In today’s unpredictable world, understanding the intricacies of an emergency fund definition finance is crucial. As we navigate through various financial challenges, having a solid plan that includes an emergency fund can provide us with the security we need. In this comprehensive article, we’ll delve into what an emergency fund is, why it matters, how much to save, and practical steps to build and maintain this essential safety net.

Understanding Emergency Fund Definition in Finance

An emergency fund serves as a financial buffer that can help you manage unexpected expenses without incurring debt. The term itself encapsulates a vital concept within personal finance; it refers to a specific amount of savings that can cover emergencies such as job loss, medical emergencies, or urgent home repairs. For instance, an unexpected medical bill can potentially throw your entire financial plan off balance, making it essential to understand the emergency fund definition finance thoroughly.

The Importance of an Emergency Fund

Building an emergency fund is not just about saving money; it’s about safeguarding your financial future. Life is full of uncertainties. Whether it’s a sudden illness, a car breakdown, or a job elimination, having funds put aside allows you to face these setbacks with confidence instead of panic.

Let’s delve into the reasons why maintaining an emergency fund is critical:

- Protection from Debt: By having an emergency fund, you can avoid using credit cards or loans to cover sudden expenses, which can lead to high-interest debts.

- Peace of Mind: Knowing that you have saved money for emergencies can significantly reduce stress and anxiety during challenging times.

- Financial Independence: An emergency fund empowers you to make decisions based on your needs rather than financial pressures.

How Much Should Your Emergency Fund Be? (Emergency Fund Definition Finance)

Many individuals wonder how much they should actually save for their emergency fund. While the ideal amount can vary based on personal circumstances, financial advisors typically recommend saving three to six months’ worth of living expenses. Here’s how you can calculate it:

- Calculate Monthly Expenses: List your essential monthly costs, including rent/mortgage, utilities, food, transportation, and insurance.

- Multiply by Three to Six: Take your total monthly expenses and multiply that by three to six based on your comfort level with risk and job stability.

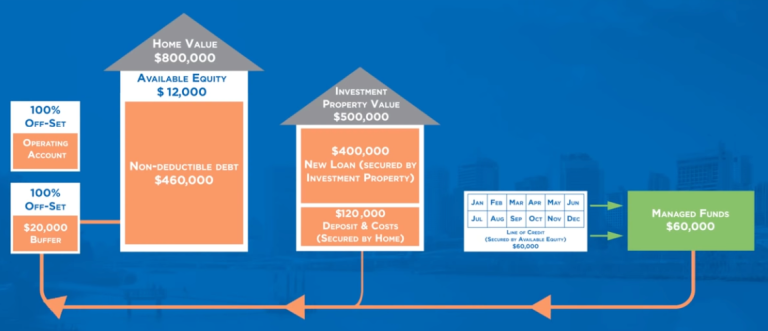

After determining the ideal amount for your emergency fund, set actionable savings goals to gradually build this safety net. To visualize the significance of maintaining such a savings pot, look at the following image:

Visual Representation of the Emergency Fund Concept

This illustration highlights the key aspects of an emergency fund, making the concept easier to grasp and internally validate your financial strategy.

Building Your Emergency Fund

Once you’ve established how much you need, the next step is to create a strategy for building your emergency fund steadily over time. Here are several strategies that can help:

1. Set Up a Dedicated Savings Account

Consider opening a separate savings account specifically for your emergency fund. This not only keeps your savings distinct from everyday spending but also reduces the temptation to dip into these funds unless absolutely necessary.

2. Automate Your Savings

To ensure consistency, set up automatic transfers from your checking account into your dedicated emergency fund. By automating this process, you can increase your savings without needing to think about it actively.

3. Build Gradually

Starting with small contributions can lead to bigger savings over time. Even if you can only allocate $50 a month, that will accumulate into significant savings, demonstrating both discipline and commitment to the emergency fund definition finance.

4. Utilize Windfalls Wisely

Tax refunds, bonuses, or gifts can provide an excellent opportunity to boost your emergency fund. Consider funneling a portion of these unexpected funds directly into your savings to accelerate your goal.

Maintaining Your Emergency Fund

Once you’ve built your emergency fund, it’s crucial to keep it maintained. Here’s how you can regularly assess and sustain your fund:

1. Regularly Review Your Fund

Every six months or annually, review your emergency fund to ensure it aligns with your current financial situation. Life changes—such as a new job, marriage, or a substantial purchase—can affect your needs.

2. Replenish as Needed

In the event you need to dip into your emergency fund, aim to restore it as quickly as possible to avoid being caught off guard in the future. Rebuilding your fund should be a financial priority.

3. Fine-Tune Your Savings Strategy

If you find your fund is insufficient or excessive due to lifestyle changes or increased financial obligations, make appropriate adjustments. The flexibility of your emergency fund is part of its strength.

Common Pitfalls and How to Avoid Them

While establishing an emergency fund seems straightforward, many individuals encounter pitfalls that can derail their efforts. Here’s a quick checklist of common mistakes to avoid:

- Neglecting Cash Flow: Avoid the trap of not tracking your expenses, which can hinder your savings ability. Maintain a budget that factors in your emergency savings.

- Overcomplicating Access: Ensure the account holding your emergency fund is easily accessible yet separate from daily expenses. Complex access can lead to unnecessary delays.

- Inconsistent Contributions: Life’s ups and downs can affect your savings habits. Stay committed to making regular contributions, even if the amounts vary month to month.

Final Thoughts on Emergency Fund Definition in Finance

In conclusion, comprehending the emergency fund definition finance is essential for anyone seeking to build financial resilience. An emergency fund provides peace of mind and a safety net during life’s uncertainties. By understanding its importance, setting realistic savings goals, and maintaining a disciplined approach, you position yourself to navigate emergencies with confidence.

Consider taking the first step today by assessing your current financial state, determining your emergency fund needs, and starting a dedicated savings strategy. Your future self will thank you for the extra layer of protection you’ve built into your financial plan.