When it comes to achieving success, whether in our personal lives or in the world of finance, it’s crucial to set clear and realistic goals. Goals provide direction and keep us motivated, but it’s equally important to understand the distinction between short-term and long-term goals. While long-term goals often seem more prominent on the path to success, short-term goals play a vital role in steering us toward those bigger aspirations. In this article, we’ll delve into the elements that define short vs long-term goals, alongside practical short term investment goals examples that can help you refine your financial strategies.

Understanding Short vs Long-Term Goals

Goals can be categorized into short-term and long-term, based largely on the time-frame they cover. Short-term goals are typically those you aim to achieve within a year or less. These might include saving a certain amount of money, learning a new skill, or completing a personal project. Long-term goals, on the other hand, are those that tend to take three to five years or longer to accomplish. Think of buying a home, saving for retirement, or pursuing a degree. While having a balance of both types of goals is important, short-term goals act as stepping stones that pave the way for long-term success.

Short Term Investment Goals Examples: Setting the Stage

When it comes to investing, having short-term investment goals can play a pivotal role in your overall strategy. They will vary depending on individual circumstances, risk tolerance, and financial needs. Here are a few examples of short term investment goals that can set you on a path to success:

1. Building an Emergency Fund

One of the most fundamental short term investment goals examples is establishing an emergency fund. This is a separate savings account designated for unexpected expenses like medical emergencies, car repairs, or job loss. A good rule of thumb is to save three to six months’ worth of living expenses in an easily accessible account, ensuring you’re prepared for the unexpected.

2. Saving for a Vacation

Another common goal is saving for a vacation. This can serve both as a rewarding experience and an incentive to save. Determine how much you’ll need, establish a timeline, and break it down into monthly savings. This goal not only enhances your financial discipline but also rewards you for your efforts when you finally take that trip.

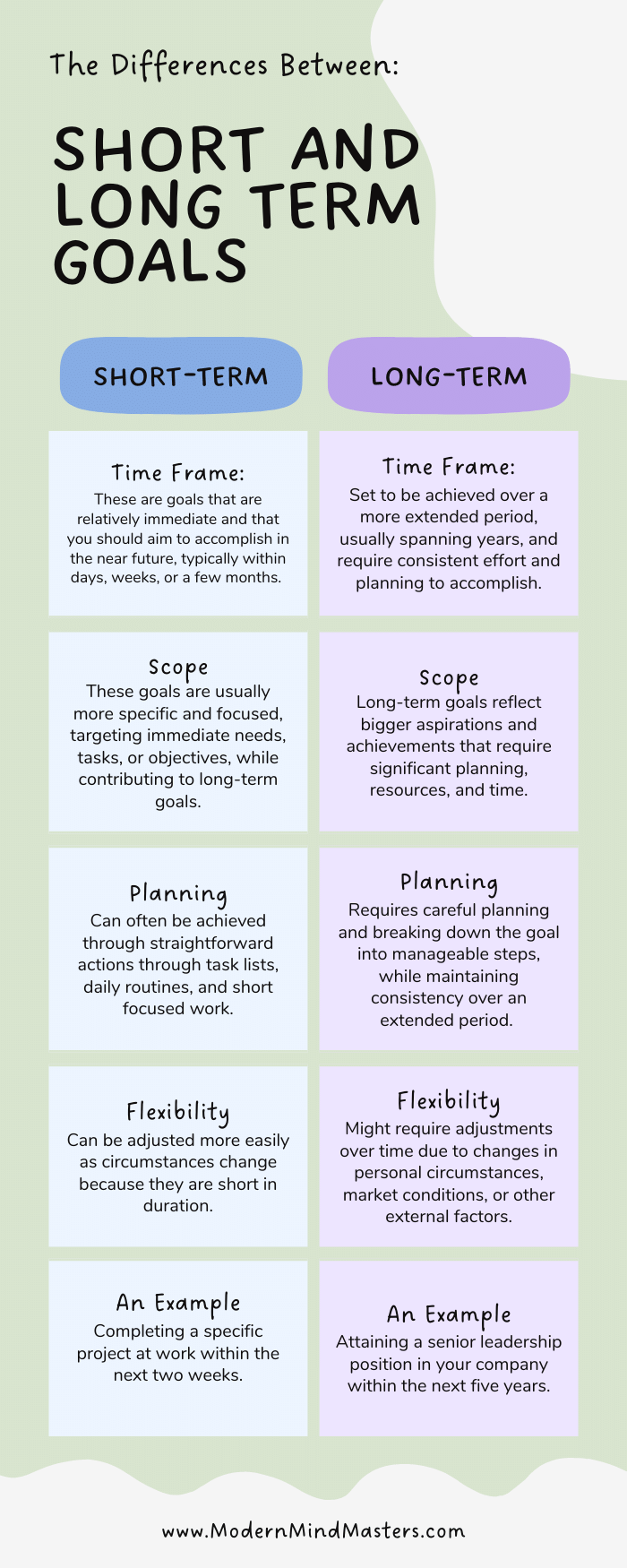

Visualizing Short vs Long-Term Goals

This diagram visually represents the differences between short-term and long-term goals. It emphasizes how short-term investment goals examples can serve as practical steps toward achieving your broader aspirations.

3. Paying Off High-Interest Debt

Another pivotal short term investment goal can be narrowing down high-interest debts. Instead of focusing solely on the total amount owed, create a plan to direct extra funds toward debts with the highest interest rates first. This can save you considerably in interest payments over time, and achieving this goal can lead to financial freedom and improved credit scores.

4. Saving for a Major Purchase

Whether it’s a new car, home appliances, or even a new computer, planning for significant purchases is another excellent short term investment goal example. By outlining your financial capabilities and creating a saving strategy, you can avoid accumulating debt tied to these purchases and enjoy them without financial stress.

Aligning Short and Long-Term Goals

Short-term and long-term goals should not be treated as separate entities. Instead, they should align and support each other. Your short-term investments create the groundwork for long-term achievements. As you accomplish your short-term goals, you’ll build confidence and skills, which will positively influence your ability to tackle more significant challenges down the line.

5. Learning New Skills

Investing in education by acquiring new skills can relate directly to professional long-term goals. Short courses, webinars, or certifications in your field can boost your earning potential and open doors to job advancement. By planning these educational investments now, you set yourself up for success in the future, establishing a solid foundation upon which to build.

6. Contributing to Retirement Accounts

Even if your primary intention is to prepare for retirement, making contributions to your 401(k) or IRA serves as an essential short term investment goal. Even small, regular amounts can grow significantly over time due to compounding, making your golden years much more enjoyable.

How to Create Actionable Short Term Goals

To maximize the benefits of your short-term goals, consider the SMART criteria: Specific, Measurable, Achievable, Relevant, and Time-bound. This framework helps ensure clarity and increase your chances of success. Here’s an example of a SMART short term goal:

Specific: I will save $1,000.

Measurable: I will track my saving progress monthly.

Achievable: I will save $200 each month for five months.

Relevant: This will help me purchase a new laptop for work.

Time-bound: I will reach this goal by the end of [month].

Monitoring and Measuring Your Progress

It’s crucial to regularly assess your short-term investment goals and track your progress. Doing so allows for adjustments if necessary, ensuring you’re on the right track. Utilizing budgeting apps or simple spreadsheets can greatly assist in monitoring your financial journey.

Keep in mind that achieving short-term goals is a stepping stone for long-term planning. The motivation and discipline gained through short term investment goals examples can catapult you into a future filled with greater financial stability and personal growth.

Final Thoughts on Short vs Long-Term Goals

Savor the small victories along your journey as these moments build confidence and reinforce your dedication to your larger ambitions. The interplay between short and long-term goals defines your overall success. By outlining specific short term investment goals examples and pursuing them diligently, you’ll create a roadmap guiding you toward achieving your long-term objectives, ultimately leading to a fulfilling and prosperous life.