Setting goals is fundamental to achieving success, especially when it comes to personal finance management. Understanding the differences between short-term and long-term goals can guide your planning process and enable you to make sound investment choices. In this article, we will dive deep into the concepts of short-term and long-term goals, while providing insights into the best investments for short-term goals, ensuring your financial journey is both informed and fruitful.

Defining Short vs Long-Term Goals

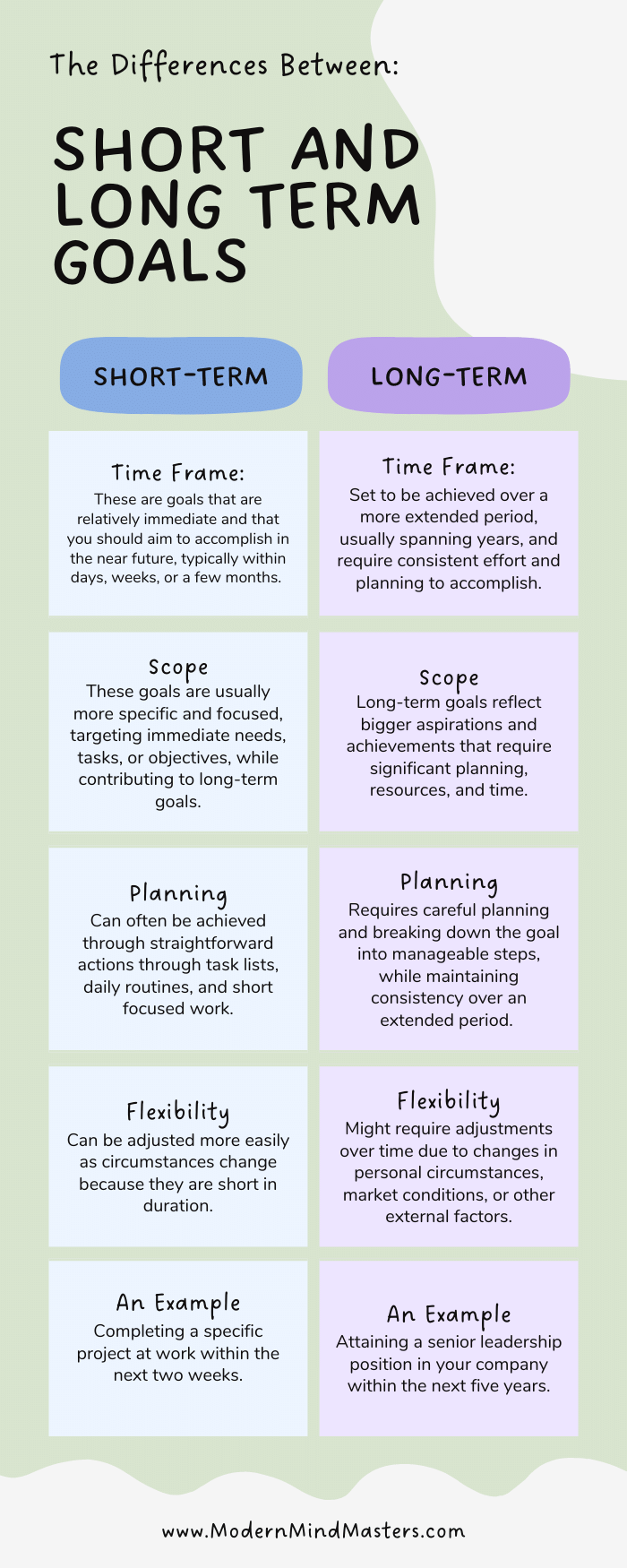

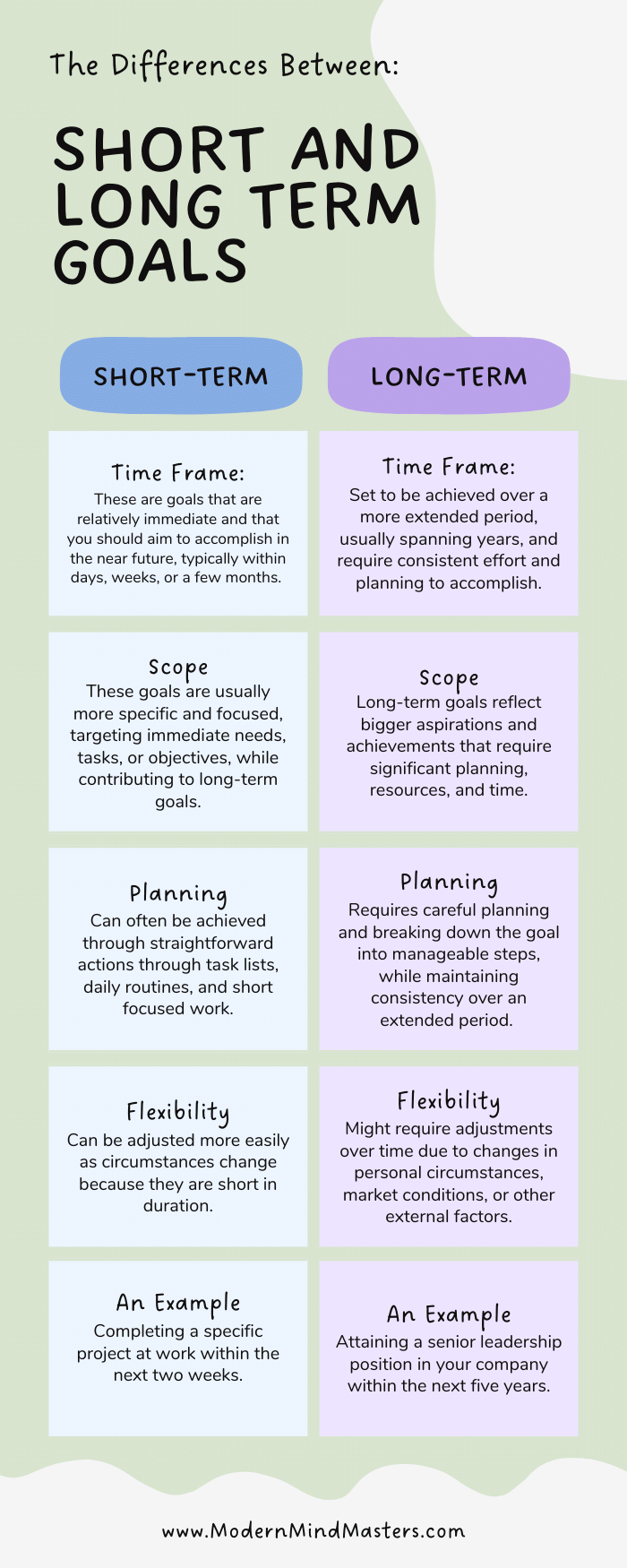

Short-term goals are typically defined as ambitions you aim to achieve within a year or two. These might include saving for a vacation, purchasing new furniture, or even paying off small debts. On the other hand, long-term goals span a broader time frame, often extending beyond two years. These may involve saving for retirement, buying a home, or setting aside funds for your children’s education. Understanding the time frame of your goals is crucial as it influences your investment strategy significantly.

The Importance of Goal Setting

Goal setting is vital because it provides direction and purpose for your financial endeavors. Without clear goals, it can be easy to lose focus and get sidetracked by day-to-day expenses or impulsive spending. Establishing both short-term and long-term goals can create a balanced financial plan, allowing you to allocate resources effectively and prioritize your efforts. Furthermore, by knowing what you’re working toward, you can measure your progress and celebrate milestones along the way, reinforcing positive financial behaviors.

Clarifying Your Short-Term Objectives

When setting short-term goals, it’s essential to be specific. For example, rather than stating you want to save money, define how much you aim to save and by when. This specificity enhances motivation and accountability. A well-structured approach to your short-term goals can simplify your path toward achieving them and preparing for further financial aspirations.

Evaluating Your Current Financial Position

Before diving into the best investments for short-term goals, it’s crucial to assess your current financial situation. Evaluate your income, expenses, savings, and outstanding debts. This exercise will help you identify areas where you can cut back on spending to allocate more towards your short-term investments. Understanding your cash flow is vital, as it determines how much money you can afford to invest or save without compromising your daily living needs.

Best Investments for Short-Term Goals

Now that you have a clear understanding of your financial position and short-term objectives, it’s time to explore the best investments for short-term goals. The following investment vehicles can assist you in reaching your short-term financial targets while managing risks effectively.

High-Yield Savings Accounts

A high-yield savings account is one of the most accessible and safest places to park your funds. Unlike traditional savings accounts, high-yield options often offer interest rates that can be several times higher, allowing your money to grow while remaining liquid. They are especially suitable for short-term goals, as you maintain easy access to your cash without prohibitive fees.

Certificates of Deposit (CDs)

Certificates of Deposit are another excellent option among the best investments for short-term goals. CDs require you to lock your money for a fixed period, typically ranging from a few months to a few years, in exchange for a higher interest rate compared to a standard savings account. While your funds will be inaccessible until the CD matures, the guaranteed returns can be very appealing for those saving towards a specific short-term objective.

Money Market Accounts

Money market accounts combine features of both savings and checking accounts. They often offer competitive interest rates, and sometimes, account holders can write checks or use debit cards linked to their money market accounts. This flexibility is beneficial for short-term goals, allowing you to earn interest while maintaining immediate access to your funds.

Investing in Stocks for Short-Term Gains

While typically considered a long-term strategy, some individuals opt to invest in stocks for potential short-term gains. This approach, although riskier, can yield significant returns if executed correctly. Invest in well-researched companies with stable performance forecasts and consider diversifying your portfolio to mitigate risks associated with market volatility. Additionally, keep abreast of market trends and investment news to make informed buy or sell decisions.

Bonds as a Short-Term Investment Option

Bonds can also feature in the discussion of the best investments for short-term goals. Short-term bonds typically have maturities of one to three years and can provide a reliable source of income. They carry less risk than stocks but usually offer lower returns. Including bonds in your investment strategy ensures some level of capital preservation while still working towards your financial goals.

Real Estate Crowdfunding

If you’re interested in real estate but want to avoid large capital requirements, real estate crowdfunding can be an intriguing short-term investment option. Through crowdfunding platforms, you can invest smaller amounts in real estate projects that are expected to generate returns within a shorter time frame. Researching the particular projects and their performance potential is essential before committing your money.

Peer-to-Peer Lending

Peer-to-peer lending involves lending your money to individuals or businesses through online platforms, offering the potential for higher interest returns. This method comes with varying levels of risk and is influenced by the borrower’s creditworthiness. For those who are comfortable with the risk, peer-to-peer lending can be a profitable way to meet some of your short-term financial goals.

Planning for Financial Success

As you explore these investment options, remember that the best investments for short-term goals will depend on your personal financial situation, risk tolerance, and future objectives. Always consider diversifying your investments to balance risk and reward effectively. Engaging with a financial advisor can also prove beneficial in tailoring a strategy that suits your short-term and long-term needs.

Creating a Balanced Financial Plan

Incorporating both short-term and long-term goals in your financial planning is crucial. While pursuing the best investments for short-term goals focuses on immediate needs, consider how these goals fit into your larger financial picture. This holistic approach enables you to allocate resources wisely while safeguarding your long-term aspirations.

Celebrating Milestones

As you achieve your short-term goals, take the time to celebrate these milestones. Acknowledging your progress boosts motivation and commitment to your financial goals. Each successful short-term achievement can serve as a stepping stone, building momentum towards reaching your long-term goals.

In conclusion, understanding the distinctions between short and long-term goals is vital for effective financial planning. By identifying your financial objectives, evaluating your resources, and considering the best investments for short-term goals, you can set yourself on a path toward financial success. This balanced strategy will create a robust foundation for your future endeavors, ensuring that you remain on track to achieving both immediate rewards and long-term prosperity.