In today’s unpredictable world, having a solid emergency fund has become essential for financial stability. Whether it’s an unexpected medical expense, a sudden job loss, or unforeseen repairs around the house, having that financial cushion can provide peace of mind and security. In this guide, we will delve into the steps you need to take to build a robust emergency fund that works for you. Additionally, we’ll include resources like the ‘emergency fund video’ that can reinforce your understanding and planning.

Understanding the Importance of an Emergency Fund

An emergency fund acts as a financial safety net, ensuring that you don’t fall into debt during tough times. Without this fund, even minor emergencies can lead to significant stress. Many financial experts recommend that individuals aim to save three to six months’ worth of expenses. This may vary based on personal circumstances, but the key takeaway is to prioritize setting one up as soon as possible.

How much should you save for your emergency fund?

Consider the following factors to determine the ideal amount:

- Your monthly living expenses

- Your income stability

- Your family size

- Your career/job sector

These elements help in estimating how much you should aim for. Once you have a number, the next step is to devise a strategy to reach your goal.

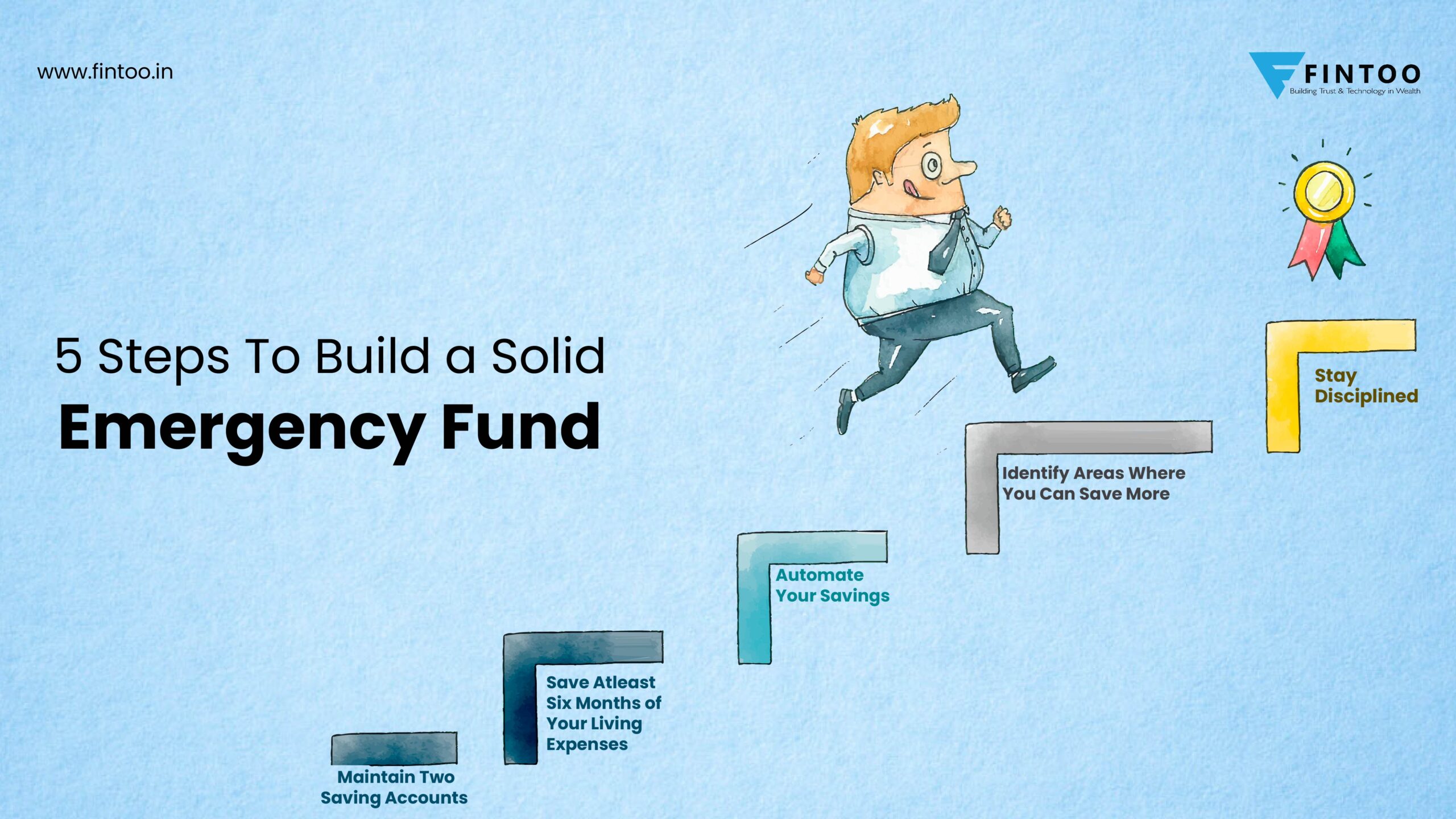

Steps to Build Your Emergency Fund

Step 1: Evaluate Your Current Financial Situation

The first step in building a solid emergency fund is to have a clear understanding of your current financial situation. Gather all your financial statements, including bank accounts, expenses, debts, and sources of income. This clarity is vital as it helps you identify how much you can realistically set aside each month.

Step 2: Set a Target Amount

Using the assessment from Step 1, establish a target for your emergency fund. As stated, this is typically three to six months’ worth of expenses. If you want, you can calculate it based on your unique financial circumstances to feel more empowered. Do you need the ‘emergency fund video’ guidance? This video can simplify your understanding of this process and provide actionable tips.

Creating a Savings Plan

Step 3: Open a Separate Savings Account

After determining your target amount, it’s wise to open a separate savings account specifically for your emergency fund. This separation reduces the temptation to dip into it for non-emergency expenditures. Look for an account with a decent interest rate to help your money grow over time while still being easily accessible in times of need.

Step 4: Automate Your Savings

To streamline your savings, consider setting up automatic transfers to your emergency fund. Whether you decide to transfer money weekly, bi-weekly, or monthly, automation can significantly simplify your savings process and ensure consistency.

Your Guide to Building an Emergency Fund

Reviewing these deposits periodically will help keep you on track towards reaching your emergency fund goal!

Staying Committed to Your Emergency Fund Goals

Step 5: Monitor and Adjust as Needed

As you progress, it’s essential to monitor your savings and expenses. Life circumstances can change, demanding adjustments in the amount you need in your emergency fund. If your expenses increase due to a new addition to the family, for example, re-evaluate your savings target and adjust your contributions accordingly. The ‘emergency fund video’ reference can help to illustrate the importance of agility in your financial planning.

Step 6: Celebrate Milestones

Every time you reach a savings milestone, celebrate it! Whether it’s reaching one month’s expenses or hitting a halfway mark, acknowledging these achievements can keep you motivated. Setting small rewards for goals will not only foster positive habits but reinforce your commitment to your financial health.

Tips for Maintaining Your Emergency Fund

Once your emergency fund is established, your next concern should be how to maintain and potentially grow it. Here are some tips:

- Keep Track of Your Expenses: Regularly review your expenses to gauge whether your goal still fits your financial landscape.

- Aim for Incremental Growth: As you pay off debts or increase your income, consider increasing your savings contributions.

- Stay Disciplined: Maintain the integrity of your emergency fund and avoid using it for planned expenses or small emergencies that can be handled differently.

Engaging with your Financial Future

Building a solid emergency fund is just one aspect of financial wellness. Alongside it, consider educational resources like the ‘emergency fund video’ to enhance your understanding and effectiveness in managing your finances. Each insight you gain leads you one step closer to financial stability and peace of mind.

Final Thoughts

Setting up an emergency fund is a critical step that requires commitment and planning. Life’s unpredictability means this fund can be a game changer when faced with unexpected financial hurdles. Start assessing your financial health today, implement the suggested steps, and watch your confidence grow as you secure your future.

Inspiration to Take Action

Remember, the key is to start now, no matter how small. The sooner you begin, the sooner you’ll build resilience against life’s uncertainties. Embrace the journey of financial empowerment, and, for that extra push, consider checking out the impactful ‘emergency fund video’ to guide you along the way.

Always stay aware that with dedication and the right strategies, achieving a solid emergency fund is within reach!