In today’s world, where many individuals and families choose to rent rather than own, understanding the nuances of renters insurance is crucial. Protecting your personal belongings and ensuring peace of mind provides a layer of security that everyone deserves. This article will delve deep into renters insurance, highlighting the coverage for renters, average premiums, and essential statistics that every renter should be aware of.

Understanding Renters Insurance: Coverage for Renters

Renters insurance is designed to cover personal property in the event of loss or damage caused by theft, fire, or other unforeseen incidents. In addition to covering your belongings, it also protects you from liability if someone is injured in your rented space. This comprehensive insurance option has increasingly become a necessity rather than a luxury for renters.

The Importance of Renters Insurance: Coverage for Renters

Many renters underestimate the importance of having insurance coverage. According to recent data, approximately 70% of US renters do not have renters insurance. This statistic highlights a significant gap in risk management among renters. Imagine losing everything in a fire or theft without any means to recover your belongings—this is where renters insurance comes in. It provides financial protection that can alleviate the stress and burden of such unfortunate events.

Key Coverage Options in Renters Insurance: Coverage for Renters

The coverage options in renters insurance typically fall into three categories: personal property coverage, liability coverage, and additional living expenses. Here’s a breakdown of what each of these covers:

- Personal Property Coverage: This covers your belongings, such as furniture, electronics, and clothing, against damages or losses due to specific risks like theft, fire, or vandalism. Most policies cover personal property at replacement cost or actual cash value.

- Liability Coverage: If someone gets injured while in your rented apartment, liability coverage can help cover medical expenses and legal fees if you are found to be at fault.

- Additional Living Expenses: If your rental becomes uninhabitable due to a covered hazard, this coverage provides financial support for temporary housing and other essential costs.

Average Premiums for Renters Insurance

When considering renters insurance, the cost is often a primary concern. The average premium for renters insurance varies based on several factors, including location, coverage amount, and personal belongings’ value. Nationally, renters can expect to pay approximately $15 to $30 per month for standard coverage.

Factors Influencing Renters Insurance Premiums

Several factors can influence the premium you pay for renters insurance:

- Location: Renters insurance is often more expensive in urban areas where the risk of theft and property damage is higher. Understanding your specific region’s risk levels can provide insights into potential costs.

- Coverage Amount: The more coverage you require, the higher your premium will be. Accurately assessing the value of your belongings ensures you get sufficient coverage without overpaying.

- Security Features: Having security measures in place, such as an alarm system or deadbolts, can lower your premium due to reduced risk for the insurer.

Renters Insurance Claims: What to Expect

To file a claim on your renters insurance, you must follow a structured process. The typical steps include:

- Document the Damage: Take photos of any damage or theft. This evidence will be crucial when filing your claim.

- Contact Your Insurance Provider: Notify your insurer about the incident as soon as possible. Providing them with necessary information and documentation expedites the claims process.

- Submit Your Claim: Fill out your insurance claim form with accuracy. Your insurer may require details about the incident, damaged items, and any police report if applicable.

- Assessment: An adjuster will likely evaluate the claim. They will assess the damages and determine how much compensation you qualify for based on your policy coverage.

- Receive Compensation: Once the claim is approved, you will receive compensation according to your policy’s terms.

How to Choose the Right Renters Insurance Policy

Selecting the appropriate renters insurance policy can feel overwhelming, but it doesn’t have to be. Here are some tips to help you choose wisely:

- Assess Your Needs: Consider the total value of your personal belongings. This number will guide you in selecting the appropriate coverage amount.

- Compare Quotes: Obtain quotes from multiple insurance providers to ensure you are getting competitive rates. Most providers offer online quotes, making it convenient for you to compare.

- Read Reviews: Research or ask for recommendations regarding insurance companies. Customer service quality and claims handling should be significant considerations in your decision-making process.

- Understand the Policy: Make sure you read the terms and conditions comprehensively. Pay attention to specific coverage, limitations, and deductibles.

Common Myths About Renters Insurance

Several myths about renters insurance persist that can lead renters to forego essential coverage:

- Myth: Renters insurance is unnecessary if you live in an apartment complex or a secured building.

Fact: While security systems may reduce risk, they do not eliminate it. Fire, water damage, and theft can still occur. - Myth: Your landlord’s insurance covers your belongings.

Fact: Your landlord’s policy typically only covers the building structure, not your personal property. - Myth: Renters insurance is too expensive.

Fact: On average, renters insurance costs less than buying a cup of coffee a day. Consider the potential financial loss without it.

Conclusion: The Necessity of Renters Insurance

In conclusion, understanding the significance of renters insurance is imperative for anyone renting a home or apartment. Renters Insurance: Coverage for Renters ensures that you are protected against potential financial loss from damages, theft, or liability claims. With average premiums being relatively affordable, prioritizing renters insurance should be a top concern for all renters. Don’t wait until it’s too late—take action today to safeguard your personal belongings and peace of mind!

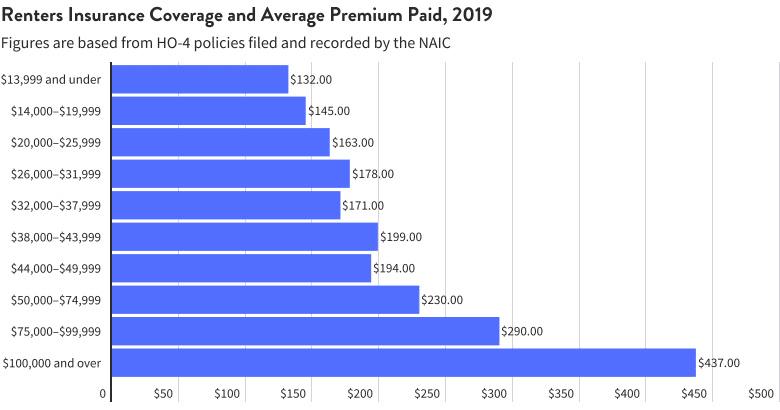

Visual Insight into Renters Insurance

This infographic summarizes crucial statistics related to renters insurance, helping you visualize and comprehend the necessary coverage options available. As you embark on your renters insurance journey, refer back to these insights to make informed decisions.