Building wealth is a journey that requires knowledge, discipline, and perseverance. To navigate this path successfully, it’s important to understand the fundamental principles that can guide you towards financial success. In this article, we will delve into the essential wealth building rules that can set you on the right course. From saving wisely to investing strategically, embracing these principles will empower you to take charge of your financial future.

Understanding the Wealth Building Rules

When it comes to financial growth, having a comprehensive understanding of wealth building rules is crucial. These guidelines not only provide a roadmap for managing your finances but also help you develop a mindset geared towards financial success. As we explore these principles, remember that consistent application is key. Mere knowledge without action will not lead to the wealth you desire.

1. The Rule of Saving

One of the most fundamental wealth building rules is to prioritize saving. Saving money consistently is pivotal for financial stability. It is often suggested that you should aim to save at least 20% of your income each month. By establishing a habit of saving, you can create a safety net that will protect you in times of need and allow you to invest in opportunities for growth.

2. The Power of Compound Interest

Understanding and leveraging the power of compound interest is one of the most effective wealth building rules. When you invest your money, the interest you earn also starts to generate income. This cycle can lead to exponential growth over time. Start investing early and take advantage of compound interest; the sooner you begin, the more wealth you’ll accumulate in the long run.

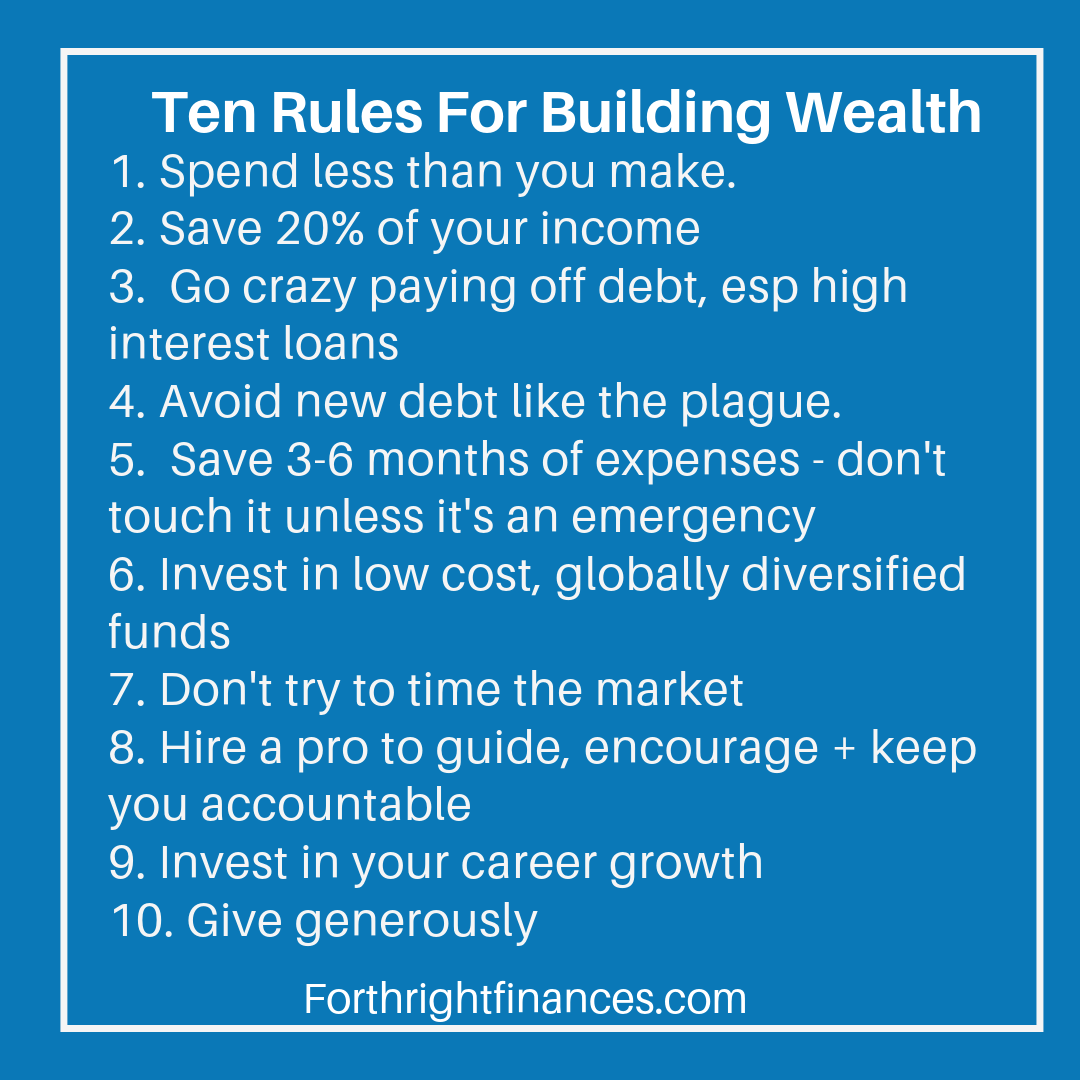

Visualizing Your Wealth Building Journey

10 Rules For Building Wealth

This visual representation of the wealth building rules serves as a great reminder of the principles that can lead to financial independence. By referring to these rules regularly, you can stay motivated and focused on your financial goals.

3. Budgeting: The Foundation of Financial Success

Creating and adhering to a budget is one of the most effective wealth building rules you can follow. A well-structured budget helps you track your income and expenses, ensuring that you do not overspend. It allows you to allocate funds for savings and investments, ensuring that your money is working for you rather than just being spent.

4. Diversification in Investing

When you begin to invest, remember that diversification is a crucial factor in wealth building rules. By spreading your investments across various asset classes such as stocks, bonds, and real estate, you minimize risks and maximize potentials for return. This approach protects against significant losses in any single investment and is crucial for long-term financial growth.

Wealth Building Rules for Real Estate

Investing in real estate can be a powerful tool in your wealth building strategy. The following wealth building rules can guide you in making sound real estate investments:

5. Research and Knowledge

Before diving into real estate investment, educate yourself about the market. Understanding local trends, property values, and economic indicators will help you make informed decisions. Knowledge is a powerful tool in all wealth building rules, and in real estate, it can significantly impact your success.

6. Understand Your Financing Options

Familiarize yourself with various financing options available for real estate purchases. From traditional mortgages to alternative financing methods, knowing the pros and cons of each can influence your investment strategy and the potential returns on your capital.

Long-Term Strategies for Wealth Building

7. Developing Passive Income Streams

Creating multiple streams of income is one of the critical wealth building rules that can lead to greater financial freedom. Consider investing in rental properties, dividend stocks, or creating digital assets. Passive income can provide financial stability, allowing you to focus on further investment opportunities or personal projects.

8. Setting Financial Goals

Establishing clear and measurable financial goals keeps you on track for building wealth. Whether your goals are short-term (like saving for a vacation) or long-term (such as retirement savings), having a roadmap can guide your financial decisions and priorities.

Reviewing and Adjusting Your Wealth Building Rules

Your financial journey should not be stagnant. As you grow and your circumstances change, continually revisiting and adjusting your wealth building rules is essential for ongoing success. Regularly reviewing your budget, investment portfolio, and goals ensures you remain aligned with your financial objectives.

9. Seek Professional Guidance

Don’t hesitate to seek advice from financial professionals when necessary. Financial advisors, accountants, and investment coaches can provide valuable insights and expertise that enhance your understanding of wealth building rules. Their guidance can help you navigate complex financial situations and identify opportunities that align with your goals.

10. Stay Disciplined and Patient

Lastly, maintaining discipline and patience is essential on your wealth building journey. Financial independence doesn’t happen overnight. Commit to your goals, be patient with your investments, and stay disciplined in your spending. Over time, your efforts will yield results.

In conclusion, applying these wealth building rules can help you pave the way toward achieving financial success. Start by saving diligently, understanding investments, creating a budget, and diversifying your portfolio. Each rule you incorporate into your financial plan will contribute to your overall wealth building journey. Remain committed, review your progress, and adapt as necessary to ensure you’re on the right track to achieving your financial dreams.