Managing small business finance is crucial for entrepreneurs who want to ensure the longevity and success of their ventures. Navigating the financial landscape can be daunting; however, with the right strategies in place, small business owners can streamline their financial processes and establish a solid foundation for growth. In this article, we will explore key aspects of managing small business finance while also emphasizing the importance of marketing these financial strategies effectively.

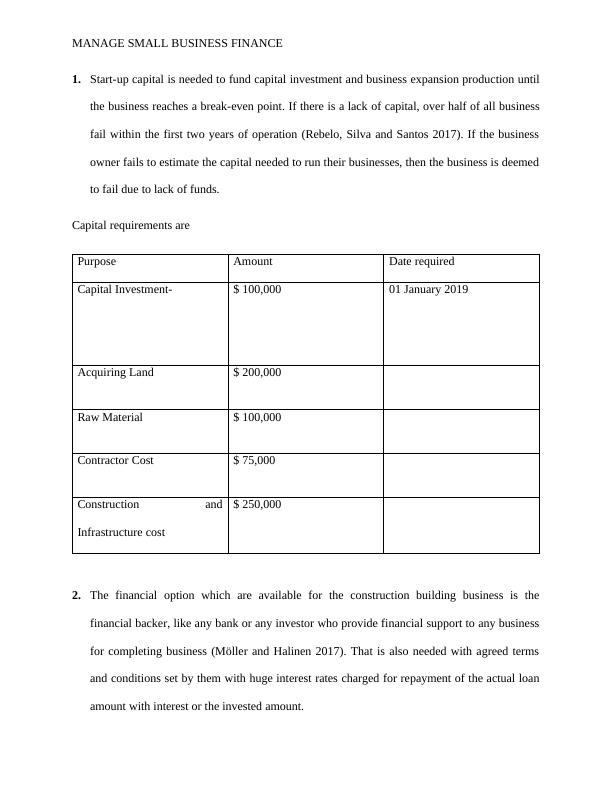

Understanding the Basics of Marketing Small Business Finance

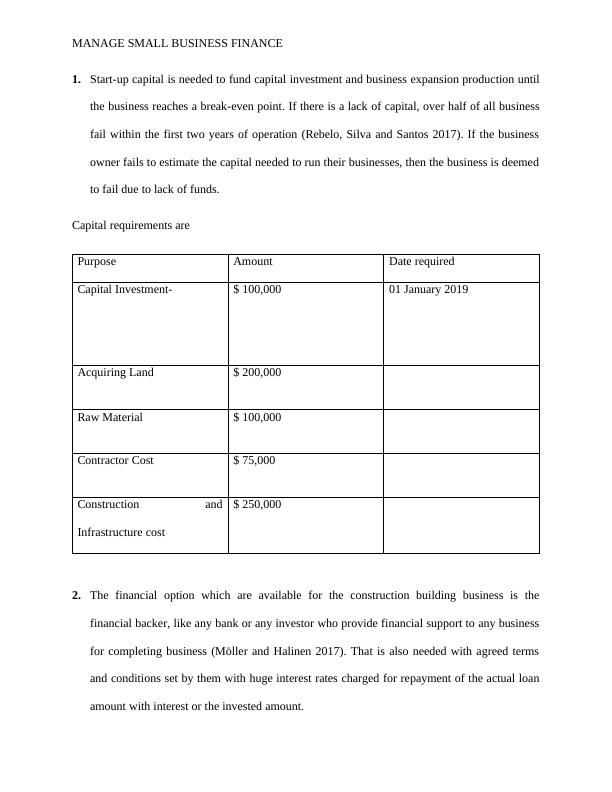

For many entrepreneurs, understanding the fundamental principles of managing small business finance is essential. First and foremost, it is important to have a clear understanding of your revenue streams and expenses. Knowing how much money comes in and goes out can help you avoid common pitfalls and make informed decisions about how to allocate resources. This is also where marketing your small business finance comes into play.

Creating a Robust Budget

One of the core components of managing small business finance successfully is creating a robust budget. A well-structured budget allows you to track your financial progress and make adjustments where necessary. Additionally, when you market your small business finance effectively, you can attract clients who recognize your commitment to financial integrity and transparency.

To create a budget, start by outlining all your income sources, followed by a detailed list of expenses. This method will give you a clear overview of your financial status and help you identify areas where you can cut back. Be realistic with your projections, and remember that a budget is not a set-it-and-forget-it tool; it requires regular review and adjustment.

Benefits of Marketing Small Business Finance Solutions

Once you have established your budget, the next step is to look at how you can leverage various marketing strategies to promote your financial solutions effectively. The effective marketing of small business finance solutions helps to enhance your business’s credibility and fosters trust among your customers.

Utilizing Social Media

In this digital age, social media platforms present an incredible opportunity for businesses to reach a wider audience. By sharing informative content that highlights your expertise in managing small business finance, you can position yourself as a trusted resource within your industry. Engage with your audience by posting finance-related tips, success stories, and even industry news to keep your followers informed and engaged.

Effective Communication in Marketing Small Business Finance

When marketing small business finance, clear and effective communication is vital. Potential clients want to see that you can articulate the value of your services and how they can benefit from them. Consider creating visual content, like infographics or video tutorials, which can simplify complex financial concepts and make them more digestible for your audience.

Investing in SEO for Enhanced Visibility

Furthermore, investing in Search Engine Optimization (SEO) can significantly improve the visibility of your offerings. By optimizing your website and content for relevant keywords, such as “managing small business finance,” you increase your chances of attracting organic traffic, which translates into potential leads. This approach can further bolster your marketing efforts and establish your authority in the field.

Image: Marketing Small Business Finance

As seen in the image above, effective marketing strategies are integral to promoting your financial services. Utilizing visuals alongside your marketing efforts adds significant value.

Networking: Building Relationships in Marketing Small Business Finance

Networking plays a crucial role in the marketing realm, especially when it comes to small business finance. Attend industry-related events, webinars, and workshops to meet fellow entrepreneurs and potential clients. This is a great way to share your knowledge and expertise in managing small business finance while also promoting your services.

Partnership Opportunities

Consider fostering partnerships with other businesses and professionals that complement your services. For example, you could collaborate with accountants or financial advisors to provide comprehensive financial solutions to your clients. This collaboration can open up new avenues for marketing small business finance effectively, as each partner brings their network and expertise to the table.

Leveraging Technology in Managing Small Business Finance

Integrating technology into your financial management processes can enhance efficiency and accuracy. There are numerous software solutions available that assist with budgeting, forecasting, and accounting. Utilizing these tools ensures that you maintain precise records, allowing you to make data-driven decisions regarding your business finances.

Mobile Apps for Financial Management

Moreover, mobile applications dedicated to financial management can enable you to track your expenses and revenues on the go. Many clients appreciate the convenience offered by these technologies, making them valuable assets in your overall marketing small business finance strategy. Marketing these modern features can attract tech-savvy customers who value efficiency.

Educating Your Audience: A Key to Marketing Small Business Finance

Education plays a pivotal role in empowering your current and potential clients. By providing resources such as blogs, e-books, or webinars focused on managing small business finance, you can build trust and establish yourself as an authority in the field. This approach aligns with the marketing objectives, as informed clients are more likely to utilize your services.

Organizing Workshops and Seminars

Hosting workshops and seminars provides an interactive platform to educate your audience on financial management. These events create opportunities for direct engagement, allowing you to address concerns and questions while showcasing your expertise in managing small business finance.

Final Thoughts on Marketing Small Business Finance

In conclusion, managing small business finance and effectively marketing your financial strategies go hand in hand. By understanding the fundamentals of budgeting, leveraging technology, and utilizing modern marketing techniques, you can establish a successful small business that thrives in today’s competitive environment. Continue to refine your approach, remain adaptable to emerging trends, and keep the focus on providing value to your clients to ensure sustained growth and success.

Prioritizing communication, education, and relationship-building efforts will create a solid foundation for your business, further enhancing your capacity to manage small business finance effectively. While the journey may be challenging, the rewards of diligent financial management and smart marketing practices will undoubtedly lead to lasting success.