As we delve into the intricate world of small business finance markets for 2022/23, it’s important to understand the factors shaping opportunities and challenges in this space. With the economy continually evolving, small business owners must arm themselves with knowledge about the current financial landscape to unlock growth potential and navigate obstacles effectively. In our exploration, we will review recent trends, financing options, and practical tips for small business owners to thrive in this dynamic environment.

The State of Small Business Finance Markets 2022/23

The small business finance markets for 2022/23 are characterized by both challenges and opportunities that can influence a company’s success. From alternative funding sources to traditional loans, understanding where to seek financing is crucial. Small businesses are the backbone of our economy, and ensuring their success is paramount for overall growth.

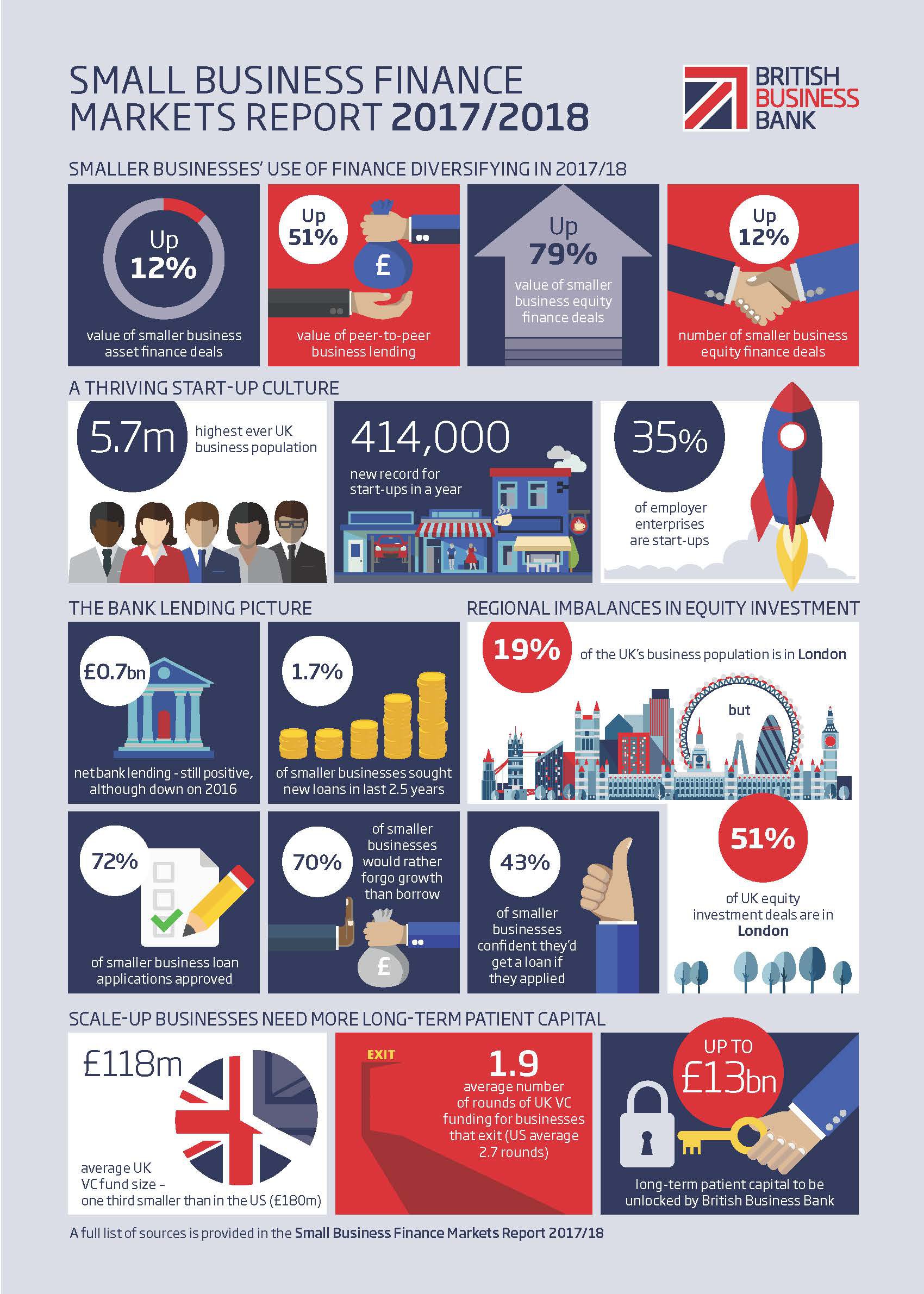

This infographic encapsulates vital insights into the state of small business finance, highlighting trends and statistics from previous years. Observing these patterns helps in recognizing how they can evolve and impact the small business finance markets for 2022/23.

Understanding Key Trends in Small Business Finance Markets 2022/23

As we transition into 2022/23, several trends emerge based on current economic indicators. One significant trend is the rise of digital lending platforms. These innovative solutions provide small businesses with easier access to cash flow, often with faster approval times and fewer requirements than traditional banking systems. Moreover, tech solutions are streamlining the lending process and providing businesses with tools to manage finance better.

Another important aspect of the small business finance markets is the increasing reliance on alternative financing options such as crowdfunding, peer-to-peer lending, and invoice financing. These methods allow small businesses to tap into diverse pools of capital that may not be available through conventional channels.

Financing Options for Small Business Finance Markets 2022/23

With a clearer understanding of the current state and emerging trends, it’s time to discuss the available financing options that will shape the small business finance markets for 2022/23. Each business is unique, and the path to financing must align with individual goals and needs.

Traditional Loan Products

Traditional bank loans and lines of credit remain a prime choice for many small businesses. However, the rigorous application processes, collateral requirements, and repayment terms can be daunting. For entrepreneurs who have established credit history and a solid business plan, these traditional forms of financing can provide long-term capital for expansion.

Alternative Financing Options

As mentioned previously, the landscape is also buzzing with alternative financing options. These options may provide quicker access to cash, albeit often at a higher cost. Nevertheless, they can be invaluable for businesses needing immediate liquidity. Popular alternatives include:

- Crowdfunding: Platforms like Kickstarter or GoFundMe empower entrepreneurs to solicit funds directly from their community.

- Peer-to-Peer Lending: Services connect individuals willing to lend money with small business owners seeking loans, often with more flexible terms than banks.

- Invoice Financing: Businesses can borrow against their unpaid invoices, providing relief from cash flow shortages.

Challenges Facing Small Business Finance Markets 2022/23

Despite the variety of financing sources, small business owners are not without their challenges. One of the key hurdles is maintaining a positive cash flow. Understanding financial management can go a long way in averting potential cash crunches. Therefore, enhancing financial literacy should be a priority for business owners, helping them assess risk and make informed decisions.

Economic Uncertainties

The unpredictable economic environment can also create challenges. Issues like inflation and supply chain disruptions can affect everything from operational costs to customer demand. Staying informed about economic indicators and market trends allows business owners to strategize effectively.

Moreover, the competitive landscape has intensified as more businesses seek financing to establish or enhance their market position. This competition may prompt lenders to tighten their requirements, making financing more challenging for small enterprises.

Strategies for Success in Small Business Finance Markets 2022/23

So, how can small business owners position themselves for success amidst the complexities of the finance markets? Here are several strategies to consider:

1. Build Strong Credit History

Maintaining a strong credit history is essential for obtaining favorable financing options. Business owners should ensure timely payments on loans and credit cards to build a positive credit profile. Additionally, monitoring credit reports regularly can help identify areas for improvement.

2. Diversify Financing Sources

Entrepreneurs should explore diverse financing options rather than relying solely on traditional banks. This could mean leveraging a mix of personal savings, traditional loans, and alternative financing sources to create a more robust financial strategy.

3. Financial Literacy and Education

Taking the time to enhance financial knowledge can yield long-term benefits. This means understanding balance sheets, cash flow statements, and profit margins. Business courses and financial workshops can provide valuable insights that empower owners to make informed financial decisions.

Conclusion: Navigating Small Business Finance Markets 2022/23

The small business finance markets for 2022/23 present both obstacles and opportunities. By understanding the landscape and employing strategic approaches to financing, small business owners can thrive despite the challenges ahead. Staying informed about trends, diversifying funding options, strengthening credit histories, and improving financial literacy are steps that can guide them along the path to sustainable growth.

In the ever-evolving world of small business finance, knowledge truly is power. Entrepreneurs are encouraged to engage with resources and explore innovative financing options tailored to their needs. With determination and a solid financial strategy, achieving success in the small business finance markets of 2022/23 becomes a more attainable goal.