In the world of trading, whether you are a novice or a seasoned expert, understanding and implementing effective money management trading strategies is crucial for success. These strategies not only help in maximizing your profits but also play a pivotal role in protecting your capital from unforeseen market fluctuations. Below, we will delve deeper into various aspects of money management trading strategies that can elevate your trading game. Through this exploration, you will gain insights that can assist in your trading journey, helping you to navigate the complexities of the financial markets with confidence.

Understanding Money Management Trading Strategies

Money management trading strategies are systematic approaches that traders use to allocate their funds and minimize risk. They involve setting limits on the amount of capital to risk on a single trade, choosing the appropriate position size based on these limits, and maintaining discipline in trading activities. By employing these strategies, traders can ensure sustainability in their trading endeavors. Proper money management can be the difference between long-term growth and catastrophic losses.

The Importance of Risk Management in Trading

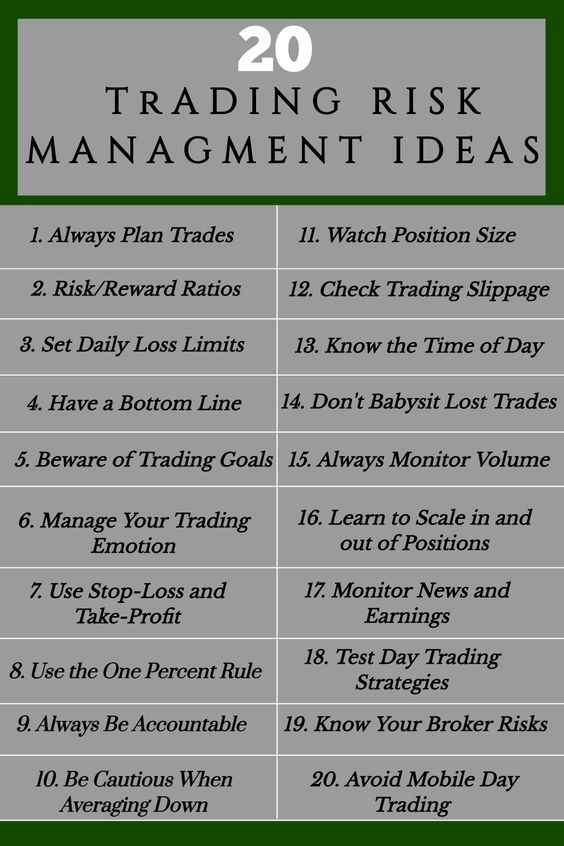

Risk management is the backbone of effective money management trading strategies. In trading, risk is inevitable. Markets can be volatile, and prices can shift dramatically in a matter of seconds. Therefore, having a solid risk management framework is essential. Here are a few aspects to consider:

- Position Sizing: Learn to determine the appropriate size for your trades based on your capital and risk tolerance. A common approach is to risk no more than 1% of your trading capital on any single trade.

- Stop-Loss Orders: Utilize stop-loss orders to limit potential losses on a trade. This automated tool acts as a safety net, preventing excessive losses if the market moves against you.

- Take-Profit Levels: Setting clear take-profit levels will help you lock in profits when your trade reaches a certain target, reducing the chance of losing gains due to market reversals.

Incorporating these risk management techniques into your money management trading strategies can significantly enhance your trading discipline and performance.

Money Management Trading Strategies for Different Trading Styles

Different trading styles—day trading, swing trading, and long-term investing—demand tailored money management trading strategies. Here’s a brief overview of how to adapt your approach based on your trading style:

Day Trading

Day traders often make multiple trades in a single day. Therefore, their money management trading strategies should focus on strict risk controls and quick decision-making. Since each trade may represent a small part of the overall capital, it is vital to set tight stop-loss orders to protect against large intraday swings.

Swing Trading

Swing traders hold positions for several days or weeks, focusing on capturing shorter-term market movements. For this style, money management trading strategies should incorporate a slightly more relaxed approach to stop-loss placement, allowing for some price fluctuation while still protecting capital. Position sizes should be increased cautiously based on the trader’s confidence level and prevailing market conditions.

Long-term Investing

Investors who adopt a long-term perspective typically have a different outlook on risk. Their money management trading strategies will involve more extensive research and analysis, concentrating on fundamental aspects of stocks or assets. Allocating capital according to risk profiles and diversifying portfolios are crucial elements of long-term money management.

Emotional Discipline in Trading

Adopting money management trading strategies is one aspect; maintaining emotional discipline is another. Trading can be emotionally taxing, leading to decisions driven by fear or greed. Here are some tips to keep your emotions in check:

- Stick to Your Plan: Always establish a clear trading plan and abide by it. Having a set strategy helps minimize emotional decision-making.

- Avoid Overtrading: Resist the urge to trade excessively to compensate for previous losses or to chase moving markets. This can be detrimental to your overall success.

- Stay Educated: Continuous learning about market dynamics enhances your confidence and can help reign in emotional responses during trading.

By fostering emotional discipline and adhering strictly to money management trading strategies, you can create a more stable trading environment.

Reviewing and Adjusting Your Money Management Trading Strategies

No money management trading strategy is set in stone. Traders should periodically review their strategies and adjust as necessary. Market conditions change, and what works in one environment may not work in another. Here are some points to consider when evaluating your approach:

- Performance Analysis: Regularly review your trading performance, noting areas of success and improvement. This analysis provides insight into what money management trading strategies work best for you.

- Market Changes: Adapt your strategies to the evolving market landscape. Conditions that favor one style of trading may not be suitable in different contexts.

- Personal Growth: As you grow as a trader, your strategies and risk tolerance may evolve. It’s important to be flexible and willing to change as you learn.

The Role of Technology in Trading Strategies

Modern technology significantly influences how traders approach money management trading strategies. Algorithms and trading software can assist in various aspects, from executing trades to analyzing performance. Leveraging technology effectively can enhance your capabilities. Here’s how technology can aid in your learning and implementation:

- Automated Trading: Many traders utilize algorithms that help execute trades swiftly based on pre-defined criteria, thus ensuring discipline in adhering to money management practices.

- Analytical Tools: Various platforms provide advanced analytics that allow traders to back-test their strategies, ensuring they are grounded in empirical evidence.

- Social Trading: Platforms that allow copy trading or sharing strategies with a community enable new traders to learn from the successes and failures of others, further enhancing their understanding of money management.

While leveraging technology can transform your trading experience, it is crucial to remember that no tool can replace the foundational principles of sound money management trading strategies.

Your Path Forward

As you navigate the intricate world of trading, remember that money management trading strategies form the bedrock of your success. By embedding proper risk management techniques into your trading routine, adapting your choices based on your style, and maintaining emotional discipline, you will be better positioned to weather market storms. Staying informed about changes in technology and periodically reviewing your methodology will also play vital roles in your ongoing development as a trader.

Ultimately, the journey of trading is a marathon, not a sprint. The money management strategies you choose will define your path towards long-term profitability. Stay committed, keep learning, and you will harness the immense potential that trading holds.