The financial landscape has undergone remarkable changes over the past few decades, with asset management firms playing a pivotal role in shaping investment strategies and market dynamics. Among these firms, BlackRock has emerged as a powerhouse, significantly influencing the trajectory of assets under management across various sectors. In this article, we delve into the “blackrock assets under management by year,” shedding light on its growth, the factors contributing to this expansion, and the implications for the broader financial ecosystem.

Understanding BlackRock’s Growth: Assets Under Management by Year

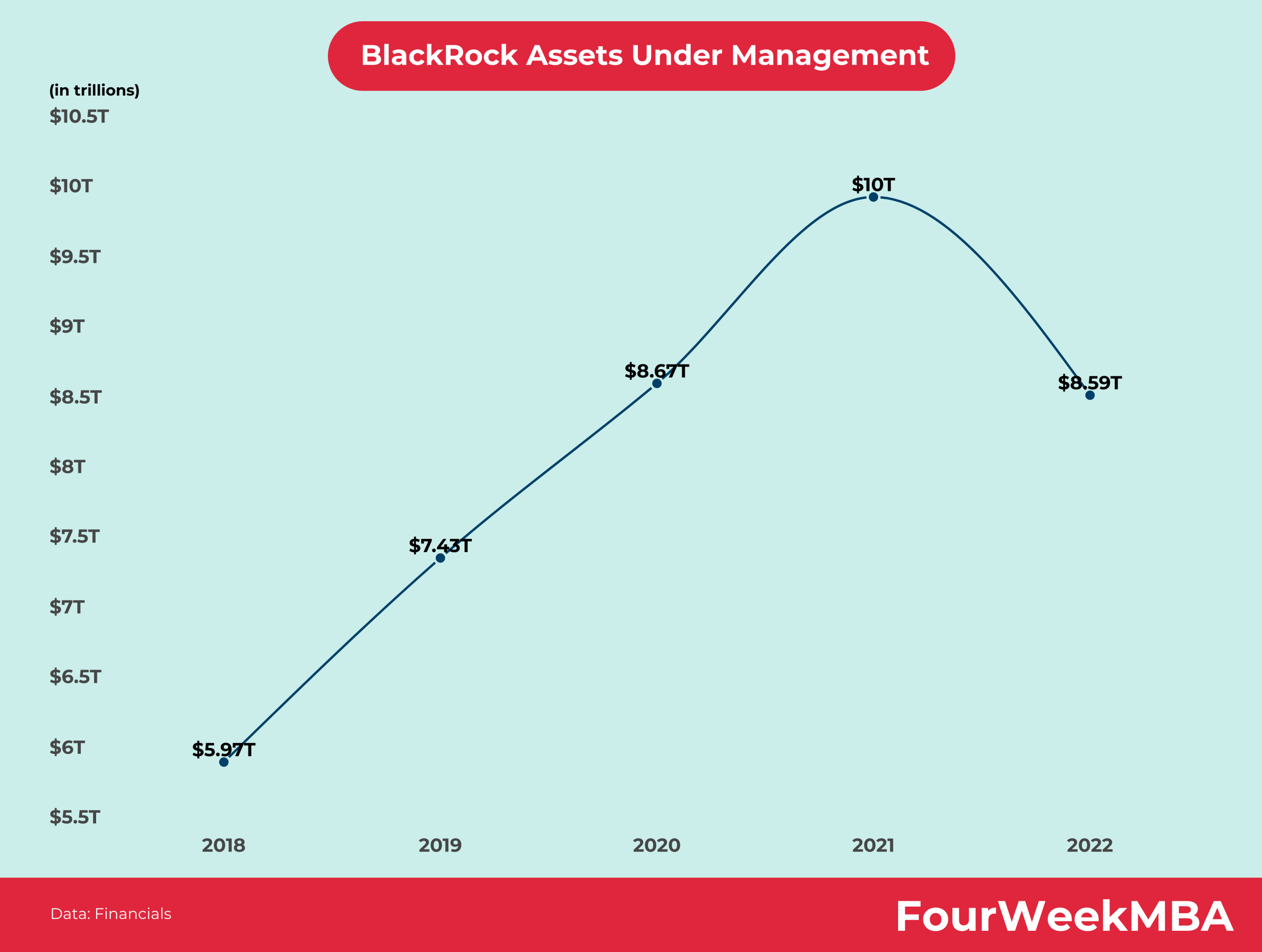

The image above provides a visual representation of BlackRock’s journey, showcasing its assets under management over the years. This remarkable growth can be attributed to a combination of strategic acquisitions, innovative investment products, and a deep understanding of market trends. As we analyze the data, it becomes clear that BlackRock has not only expanded its financial footprint but has also adapted to changing market conditions and investor demands.

Key Milestones in BlackRock’s Asset Management Journey

To truly appreciate the magnitude of “blackrock assets under management by year,” we must revisit some key milestones that have defined the company’s journey. Established in 1988, BlackRock started as a risk management and fixed income investment firm. Its initial focus on managing risk helped it gain the trust of institutional investors, a foundational aspect that would propel its growth in subsequent years.

By the early 2000s, BlackRock began to diversify its portfolio, expanding into equity and alternative investments. The acquisition of Merrill Lynch Investment Managers in 2006 marked a turning point, significantly boosting its assets under management and allowing it to broaden its clientele. This acquisition was instrumental in placing BlackRock on the map as one of the largest asset management firms in the world.

BlackRock’s Assets Under Management by Year: A Detailed Analysis

In examining “blackrock assets under management by year,” one cannot overlook the impact of the 2008 financial crisis. While many firms struggled during this tumultuous period, BlackRock’s reputation for risk management and investment expertise attracted new clients. This influx of capital resulted in a significant increase in assets under management, underscoring the firm’s resilience in challenging times.

Over the next decade, BlackRock continued to innovate, embracing technology and data analytics to enhance its investment strategies. The introduction of exchange-traded funds (ETFs) and passive investment strategies allowed BlackRock to capture a larger share of the market, further solidifying its position as a leader in the asset management space.

As we analyze the years following the financial crisis, we see a remarkable upward trajectory in BlackRock’s assets under management. By 2015, the firm had surpassed the monumental milestone of $5 trillion in assets, showcasing its ability to adapt and thrive in a dynamic marketplace. The trend continued, and by 2020, BlackRock’s assets under management had reached an astonishing $8.68 trillion, a testament to its robust business model and client-centric approach.

The Broader Implications of BlackRock’s Growth

Understanding the implications of “blackrock assets under management by year” goes beyond just financial figures; it reflects broader trends within the investment landscape. BlackRock’s growth signals a shift towards passive investing, with many investors opting for lower-cost investment options that ETFs provide. This shift has reshaped the investment industry, prompting traditional active management firms to rethink their strategies.

The significant influence of BlackRock has also raised discussions around market concentration and the power these large asset managers wield. With trillions of dollars in assets, BlackRock plays a crucial role in corporate governance, activism, and sustainability efforts, impacting various sectors globally. A keen understanding of these dynamics is essential for investors and policymakers alike, as they navigate the implications of such concentration in the financial markets.

Future Outlook for BlackRock’s Assets Under Management

Looking ahead, the trajectory of “blackrock assets under management by year” seems poised for continued growth. The integration of technology in asset management, coupled with the rising demand for sustainable investing, presents new opportunities for the firm. As BlackRock continues to innovate and evolve its investment strategies, the potential for growth remains significant.

Furthermore, as investors increasingly prioritize environmental, social, and governance (ESG) factors in their investment decisions, BlackRock’s commitment to sustainability may attract even more assets. The firm’s emphasis on responsible investing aligns with global trends, positioning it favorably within a competitive landscape.

Conclusion: The Significance of BlackRock’s Asset Management Journey

The journey of “blackrock assets under management by year” reflects not only the story of a successful firm but also serves as a mirror to the evolving landscape of asset management. From its humble beginnings to its current stature as a global leader, BlackRock’s success exemplifies the importance of innovation, adaptability, and a forward-thinking approach in finance.

As investors keep a keen eye on the developments within the asset management sector, understanding the growth of firms like BlackRock will be essential for informed decision-making. The analysis of their assets under management offers valuable insights into market trends, investment strategies, and the potential challenges that lie ahead.

In a rapidly changing financial environment, staying informed about the trends shaping the industry is a key component of successful investment management. BlackRock’s evolution serves as an important case study for both industry participants and investors looking to navigate the complexities of the modern financial world.