When considering the financial landscape of the modern world, one name prominently stands out: BlackRock. Known as the world’s largest asset management firm, the question arises: how much does BlackRock manage in assets? In 2024, BlackRock is projected to oversee an astounding amount of financial resources. The implications of such asset management go beyond figures; they symbolize the power and influence that BlackRock holds in the global economy.

Understanding How Much Does BlackRock Manage in Assets

BlackRock’s influence is felt across various asset classes, and its management capabilities stretch into the trillions of dollars. But just how much does BlackRock manage in assets? As of 2024, the firm reported managing approximately $10 trillion. This figure is mind-boggling and signifies the trust that investors, both retail and institutional, place in the firm. With a range of products including exchange-traded funds (ETFs), mutual funds, and private equity, BlackRock’s vast asset management portfolio showcases its versatility and dominance in the financial realm.

Visualizing BlackRock’s Asset Management

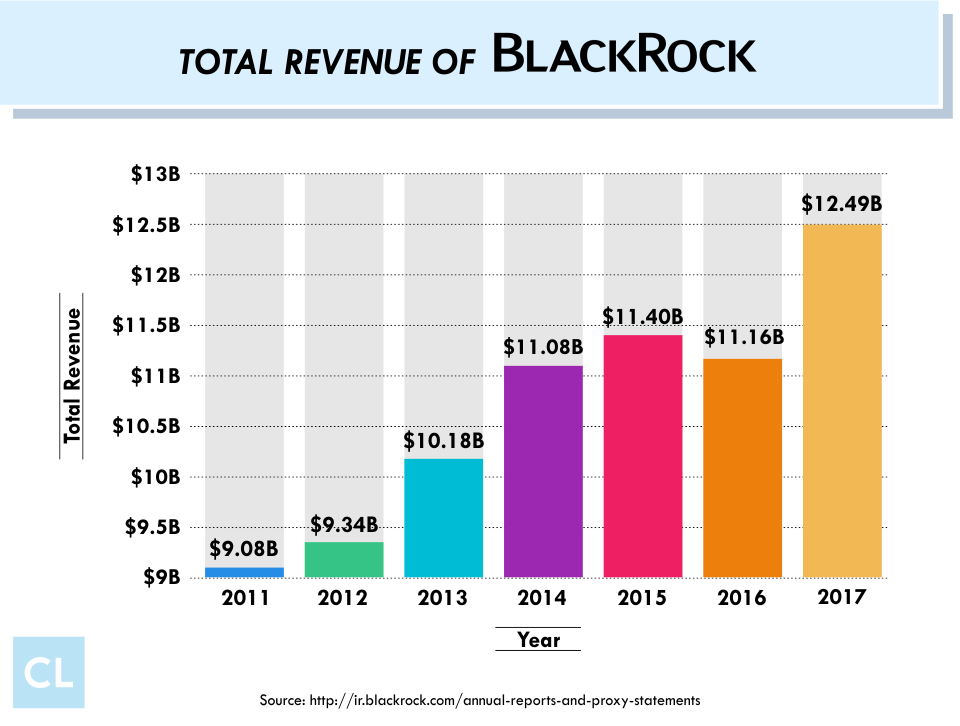

To better understand the scope of BlackRock’s financial management, let’s look at a visual representation that encapsulates its journey over recent years.

Total Revenue of BlackRock – A Decade of Growth

This graphic illustrates how BlackRock’s revenue has evolved over a span of years, correlating with its asset management capabilities. The growth trajectory not only highlights the firm’s operational efficiency but also its ability to attract and retain assets under management (AUM).

Factors Contributing to BlackRock’s High Asset Management

So, what factors contribute to how much BlackRock manages in assets? Several elements play crucial roles:

- Innovation in Investment Products: BlackRock is a pioneer in the ETF space, with its iShares brand leading the way. This level of innovation ensures a steady influx of both retail and institutional investors, maintaining the firm’s robust asset management.

- Global Reach: With operations in over 100 countries, BlackRock capitalizes on diverse markets, enhancing its ability to gather assets globally.

- Client Trust: BlackRock has built a strong reputation over decades, earning the trust of clients ranging from governments to individual investors.

- Data and Technology: BlackRock utilizes advanced technology and data analytic tools, allowing for sophisticated market insights that drive investment decisions.

The Impact of Economic Changes on AUM

Another consideration in understanding how much does BlackRock manage in assets is the economic environment. For instance, during periods of market volatility, BlackRock’s diversified offerings enable it to attract flow as investors seek stability. Moreover, the firm’s cautious yet strategic approach to investments helps safeguard its asset base and build long-term relationships with clients.

Investment Strategies Driving AUM

BlackRock employs a range of investment strategies that are pivotal in determining how much does BlackRock manage in assets. By aligning with market trends and economic indicators, the firm tailors its strategies efficiently. Some notable strategies include:

- Active Management: This involves managers actively making decisions on the allocation of assets, aiming to outperform benchmarks.

- Passive Management: Known for its index funds, this strategy aims to replicate the performance of a specific index, which often attracts investors seeking broader market exposure.

- Alternative Investments: Incorporating real estate, commodities, and private equity allows BlackRock to diversify its offerings beyond traditional equity and bond markets.

Client Segmentation and Asset Allocation

Understanding how much does BlackRock manage in assets also necessitates a look at its client segmentation. The firm caters to a diverse clientele, including institutional investors, governments, and retail clients. Each segment comes with different expectations and investment goals, prompting BlackRock to develop bespoke strategies that meet these unique needs. This level of customization not only attracts a wide array of clients but also contributes significantly to its growing AUM.

Future Prospects for BlackRock

Looking forward, how much does BlackRock manage in assets is likely to increase. As the landscape of global finance evolves, factors such as the rise of sustainable investing and the increasing demand for personalized financial solutions are expected to drive growth. BlackRock has already made strides in integrating Environmental, Social, and Governance (ESG) factors into its investment processes, positioning itself as a leader in this burgeoning area.

Moreover, technological advancements will further play a role in asset management. BlackRock continues to invest heavily in Aladdin, its investment and risk management platform, which streamlines operations and enhances decision-making capabilities. These innovative practices not only appeal to modern investors but also ensure the firm remains at the forefront of asset management.

Conclusion: The Endless Pursuit of Assets

In summary, BlackRock’s impressive figures when it comes to asset management are not simply numbers; they represent a company that has established a robust architecture for growth and management efficiency. As of 2024, the amount of assets that BlackRock manages underscores its pivotal place on the world stage of finance. The firm’s future pursuits in technology, sustainable investing, and diverse product offerings suggest that the question of how much does BlackRock manage in assets will inevitably yield even more remarkable figures in the years to come.