BlackRock, the world’s largest asset manager, has captured significant attention and interest in the finance world due to its colossal portfolio of assets under management. As institutions, individual investors, and financial analysts track BlackRock’s influence, understanding the intricacies of what these assets entail and how they reflect market trends becomes crucial.

Understanding the Assets Under Management of BlackRock

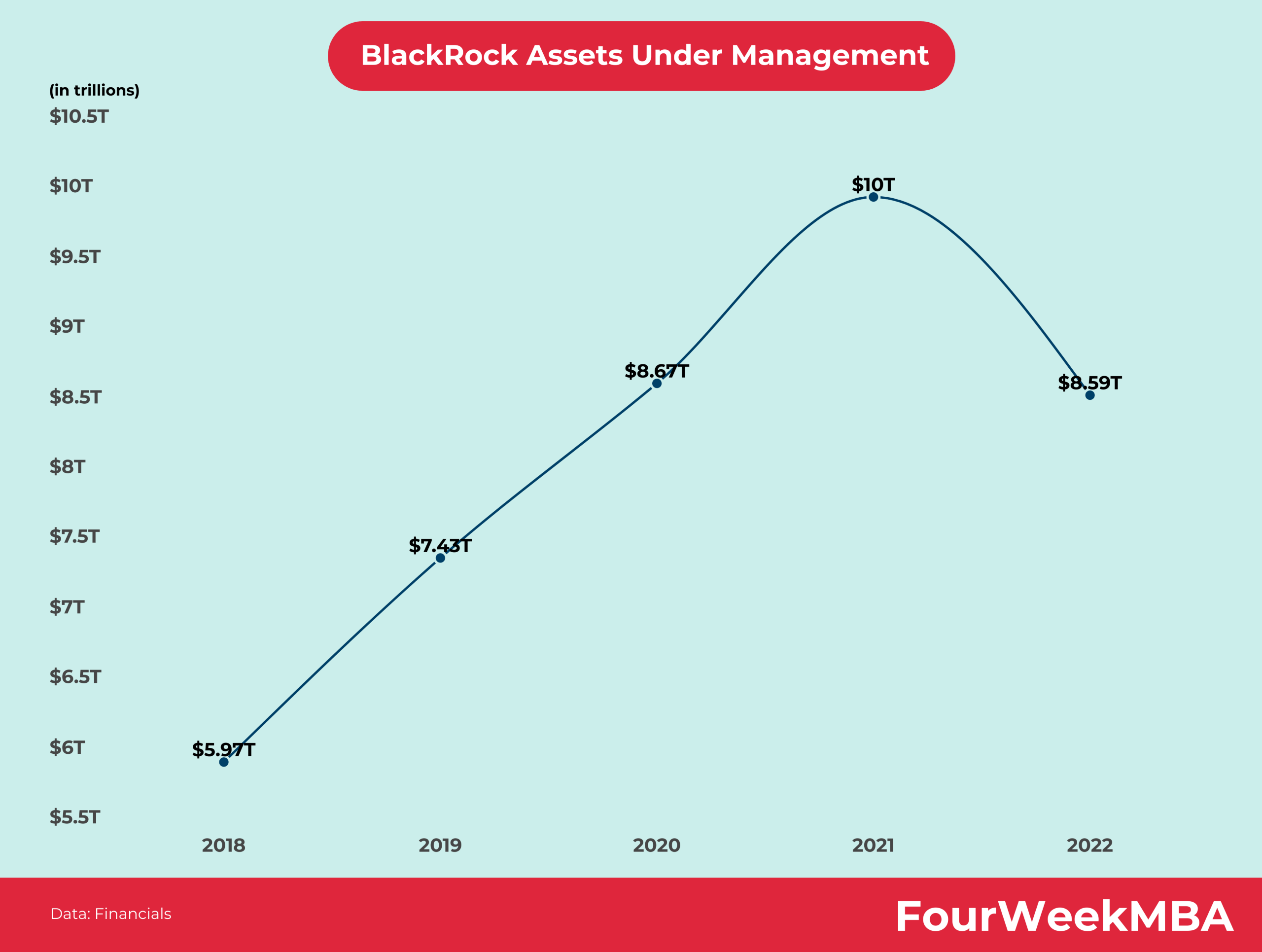

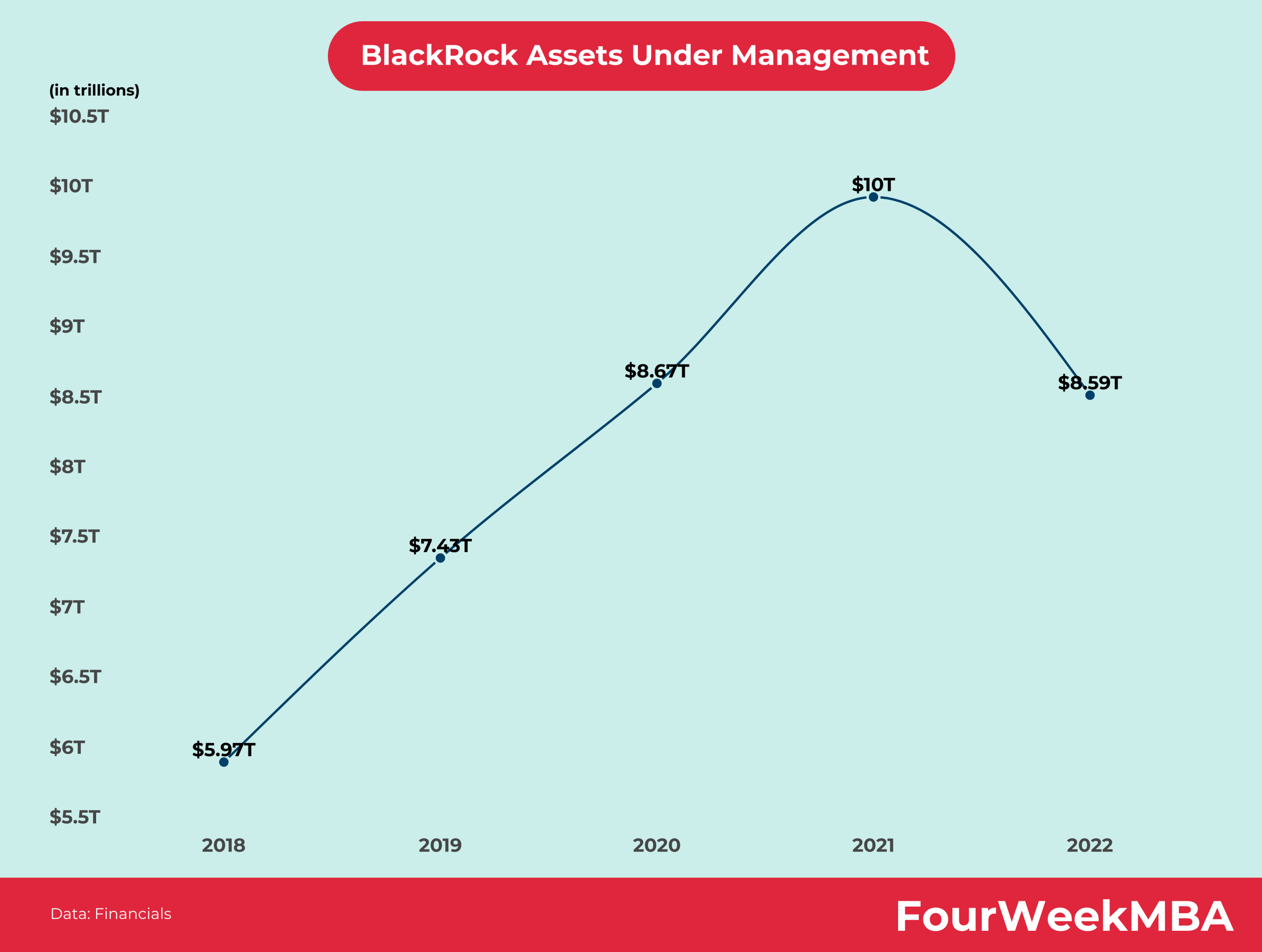

This visual representation illustrates the staggering amounts that BlackRock, as a powerhouse in the investment landscape, manages. As of recent reports, the assets under management of BlackRock have reached unprecedented heights, encapsulating a diverse range of investments across various sectors.

The Scale of BlackRock’s Influence

The financial world is often influenced by major players, and the assets under management of BlackRock position it as a titan in the industry. With trillions of dollars in assets, BlackRock not only realizes significant expense ratios but also plays a critical role in shaping investment trends worldwide.

From sovereign wealth funds to pension schemes, the breadth of BlackRock’s investments reflects a strategic approach focused on both growth and risk management. Investors have been gravitating towards BlackRock and amplifying their profile as a leading asset manager, further solidifying their industry dominance.

Strategic Investments Driving BlackRock’s Assets Under Management

BlackRock employs a multi-faceted investment strategy, which explains the vast scale of its assets under management. Let’s delve into a few key areas where BlackRock’s expertise translates into successful investment outcomes.

Equities: Building Wealth through Large-Scale Investments

BlackRock’s equities portfolio exemplifies its robust methodology. The firm invests in a diversified array of stocks, prioritizing long-term growth. The assets under management of BlackRock in this sector reflect a commitment to capital appreciation, which is appealing for both institutional investors and retail investors.

By investing heavily in large-cap companies and growth-oriented sectors, BlackRock maximizes the potential returns for its clients. Their team employs data-driven analytics and extensive research to stay ahead in identifying emerging trends and opportunities within the market.

Fixed Income: Stability in Uncertain Times

In the realm of fixed-income investments, BlackRock’s approach is characterized by stability and risk management. The assets under management of BlackRock in bonds and other fixed-income instruments cater to investors seeking consistent returns. This segment acts as a buffer during volatile market conditions, making it an essential element of their investment strategy.

BlackRock’s diverse bond offerings include government securities, corporate bonds, and municipal bonds, allowing them to manage risks effectively while delivering reliable income streams.

Alternative Investments: Diversifying for Enhanced Returns

BlackRock is also a significant player in alternative investments, including real estate, private equity, and commodities. The assets under management of BlackRock in these categories provide investors with exposure to non-conventional asset classes that can potentially yield higher returns.

With a focus on diversifying risk, BlackRock’s alternative investments contribute to a balanced portfolio. By leveraging its extensive networks and industry knowledge, BlackRock identifies lucrative opportunities that align with their clients’ risk tolerance and investment objectives.

The Relevance of BlackRock’s Assets Under Management in Today’s Market

The relevance of BlackRock’s assets under management cannot be overstated, particularly in today’s economic climate. As the markets continue to fluctuate, the firm’s strategies are closely watched and duplicated by other investment managers.

BlackRock’s size offers advantages in negotiations, allowing the firm to secure better rates and fees for its clients. Similarly, this vast scale provides a significant competitive edge when it comes to accessing exclusive investment opportunities that smaller firms might find difficult to tap into.

The Impact of Global Trends on BlackRock

As the global economy shifts, BlackRock’s assets under management may reflect these transformative trends. With increasing focus on environmental, social, and governance (ESG) factors, BlackRock is adapting its strategies to integrate these considerations into its investment paradigms.

By aligning their assets under management with sustainable practices, BlackRock positions itself as a leader not just in return generation but also in corporate responsibility. The firm recognizes the growing demand from investors who are increasingly prioritizing sustainability in their portfolios.

Technological Advancements and the Future of BlackRock

As technology continues to revolutionize every sector, including finance, BlackRock is leveraging advanced data analytics and artificial intelligence to enhance its investment methodologies. The assets under management of BlackRock will likely continue to grow as they refine their use of technology for market analysis, client engagement, and portfolio management.

BlackRock’s commitment to innovation in this space ensures that it remains at the forefront of the investment management industry. The integration of fintech solutions allows for enhanced decision-making processes and strengthens the overall effectiveness of their investment strategies.

Conclusion: The Future of BlackRock’s Assets Under Management

With the assets under management of BlackRock continuing to increase, one has to ponder what the future holds for this financial giant. As they sharpen their focus on sustainable investing and embrace technological advancements, BlackRock is likely poised for even greater influence across global financial markets.

For investors, understanding the shifts in BlackRock’s managed assets is essential. It not only helps gauge their financial strategies but also provides insights into the broader dynamics of the investment landscape. As we watch this evolving story, the assets under management of BlackRock remain a focal point worth following in the ever-adapting world of finance.