Ah, the elusive money management form! An elegant piece of paper that holds the power to make or break our financial sanity. If you’ve ever had to fill one out, you know it’s like trying to fold a fitted sheet—confusing, frustrating, and somehow always wrong. Buckle up, folks! We’re diving into the whirlwind of change management forms that promise to make our lives easier while proving, time and again, that hilarity can be found in the mundane.

Understanding the Money Management Form

The money management form is not just a bland piece of paperwork; it’s a thrilling ride through the twisted labyrinth of budgets, predictions, and possibly even a pet dragon—or was that just my imagination? Either way, the idea of financial stability can spark sheer joy in even the most stoic of hearts. It’s like climbing a mountain, only to realize you forgot your snacks at the base!

Why a Money Management Form?

Imagine this: It’s a rainy day (we all have them), and an unexpected expense pops up. Perhaps the air conditioner has decided to retire early or your cat has developed a taste for the finer things in life, like gourmet cat treats. A money management form swoops in like a superhero! It doesn’t wear a cape, but it does have checkboxes, and that’s probably even cooler. You can track your spending, plan for the future, and ensure your emotional support cat doesn’t bankrupt you.

The Anatomy of a Money Management Form

The money management form contains all the delights of adulthood compressed into one single document. It has categories for income, expenses, and more! It’s like preparing for a trip to the grocery store but only discovering you have the budget of a wealthy diplomat.

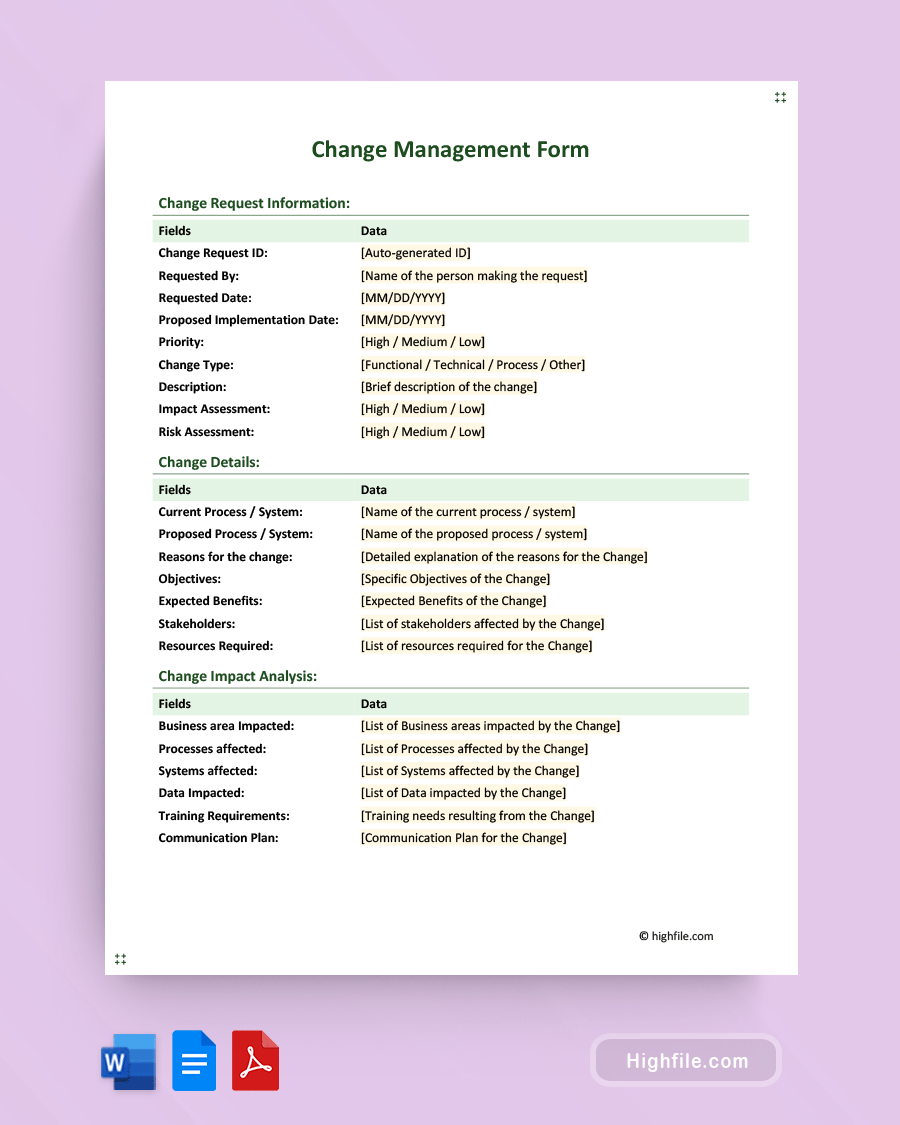

To make this adventure even more exciting, here’s the star of the show—our money management form!

Look at that beauty! With its charming layout and infinite possibilities of scribbling and crossing out numbers, who wouldn’t feel like a financial Picasso? Just remember, the journey of tracking every cent begins with a single checkbox!

Complications With Your Money Management Form

As simple as it sounds, filling out a money management form can sometimes resemble a tragic comedy. You fill out your income, but wait—did I forget about the wallet that fell into the couch and discovered an entire $20 bill?! Ah, yes. Now I can afford those artisanal avocado toasts!

Tips to Master Your Money Management Form

But fear not, fellow financial wanderers, there’s hope! Below are some tips to help you conquer the dreaded money management form, turning potential chaos into a majestic symphony of organization.

1. Gather Your Wits – and Your Receipts!

Before diving headfirst into the world of money management forms, gather all your receipts like a forager finding truffles in the forest. These little slip of paperhouses hold the difference between knowing you blew your budget on fancy lattes instead of ramen noodles.

2. Categorize Like You’re in a Supermarket

Subject each of your expense descriptions to the supermarket shelves. Label them food, luxury items, and ‘Oops, I did it again’ purchases. This will save you endless amounts of grief when you reach the ‘Does Avocado Toast Count as a Grocery Item’ debate! Spoiler: it does.

Fun Ways to Use Your Money Management Form

Once you’ve mastered your money management form, you may find inspiration for its use beyond the financial realm. Here are a few fun ways to ride the organizational wave:

Budget Battles

Why not turn budget tracking into a game? Challenge yourself to see how long you can go without deviating from your budget plan. Every time you succeed, reward yourself with a tiny celebration: a dance break, a piece of chocolate, or even a quick break to pet your cat! Bonus points if you can convince the cat to join in the dance.

Artistic Expression

The money management form doesn’t have to be bland. Add stickers! Color-code your spending categories! Who says money management can’t be chic? Your finances deserve flair—treat them like the royalty they are!

Final Thoughts on Your Money Management Form

At the end of the day, the money management form is much more than numbers on paper. It’s your ticket to discovering financial awareness, taking control of your fiscal destiny, and perhaps even understanding why you seem to have more online shopping packages than you have fingers to count them on.

Your form may become your BFF and financial compass, guiding you through the storms of unexpected expenses and impulsive purchases. Fill it out, embrace its quirks, and smile at the joys it will bring to your life.

So, grab that money management form, channel your inner accountant, and let the wild journey of finances begin! And never forget, every time you look at your form—there’s a little bit of humor in every transaction, and somewhere out there, an avocado still longs to be your creamiest ally!