In today’s financial landscape, knowing your credit score is crucial for making smart decisions. With numerous credit score applications available, it’s important to choose a reliable and effective credit score app that can guide you through the intricacies of credit management. OneScore is a standout option that provides free credit scores from CIBIL and Experian, ensuring you have access to the information you need, when you need it. Understanding your credit score is not just about numbers; it’s about empowering yourself to take control of your financial health.

Why Choose a Credit Score App Like OneScore?

If you’ve ever thought about monitoring your credit score but felt overwhelmed by the options, let me ease your worries. OneScore offers a user-friendly platform that simplifies the credit management process. Here’s why it’s worth your time:

- Free Access to Your Credit Score: OneScore allows you to check your credit score without any hidden fees. This feature is particularly beneficial for those on a budget who want to stay informed about their financial standing.

- Insights and Analysis: The app not only provides your score but also offers insights that explain what factors influence your credit score, helping you understand your financial health better.

- Alerts and Updates: Stay informed with real-time alerts about changes to your credit report, helping you be proactive about your credit health.

The Importance of Maintaining Your Credit Score

Your credit score affects so many aspects of your financial life—like loan approvals, interest rates, and even job applications. By regularly checking your score through a credit score app like OneScore, you can monitor your financial trajectory and take action before small issues become big problems.

Understanding Your Credit Score Through OneScore

Find Out Your Credit Score with OneScore

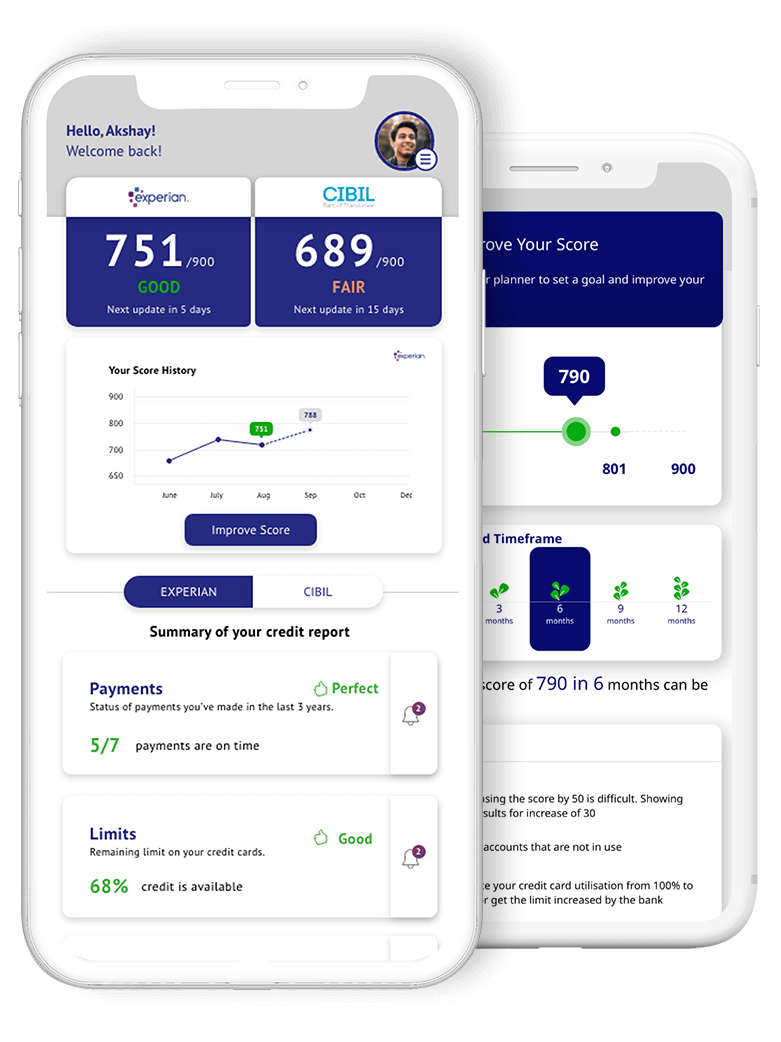

OneScore stands out by demonstrating your credit score in an easy-to-understand manner. The app’s interface is designed not only to show your score but also to provide context through various educational resources. You can learn about the different credit scoring models used, how your actions can impact your credit score, and what steps you can take to improve it.

The Features That Make OneScore the Best Credit Score App

Aside from providing access to your free credit scores from CIBIL and Experian, OneScore is equipped with several features aimed at enhancing your credit literacy. Here’s what you can look forward to:

- Personalized Recommendations: OneScore offers tailored tips based on your individual profile. These recommendations could range from reducing credit utilization to paying off certain debts that may be dragging your score down.

- Credit Monitoring: With the credit score app, you don’t just get a one-time score; you receive continuous credit monitoring that keeps you informed about potential changes affecting your score.

- User-Friendly Dashboard: The dashboard layout is intuitive, making navigation simple, even for those not tech-savvy. Finding your score and understanding its components has never been easier!

How to Get Started with OneScore?

Getting started with OneScore is a breeze. Simply download the app from your device’s app store, create an account, and enter the required details. Within minutes, you’ll have access to your free credit score and a wealth of resources to help you improve it. It’s as simple as that!

Keeping Track of Your Credit Score Over Time

One of the greatest advantages of using a credit score app like OneScore is the ability to track your credit score over time. You can see how your score fluctuates based on your financial behaviors, such as taking out new loans, missing payments, or reducing credit card balances. This historical perspective allows you to make informed decisions moving forward.

Using OneScore to Educate Yourself About Credit

Beyond just tracking your number, OneScore provides a plethora of educational content within the app. You can explore topics such as:

- Understanding Credit Utilization: The app educates users on how credit utilization—using too much of your available credit—can impact your score and what a healthy ratio looks like.

- Building a Positive Credit History: Learn strategies to establish a positive credit history, including timely bill payments and responsible credit use.

- Identifying and Disputing Errors: OneScore guides you on how to identify possible errors in your credit report and the steps to dispute these inaccuracies effectively.

The Convenience of Accessing Your Score Anytime, Anywhere

In our increasingly digital world, having your credit score at your fingertips is indispensable. The OneScore app means you’ll always know where you stand with your credit, whether you’re at home or on the go. That peace of mind can help you make confident financial decisions—whether it’s purchasing a new home, financing a car, or simply managing your expenses better.

Final Thoughts: Take Control of Your Financial Future with OneScore

In a society where credit scores can dictate opportunities, having a reliable credit score app is vital. OneScore not only provides the essential data you need but also educates you on the importance of your credit score and how to improve it. Don’t let uncertainty hold you back—download OneScore today and take the first step in owning your financial future!

With the continuous monitoring and a thorough understanding of what influences your credit score, you’ll be well on your way to achieving a healthier financial standing. Knowledge is power, and in the realm of finance, staying informed is key!