through the tool’s dashboard, ensuring you stay on track with your spending and savings goals.

5. **Adjust as Necessary:** Financial planning is a dynamic process. Don’t hesitate to adjust your budgets and goals as your financial situation evolves.

Common Mistakes to Avoid with Your Personal Finance Management Tool

While the best personal finance management tool streamlines handling finances, users often make several common mistakes:

1. **Infrequent Use:** If you treat the tool as a one-time resource, you might miss out on valuable insights. Regular use will yield the best results.

2. **Ignoring Trends:** Financial behaviors evolve. Pay attention to changes in your spending patterns and adjust your budgets accordingly.

3. **Set and Forget:** Creating a budget is just the beginning. Revisiting and refining your budget should be a regular part of managing your finances.

4. **Neglecting Savings Goals:** Don’t lose sight of your savings objectives. Regular contributions to savings goals should align with your overall financial strategy.

5. **Technical Overconfidence:** Understanding the nuances of a financial tool is essential. Make time for learning about all features it offers, ensuring you’re getting the most from your efforts.

Conclusion: Take Charge of Your Financial Future

Embarking on your personal finance journey may seem overwhelming at first, but utilizing the best personal finance management tool can significantly lighten the load. By enabling you to budget effectively, track spending effortlessly, and evaluate progress towards your financial goals, this tool becomes an indispensable ally in the quest for financial success.

Remember, managing your finances is a lifelong endeavor, but with the right support and resources, achieving your dreams is not just a possibility; it’s a certainty. Take the step today to incorporate the best personal finance management tool into your life and watch as your financial confidence soars.