Are you ready to take charge of your finances and make money management feel like a walk in the park? Whether you’re a budgeting novice or just looking for some fresh strategies, you’ve come to the right place! Today, we’ll explore 18 budgeting tips to make money management easy and help you get your finances in tip-top shape. Let’s dive in, shall we?

Get Started with Simple Budgeting Tips for Beginners

First things first: it’s essential to have a clear understanding of where your money is going each month. Starting with a budget can seem daunting, but fear not! With these 18 budgeting tips to make money management easy, you’ll be controlling your spending in no time.

1. Track Your Expenses

The first step in budgeting is knowing precisely what you spend your money on. Begin by tracking your daily expenses for at least a month. You can use a simple notebook, a budgeting app, or a spreadsheet to record your transactions. By seeing where your money is going, you can identify patterns and areas where you can cut back.

2. Set Financial Goals

What do you want to achieve financially? Saving for a vacation, paying off debt, or building an emergency fund are all great goals to have. Having clear objectives will give you direction and motivation, and it’s one of the key budgeting tips to make money management easy. Write down your goals and keep them visible to remind yourself of what you’re working toward.

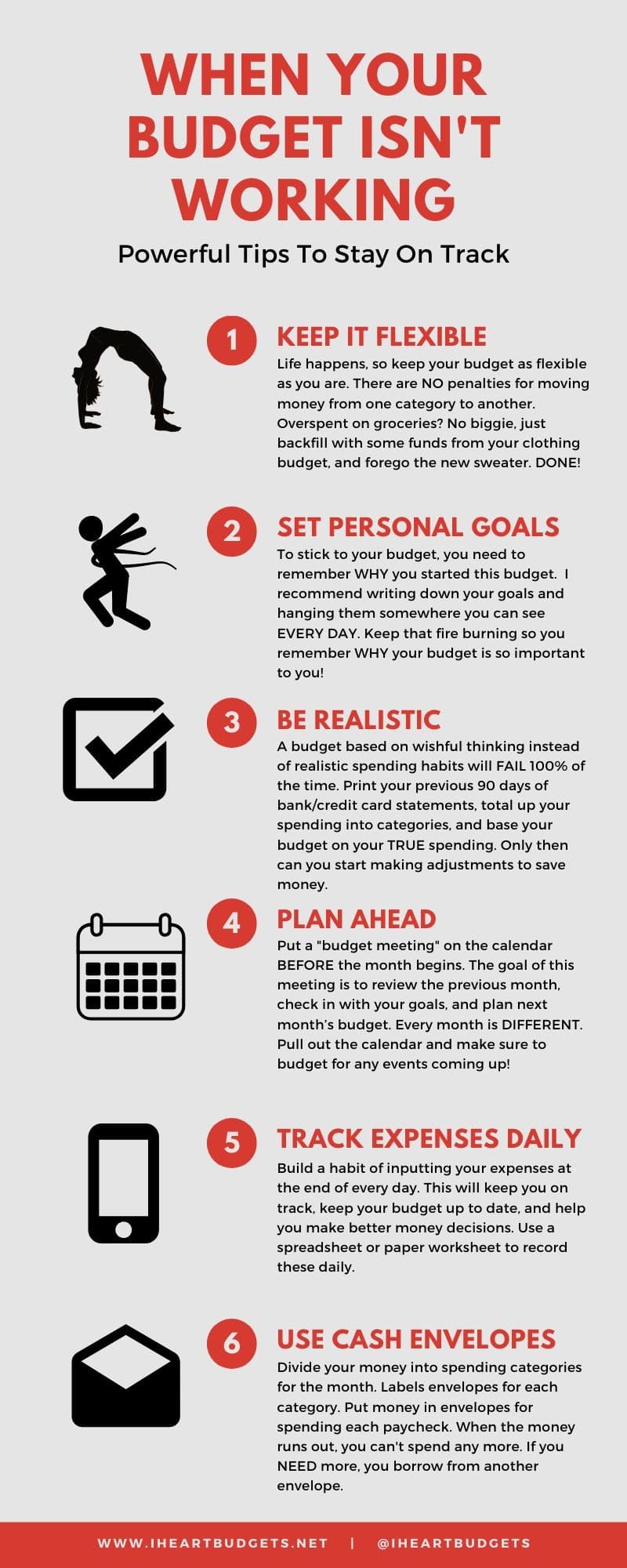

Visualize Your Financial Journey

This infographic captures the essence of budgeting — from essential tips to actionable advice for sticking to your budget. Visual elements help simplify the process and can make a complex topic much easier to digest.

3. Categorize Your Spending

Once you have a record of your expenses, categorize them into fixed expenses (like rent or mortgage), variable expenses (like groceries), and discretionary expenses (like entertainment). This categorization helps you see where you can potentially trim excess spending.

4. Create a Realistic Budget

Based on your tracking and categorization, it’s time to create a budget. Ensure it reflects your actual income and expenses. Remember, there’s no one-size-fits-all budget—tailor it to your lifestyle and needs. This flexibility is one of the most important budgeting tips to make money management easy!

Stick to Your Budget with These Practical Tips

5. Use the 50/30/20 Rule

A popular method to guide your budgeting is the 50/30/20 rule. Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This straightforward structure makes it easier to manage your finances while ensuring you’re saving a portion of your earnings.

6. Automate Your Savings

One of the easiest ways to stay on track is to set up automatic transfers to your savings account each payday. This way, you’re paying yourself first, and it eliminates the temptation to spend that money. Automating your savings is a game-changer when it comes to the 18 budgeting tips to make money management easy.

Stay Informed and Adjust as Needed

7. Review Your Budget Regularly

Life changes, and so should your budget. Make it a habit to review your budget monthly or quarterly to see what’s working and what’s not. Adjust your categories and targets as needed to ensure you are on track toward your goals.

8. Don’t Be Afraid to Cut Costs

Sometimes, you may have to make tough decisions to stick to a budget. If you find that entertainment or dining out is taking a significant chunk of your spending, consider finding more affordable alternatives. Sacrificing a couple of luxuries can free up funds for savings or debt repayment, making money management a lot simpler.

Enhance Your Budgets with Smart Choices

9. Use Budgeting Apps

Embrace technology! Many budgeting apps can help you track your spending in real-time. These tools link to your bank accounts and provide insights into your financial habits, making budgeting more manageable. Using tech resources is one of the top 18 budgeting tips to make money management easy.

10. Consider Cash for Discretionary Spending

Using cash for discretionary spending can be an effective way to avoid overspending. Withdraw a set amount of cash for the month, and once it’s gone, it’s gone! This approach helps enforce a more disciplined approach to your budget. And who says budgeting can’t be fun?

Plan for Variability

11. Prepare for Irregular Expenses

Don’t let surprises derail your budget! Anticipate irregular expenses, such as medical bills or car maintenance, by setting aside a small amount each month. Factor these into your budget to avoid dipping into savings when unexpected costs arise.

12. Build an Emergency Fund

A solid emergency fund can protect you from financial mishaps that could break your budget. Aim to save at least three to six months’ worth of expenses. This safety net is crucial in keeping your budgeting journey smooth and stress-free.

Finding Motivation and Support

13. Look for Budgeting Inspiration

Surround yourself with motivation! Follow personal finance bloggers, listen to podcasts, or join online communities that focus on budgeting. Learning from others is not only inspiring but can provide you with fresh perspectives on your budgeting strategies. It’s comforting to know you’re not alone in this journey and that many are following similar 18 budgeting tips to make money management easy.

14. Share Your Goals

Accountability can be an essential part of sticking to your budget. Share your financial goals with friends or family members who can help keep you on track. Having a support system can make all the difference in maintaining your resolve.

Celebrate Your Progress!

15. Set Up Rewards

As you hit your budgeting milestones, reward yourself! Whether it’s a small treat or a bigger celebration, acknowledging your achievements is crucial. These rewards can serve as motivation to keep going and reinforce positive budgeting behaviors.

16. Be Patient with Yourself

Budgeting is a skill that takes time to develop. Be patient and kind to yourself if you encounter setbacks. Instead of being discouraged, view them as learning opportunities. Remember, every step you take is a step toward financial freedom.

Keep Learning

17. Educate Yourself on Personal Finance

The more you know about managing your money, the better your budgeting efforts will be. Read books, attend workshops, or take online courses to deepen your understanding of personal finance. Knowledge is power when it comes to budget management!

18. Embrace Flexibility

Finally, be willing to adapt and change your budgeting approach as your life evolves. Your financial situation may change due to life events like a new job, marriage, or other scenarios. Embracing flexibility will make your budgeting journey more sustainable and enjoyable.

In conclusion, implementing these 18 budgeting tips to make money management easy is all about creating a plan that works for you and sticking to it. Budgeting might take time, but with commitment and practice, you’ll be on your way to financial success! Happy budgeting!