The journey towards financial independence often revolves around one crucial aspect: money management. It’s not simply about saving money but understanding how to leverage and grow your funds effectively. One of the most powerful principles in this realm is compounding. Compounding is the process where the value of an investment increases exponentially over time due to earned interest on both the initial principal and the accumulated interest from previous periods. In this article, we will delve into the strategies for effective money management compounding, revealing insights that can propel your financial success. Whether you’re a novice investor or looking to sharpen your skills, mastering the art of compounding is essential.

Understanding the Basics of Money Management Compounding

At its core, money management compounding involves not just how much you save but how effectively that money can grow. The earlier you begin to invest, the more time your money has to compound, thus maximizing your potential returns. For most people, the most daunting aspect of investing is the sheer complexity of the available options. However, simplifying your approach and focusing on time-tested strategies can yield impressive results over time.

The Power of Compound Interest

Understanding compound interest is crucial in your journey through money management compounding. Simple interest earns based on the principal alone, while compound interest earns on both the principal and the interest previously accumulated. This may not seem like a significant difference initially, but over a significant time span, the effects are monumental.

Strategies for Effective Money Management Compounding

To harness the power of compounding effectively, consider the following strategies:

- Start Early: The earlier you start saving and investing, the more you benefit from compounding. Even small amounts can grow significantly over time.

- Consistent Contributions: Make regular contributions to your investment accounts. Whether it’s monthly or annually, consistent contributions can greatly enhance your compounding potential.

- Choose High-Quality Investments: Invest in assets that have a strong potential for compounding growth, such as stocks or mutual funds with a history of good performance.

- Reinvest Dividends: Instead of cashing out dividends, reinvest them. This strategy is critical in maximizing the effect of money management compounding.

Each of these strategies can significantly increase your financial growth over time, illustrating the timeless adage that “time in the market beats timing the market.” The trajectory of your financial future can change dramatically with a little patience and understanding of compounding principles.

Understanding Risk in Money Management Compounding

Investing isn’t without its risks. Recognizing the balance between risk and reward is essential in your money management compounding journey. High-return investments often come with higher risks. Diversification is a key tactic here—spreading your investments across various sectors can mitigate some risks while still allowing for compounding growth. While nothing is guaranteed, a well-balanced portfolio can help ensure that you don’t put all your eggs in one basket.

The Role of Financial Literacy in Money Management Compounding

To effectively engage with money management compounding, gaining a solid understanding of financial concepts is vital. Financial literacy allows you to assess options critically and make better-informed decisions regarding saving and investing. There are numerous resources available online, including websites, podcasts, and books focused on investment strategies, personal finance, and economic principles. The more informed you are, the more confident you’ll be in making choices that will benefit you in the long run.

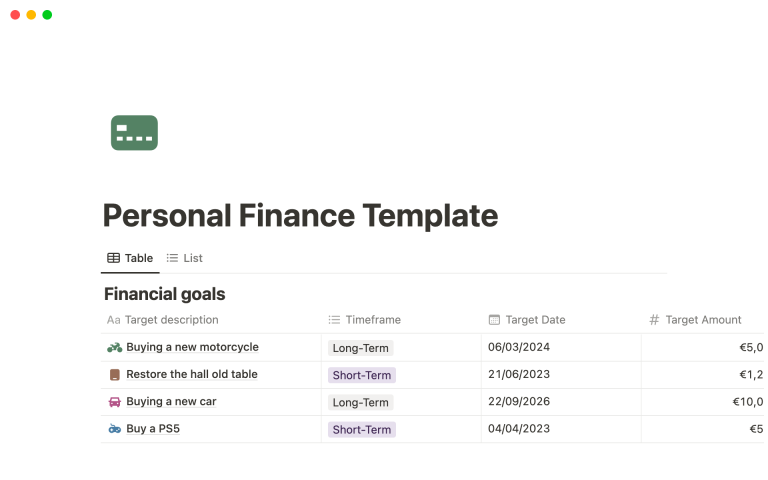

Creating a Long-term Financial Plan

Having a long-term financial plan is essential for practicing effective money management compounding. Start by defining your financial goals, whether it’s retirement, education for your children, or even a dream vacation. Once you have your goals in place, break them down into tangible milestones. Keeping your goals in sight will motivate you to stick to your investment strategy even when the market fluctuates.

Adjusting Your Plan as Needed

Life is dynamic, and your financial plans may need to adjust as your situation changes. Regularly review your portfolio to ensure that your investments still align with your goals. Markets evolve, and so should your strategies. Flexibility is key to sustained success in money management compounding.

Compounding Over Different Time Horizons

It is helpful to consider how compounding works over various time horizons: short-term, medium-term, and long-term. Each horizon has distinct strategies and expectations. For example, for short-term savings goals, such as purchasing a car, you might prefer lower-risk investments that don’t rely heavily on compounding. In contrast, for a long-term goal like retirement, you should prioritize investments that benefit substantially from money management compounding, allowing your finances to grow over decades.

Realizing the benefits compound over time can create a significant impact on your overall financial wellness. To illustrate, let’s look at a hypothetical example: consider saving $50 each month. If you invest this consistently at a modest 7% annual return, after 30 years, your investment can grow substantially just because each year’s returns begin earning their own returns. This residual effect of compounding is powerful and emphasizes the importance of early and consistent contributions.

Harnessing Technology in Money Management Compounding

Technology has revolutionized how we manage money. Various platforms allow you to track investments, analyze performance, and even automate your savings. Robo-advisors can create tailored investment strategies that optimize for compounding growth based on your risk profile and goals, making smart investing accessible to everyone.

Additionally, personal finance apps can help you budget effectively, ensuring that you can consistently contribute to your investments without overspending. By embracing technology, you can build a robust financial foundation that incorporates money management compounding seamlessly into your life.

Final Thoughts on Money Management Compounding

Mastering money management compounding is an essential skill for financial wellness and growth. Through understanding the principles of compound interest, implementing effective strategies, and maintaining financial literacy, you can set yourself on a course toward a prosperous future. Remember, the power of compounding is on your side, and the sooner you start, the better off you’ll be. Ensure your strategies are adaptable and informed, and embrace the journey ahead with confidence. The wealth you build will not only secure your future but may also allow you to forge a legacy for generations to come.