Understanding the money management meaning is essential for anyone looking to take control of their finances. Money management is not merely a technical skill; it’s an art that allows individuals to make informed decisions about their income, expenses, savings, and investments. With the ability to manage money wisely, one can achieve financial stability, reduce anxiety surrounding financial matters, and ultimately lead a more fulfilling life. In this post, we delve deeper into the concept of money management, exploring its meaning, significance, and practical tips to enhance financial literacy.

Exploring the Money Management Meaning

This infographic provides a visual interpretation of money management meaning. As you can see, effective money management encompasses various components such as budgeting, saving, investing, and planning for future expenses. Each of these elements plays a crucial role in crafting a comprehensive money management strategy.

Why Money Management Meaning Matters

Understanding the money management meaning is not just for those who wish to be financial experts; it’s for everyone. Money, when used wisely, can open doors to opportunities that may otherwise remain closed. Here are a few reasons why grasping the meaning of money management is crucial:

- Preventing Debt: A good understanding of money management aids in preventing the pitfalls of debt accumulation. When you have a firm grasp of where your money is going, it becomes easier to avoid overspending and living beyond your means.

- Building Wealth: Appreciating the meaning of money management can guide you towards making wise investments that pay dividends over time. The more you invest smartly, the more your money can work for you instead of the other way around.

- Financial Security: Knowing how to manage your money effectively can provide a safety net during uncertain times, such as job loss or unforeseen expenses.

Breaking Down Money Management Meaning: Key Components

To grasp the money management meaning fully, it’s vital to break it down into its core components. Each aspect is interdependent, forming a holistic approach to managing your finances:

1. Budgeting

Budgeting forms the foundation of money management meaning. It involves creating a plan for how you will spend your money each month. A budget allows you to anticipate your expenses and aligns them with your income. By tracking and categorizing your spending, you can see where you might be overspending and adjust accordingly.

2. Saving

Savings are another essential aspect of understanding money management meaning. Having a safety net of savings can help you handle emergencies, such as medical expenses or home repairs, without going into debt. Aim to save at least 20% of your income if possible, which will set you up for long-term success and stability.

3. Investing

Investing is a powerful tool to grow your wealth and secure your future. Once you grasp the money management meaning, you’ll understand the importance of allocating a portion of your income towards investments. This can include stocks, bonds, mutual funds, or real estate. The earlier you start investing, the more time your money has to grow through the power of compounding.

4. Financial Planning

Lastly, financial planning is a critical element within the scope of money management meaning. This involves setting specific, achievable financial goals and developing a strategy to reach them. Whether it’s buying a house, funding your child’s education, or preparing for retirement, having a financial plan helps keep you focused and motivated.

Practical Tips to Enhance Your Money Management Skills

Understanding the meaning of money management is just the beginning. To turn that knowledge into effective practice, consider the following tips:

- Educate Yourself: Take the time to read books, attend classes, or listen to podcasts about personal finance. The more you learn, the better equipped you will be to manage your money.

- Create a Financial Diary: Keeping a record of your expenses can uncover insights about your spending habits. This practice can highlight areas where you can cut back and save more.

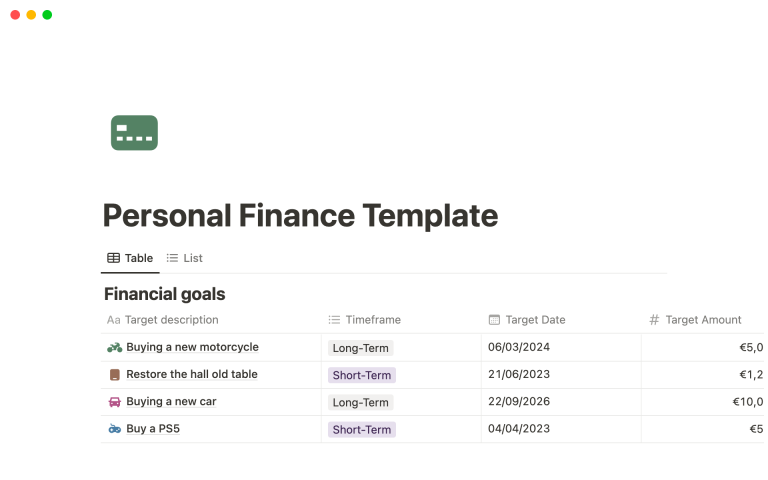

- Use Financial Tools: Take advantage of budgeting apps and financial planning tools that help track your income and expenses. These tools often provide insights and suggestions tailored to your financial habits.

- Set a Monthly Review: At the end of each month, review your budget and financial goals to assess progress. Adjust your strategy as necessary to stay on track.

The Impact of Poor Money Management

Understanding money management meaning is vital because the consequences of poor money management can be severe. Many face anxiety from mounting debt, lack of savings, and an inability to manage living expenses. Moreover, they may miss out on investment opportunities that could secure their future. Financial stress can impact mental health, relationships, and overall quality of life. Therefore, grasping the essence of money management and implementing effective practices is crucial to avoid these pitfalls.

Reassessing Your Money Management Strategy

As your financial situation evolves, so should your approach to money management. Regularly reassess your strategy to ensure it aligns with your current goals and circumstances. Life events like marriage, having children, or changing jobs can significantly impact your financial landscape. Keeping an open mind and being flexible can lead to smarter decisions regarding your finances.

Conclusion: The Ever-Evolving Money Management Meaning

The meaning of money management is a continuously evolving concept that adapts to your changing needs and goals over time. By understanding this meaning and the components that play into it, you can make informed decisions that drive your financial health. Establish clear goals and develop a structured approach to budgeting, saving, investing, and planning for the future. With commitment and education, anyone can master the art of money management and secure a stable financial future.

In summary, taking the time to learn about money management meaning is not just a personal choice—it’s a necessity. Your future self will thank you for the efforts you put into understanding the value of money management today.