In today’s fast-paced world, understanding personal finance has never been more crucial. With myriad resources available, it can be overwhelming to know where to start. Luckily, we have a stunning personal finance infographic that simplifies the landscape of personal finance, making it accessible for everyone. Let’s dive into the essentials of personal finance, budgeting strategies, investment options, and how to achieve financial freedom.

The Personal Finance Infographic: A Visual Guide

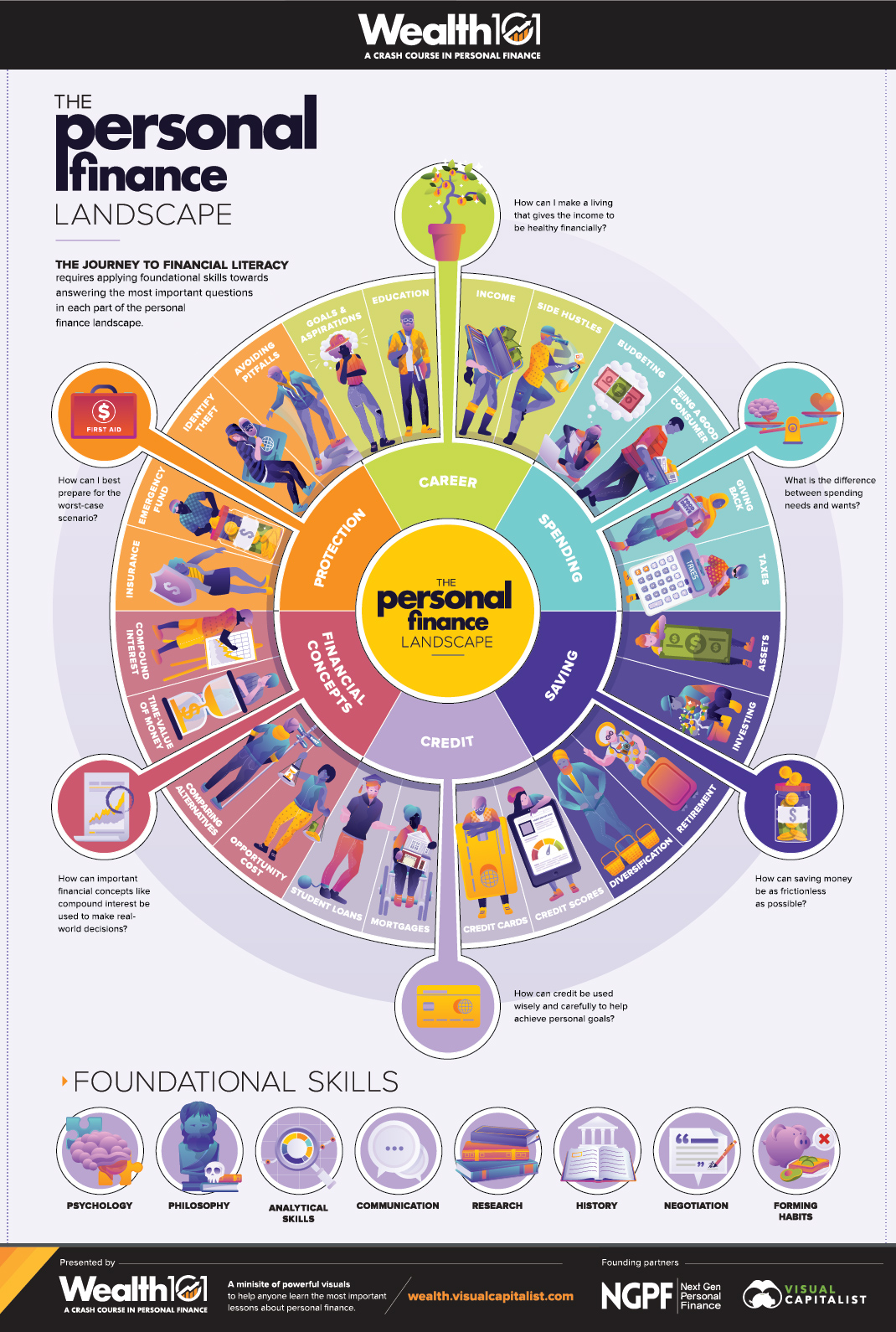

This comprehensive personal finance infographic covers various aspects of managing your money more effectively. With visually appealing graphs and data, it breaks down key areas such as income sources, expenses tracking, debt management, and future planning. Understanding these components can empower you to make wiser financial decisions.

Decoding Your Income Sources

Income is the primary driver behind your financial choices. The personal finance infographic highlights different income streams, including active income from employment and passive income through investments or side businesses. Grasping how these income types fit into your financial strategy can motivate you to diversify your earnings.

Navigating Active vs. Passive Income

Active income refers to the money earned through direct employment or services you provide, while passive income comes from investments—such as rental properties or dividends. The personal finance infographic emphasizes the importance of establishing multiple income streams to enhance your financial security. Aim to create a balance between active and passive income to ensure smooth sailing toward your financial goals.

Mastering Expense Tracking

To achieve financial stability, tracking your expenses is paramount. The personal finance infographic presents strategic methods for monitoring spending habits, which is critical for designing a successful budget. By categorizing your expenses—like fixed, variable, and discretionary—you can identify areas for reduction, allowing for more savings or investment opportunities.

Creating a Practical Budget Plan

A comprehensive budget plan is your roadmap to financial success. It provides a clear outline of your income and expenses, enabling informed decisions about saving and spending. The personal finance infographic suggests the 50/30/20 rule as a fantastic starting point: allocate 50% of your income to necessities, 30% to wants, and 20% to savings and debt repayment. Adopting this method can help you balance your monthly budget effectively, ensuring you’re living within your means while still enjoying life.

The Importance of Saving for Emergencies

Having an emergency fund is a cornerstone of personal finance. The personal finance infographic illustrates the ‘Three to Six Months’ rule, which states that you should aim to save enough to cover three to six months of living expenses. This safety net not only provides peace of mind but also protects you against unexpected financial shocks, such as job loss or unexpected medical costs. The infographic emphasizes that this fund should be easily accessible, ideally kept in a high-yield savings account.

Strategies for Effective Saving

Saving can often feel daunting, especially when you have immediate expenses to manage. The personal finance infographic presents some practical tips for boosting your savings. Consider automating your savings by setting up direct deposits into your savings account each month. This “pay yourself first” strategy helps you save before you have a chance to spend. Additionally, it’s essential to set specific savings goals, whether for travel, a new car, or retirement—a clear objective can motivate you to stick to your saving plans.

Investing: Building Long-Term Wealth

Your journey toward financial independence is incomplete without considering investments. The personal finance infographic highlights various investment vehicles such as stocks, bonds, mutual funds, and real estate. Understanding the risk factors and potential returns associated with each option is key to making informed investment choices.

Diversifying Your Investment Portfolio

Diversification is the name of the game when it comes to investing. The personal finance infographic stresses the importance of spreading your investments across various asset classes. This practice protects you from significant losses if one sector performs poorly. Research different investment options and assess your risk tolerance to determine the best mix for your portfolio. Investing consistently, even in small amounts, can compound your wealth over time, leading to significant financial growth.

Managing and Reducing Debt

Debt can be a major obstacle in your personal finance journey. The personal finance infographic outlines effective strategies for managing and reducing debt, emphasizing the importance of evaluating your current financial situation. Understanding how much you owe and to whom is the first step toward developing a repayment plan.

Devising a Debt Repayment Strategy

Consider utilizing the snowball method, where you focus on paying off the smallest debts first while making minimum payments on larger debts. This approach not only helps you eliminate bills more quickly but also provides motivational boosts as you see debts disappearing. On the other hand, the avalanche method prioritizes debts with the highest interest rates, ultimately saving you more money over time. Whichever method you choose, the personal finance infographic underscores the importance of staying committed and organized to boost your financial health.

Planning for Retirement

It’s never too early to start planning for retirement. The personal finance infographic stresses the benefits of taking advantage of retirement accounts, such as a 401(k) or an IRA. These accounts not only provide tax advantages but also offer the opportunity for your money to grow over time through compounding interest.

Setting Retirement Goals

Begin by evaluating your current savings and estimating how much you’ll need for retirement. This figure may vary based on factors such as desired lifestyle, healthcare, and living arrangements. The personal finance infographic suggests that contributing consistently to your retirement accounts and revising your contribution levels as your income grows can significantly impact your long-term savings. Planning ahead can relieve stress during your retirement years, enabling you to enjoy a comfortable and fulfilling life.

The Path to Financial Wellness

Overall, understanding personal finance is an essential skill that can navigate you towards financial security and independence. The personal finance infographic serves as a valuable resource, summarizing critical concepts that empower you to make informed decisions about your money. Remember, personal finance is a lifelong journey—stay proactive, continually educate yourself, and adjust your strategies as your life evolves. By implementing these principles, you’re well on your way to establishing a prosperous financial future.

To recap, the world of personal finance is layered with intricacies—from managing your income and expenses, saving for emergencies, investing wisely, to planning for retirement. With the right tools and knowledge, you can take charge of your financial destiny. Embrace the lessons from our personal finance infographic, and start paving your way to a wealthier tomorrow.