Investing in real estate can be a rewarding venture, allowing individuals to grow their wealth and secure their financial future. The world of real estate offers diverse opportunities, but knowing how to navigate this landscape can be challenging. In this article, we will explore various effective methods on how to invest in real estate, equipping you with the knowledge to build a robust portfolio.

Top Strategies on How to Invest in Real Estate

Whether you are a novice or an experienced investor, understanding the different avenues of real estate investment is crucial. Here are five commendable strategies on how to invest in real estate that can help you develop a strong portfolio.

1. Rental Properties

Investing in rental properties is one of the most popular forms of real estate investment. This strategy provides a steady stream of income, making it an ideal choice for individuals looking to build their portfolios. Here’s what you need to know:

- Choose the right location: Look for areas with high rental demand and potential for appreciation.

- Inspect properties thoroughly: Ensure that the property is in good condition and can attract quality tenants.

- Understand the market: Keep abreast of rental prices in the area to set competitive rates.

By focusing on rental properties, you can build a sustainable income source while increasing the value of your investments over time.

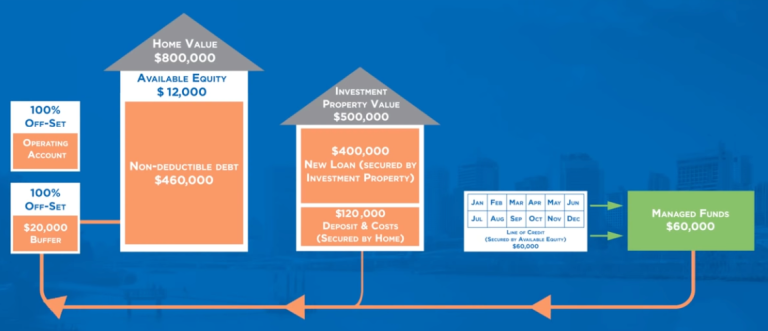

Visual Insights of How to Invest in Real Estate

This image illustrates the diverse landscape of real estate investment options. From single-family homes to multifamily units, visualizing these opportunities can help solidify your understanding of how to invest in real estate effectively.

2. Real Estate Investment Trusts (REITs)

If you’re looking for a more hands-off approach, Real Estate Investment Trusts (REITs) might be the perfect fit. REITs allow you to invest in real estate without owning physical properties. Here are some key benefits:

- Liquidity: REITs are traded on major exchanges, allowing you to buy and sell shares easily.

- Diversification: Investing in a REIT means exposure to a variety of property types, reducing risk.

- Regular payouts: REITs are required to distribute at least 90% of their taxable income to shareholders, which can offer attractive dividends.

For many investors, REITs present a convenient way to learn how to invest in real estate while maintaining liquidity and flexibility.

Mastering the Art of How to Invest in Real Estate

3. Fix-and-Flip

This investment strategy involves purchasing distressed properties, renovating them, and then selling for a profit. While it requires knowledge, time, and often a sizable budget, the rewards can be substantial. Here’s how you can succeed in this strategy:

- Due diligence: Research neighborhoods and properties thoroughly to identify undervalued houses.

- Budget wisely: Ensure that you factor in all renovation costs to avoid losing money on the flip.

- Stay updated on market trends: Understanding the local real estate market will help determine the right time to sell.

With the right approach, mastering how to invest in real estate through fixing and flipping can yield significant profits.

4. Real Estate Crowdfunding

In recent years, real estate crowdfunding platforms have become popular among investors looking for accessible ways to participate in property financing. These platforms allow individuals to pool their resources to invest in real estate projects. Key points to consider:

- Low minimum investments: Many crowdfunding platforms require lower minimum investments than traditional real estate purchases.

- Variety of projects: You can choose to invest in various properties, from commercial to residential developments.

- Assessment of risk: Research the site and its track record before investing to better understand the risks involved.

Real estate crowdfunding is an exciting way to learn how to invest in real estate without committing to large sums of money upfront.

5. Vacation Rentals

With the rise of platforms like Airbnb and VRBO, vacation rentals have gained popularity among investors. This method can yield higher returns compared to traditional rentals, especially in desirable locations. Consider these factors:

- Market analysis: Research local tourism trends and demand to choose the right property.

- Property management: Decide whether you want to manage the property yourself or hire a management company.

- Legal obligations: Understand the regulations in your area regarding short-term rentals.

By diving into the vacation rental market, investors can explore an exciting and potentially lucrative avenue on how to invest in real estate.

Final Thoughts on How to Invest in Real Estate

As you explore these different methods for how to invest in real estate, remember that successful investing starts with education, research, and a clear strategy. Real estate investing is not a get-rich-quick scheme; it demands patience and a long-term perspective. By understanding the various investment strategies available, you can make informed decisions that align with your financial goals.

Marketing, networking, and continuous education are also integral to your success. Join local real estate groups or online forums, and stay connected with industry trends to keep building your knowledge base.

In conclusion, the world of real estate investment is vast and full of opportunities waiting to be explored. Equip yourself with the right tools, strategies, and information, and embark on your journey to building a prosperous real estate portfolio.