Effective money management is crucial for anyone looking to navigate the complex world of trading. It encompasses the strategies and techniques aimed at minimizing financial risks while maximizing potential returns. Understanding money management not only involves mastering financial principles but also implementing a disciplined approach to trading. In this article, we delve into the significance of management money trading books and provide insights that can help traders enhance their financial acumen.

Key Principles in Management Money Trading Books

At the heart of successful trading lies an understanding of key financial principles. These principles, which are often discussed in management money trading books, serve as a foundation for building effective trading strategies. Books that focus on these principles can provide invaluable insights into risk management, capital allocation, and developing a robust trading plan.

Understanding Risk Management

Risk management is an essential aspect of trading that is extensively covered in various management money trading books. These books illustrate how to assess and quantify risks associated with different trading strategies. By understanding risk management, traders can set appropriate stop-loss orders, determine position sizes, and minimize potential losses. The art of preserving capital often separates successful traders from those who struggle.

Recommended Reading for Aspiring Traders

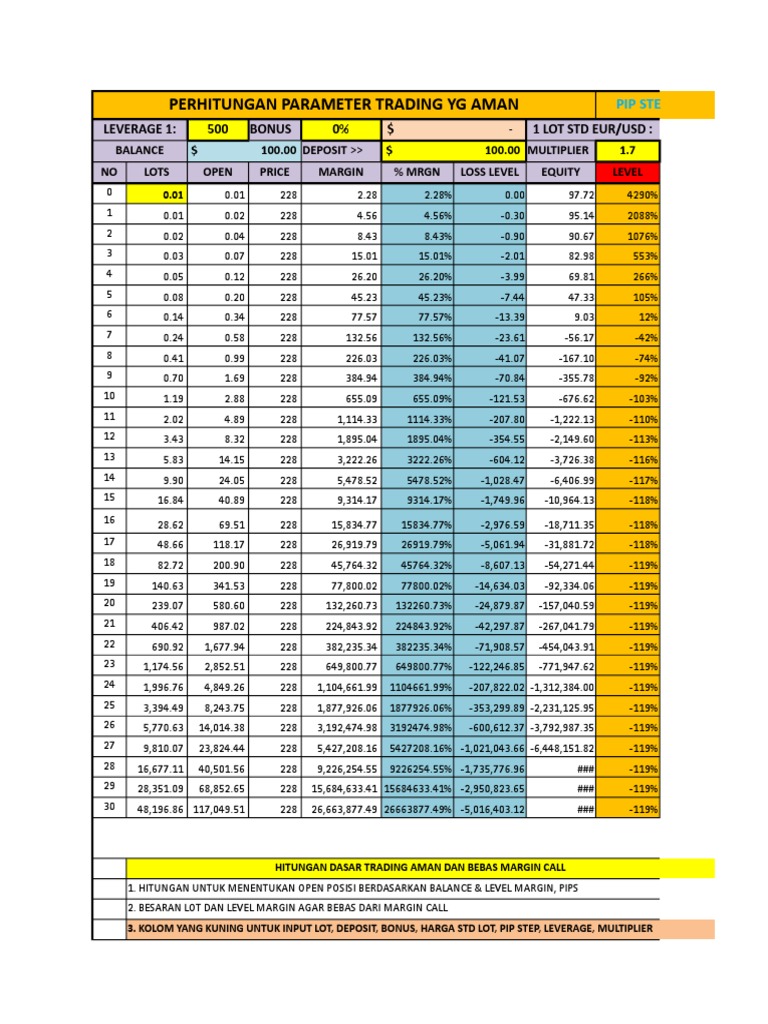

The visual representation showcases one of the best management money trading books available today. This resource not only delves into the technical aspects of trading but also emphasizes the importance of emotional discipline. Recognizing the psychological facets of trading can significantly influence a trader’s decision-making process, making this book an essential read.

Capital Allocation Strategies

Effective capital allocation is another crucial topic addressed in management money trading books. These books outline various strategies for distributing capital across different trades, allowing traders to maximize returns while mitigating risks. By understanding how to efficiently allocate capital, traders can not only survive but thrive in varied market conditions.

The Importance of a Trading Plan

A well-defined trading plan is central to successful trading and is a recurring theme in management money trading books. A trading plan outlines the trader’s goals, risk tolerance, and methods for entering and exiting trades. It serves as a roadmap that guides traders through the complexities of the market. Without a solid plan, traders may fall prey to emotional decision-making and impulsive actions.

Psychological Considerations in Trading

Another essential aspect covered in management money trading books is the psychological component of trading. Emotions such as fear and greed can significantly impact trading performance. Understanding these emotions and having strategies to manage them can help traders remain disciplined and focused. Many books provide practical tips on maintaining a balanced psychological state, which is vital for long-term success.

Case Studies and Real-World Examples

Many management money trading books provide case studies and real-world examples that illustrate the application of theoretical concepts in actual trading scenarios. These examples not only enhance understanding but also allow traders to learn from the successes and mistakes of others. By examining various trading outcomes, traders can better prepare for their endeavors in the market.

The Role of Trading Journals

Maintaining a trading journal is another vital practice emphasized in management money trading books. A trading journal allows traders to reflect on their trades, analyze performance, and identify areas for improvement. Documenting trades can lead to better self-awareness and can significantly contribute to a trader’s learning curve. This practice aligns with the notion that every loss can serve as a valuable lesson in the journey toward becoming a proficient trader.

Conclusion: Embracing Education in Trading

In conclusion, management money trading books offer a wealth of knowledge for those seeking to master the intricacies of trading. From risk management to psychological aspects and capital allocation strategies, these resources cover all essential facets that contribute to trading success. By investing time in learning and applying these principles, traders can improve their skills and navigate the trading landscape with greater confidence.

As you embark on your trading journey, remember that education is an ongoing process. Continuously seek out management money trading books to expand your knowledge, refine your strategies, and stay updated on market trends. The combination of theoretical knowledge and practical experience is vital for achieving long-term success in trading. Let the wisdom contained in these books guide you to make informed decisions and cultivate a disciplined approach to trading.