In today’s fast-paced world, achieving financial independence is a goal many aspire to. The freedom to make choices without the burden of financial stress can lead to a fulfilling and enjoyable life. This journey towards financial independence not only involves saving and investing but also requires a deep understanding of your personal finances and a clear vision of your financial independence number.

Understanding Financial Independence

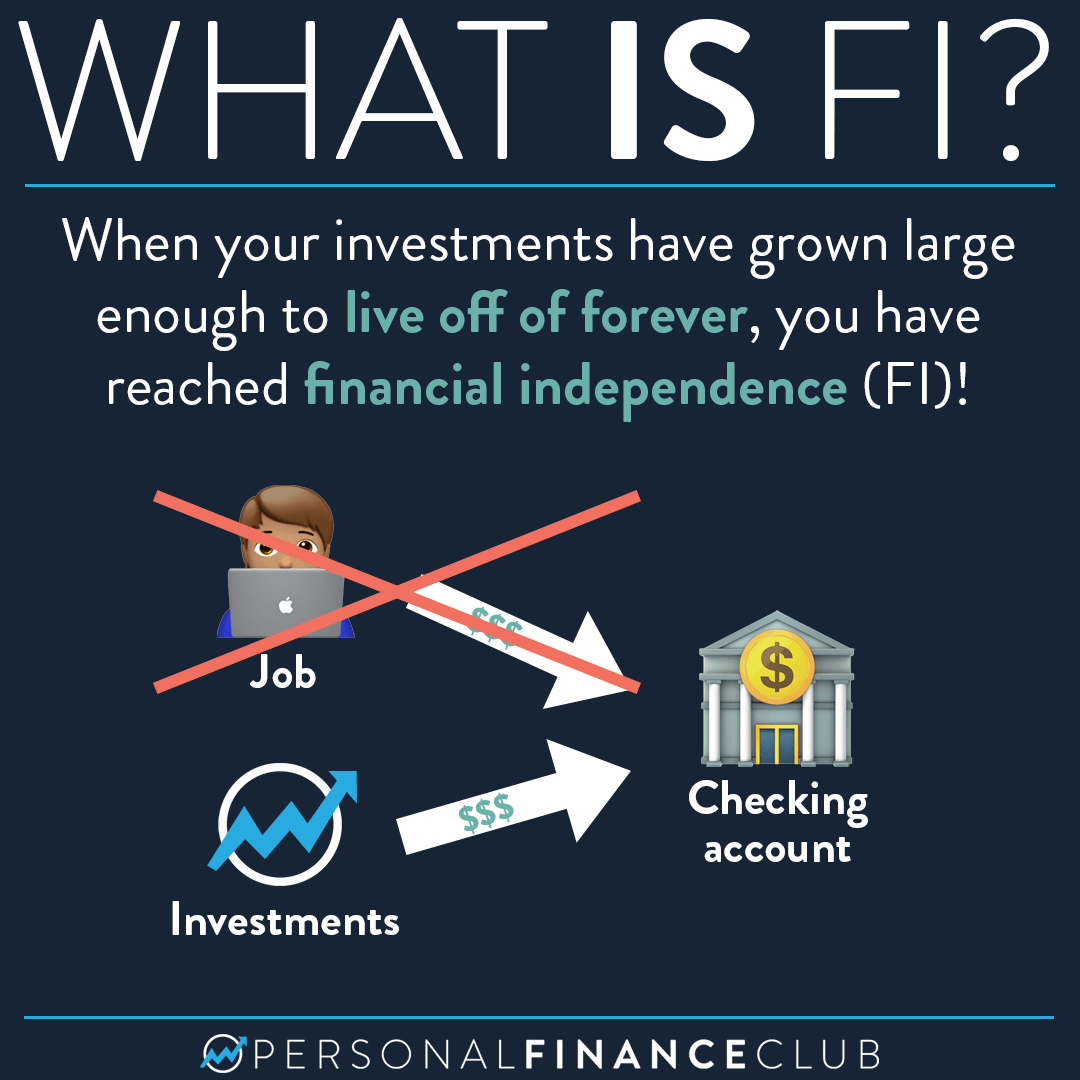

Financial independence is the state of having sufficient personal wealth to live without having to actively work for basic necessities. This means your investments and savings generate enough income to cover your lifestyle expenses. To many, this concept is akin to living life on their own terms, free from the constraints of traditional employment.

Determining Your Financial Independence Number

The financial independence number is a critical figure in your journey toward financial freedom. This number represents the total amount of savings and investments you need to accumulate to support your desired lifestyle without the need for a regular paycheck. But how do you calculate this all-important figure?

The Formula Behind the Financial Independence Number

To determine your financial independence number, start by assessing your annual expenses. A good rule of thumb is to calculate your essential expenses (housing, food, healthcare, transportation) and then add any discretionary spending (entertainment, travel, hobbies). Once you have a clear picture of your total annual expenditures, you can use the following formula:

Financial Independence Number = Annual Expenses x 25

Why use 25? This calculation is often derived from the well-known “25x rule,” which is based on the premise that if you withdraw 4% annually from your investments, your savings should last for at least 30 years. However, this is only one approach, and individual circumstances may lead to adjustments in your unique financial independence number.

The Role of Investments in Reaching Your Financial Independence Number

Investing is a crucial component in the quest for financial independence. It’s not just about saving; it’s about making your money work for you. By investing wisely, you can significantly increase your chances of attaining your financial independence number more quickly.

Consider diverse investment options such as stocks, bonds, mutual funds, and real estate. Each investment type has its own risk level and potential return, and spreading your investments across different vehicles can help mitigate risks.

Visualizing Your Goal

What is Financial Independence?

This image illustrates the concept of financial independence, encapsulating the essence of breaking free from financial shackles. Understanding what financial independence means to you can be the driving force behind your financial planning.

The Importance of Budgeting in Achieving Your Financial Independence Number

Budgeting plays a significant role in managing your finances and ensuring you remain on track to achieve your financial independence number. By creating a detailed budget, you can track your income and expenses, identify areas you can cut back on, and increase your savings rate. This will ultimately help you accumulate the wealth needed for a financially independent lifestyle.

Tools and Apps for Effective Budgeting

Utilizing digital tools and budgeting apps can streamline the process of financial tracking. Options include Mint, YNAB (You Need a Budget), and GoodBudget. Each of these platforms offers unique features that can assist in monitoring spending habits, setting savings goals, and understanding where your money goes each month.

Analyzing Your Financial Independence Number: Adjust as Needed

Revisiting and analyzing your financial independence number from time to time is crucial. Life changes, be it a new job, marriage, children, or even changes in lifestyle can affect your needs and, subsequently, your financial independence number. Regularly assessing and updating your calculations will ensure you are on the right track.

Emergency Fund: A Cushion for the Future

An essential aspect of reaching your financial independence number is having a reliable emergency fund. This fund should ideally cover 3 to 6 months of living expenses and serve as a safety net against unexpected costs. Having this cushion helps you avoid dipping into your investments if something unforeseen arises, keeping you on your path to financial independence.

Staying Motivated on Your Journey

Staying focused and motivated can be challenging, especially when financial goals take time to materialize. Here are some tips to keep your spirits high:

- Set realistic, achievable short-term goals

- Celebrate small milestones as you reach them

- Surround yourself with like-minded individuals who share similar goals

- Continue educating yourself on personal finance and investment strategies

Community and Support Systems

Engaging with communities focused on financial independence can reinforce your commitment. Online forums, local finance clubs, and social media groups can provide support, advice, and inspiration. Remember, you are not alone in this journey; many others are walking the same path.

Final Thoughts on Your Financial Independence Number

Embarking on the journey to financial independence can feel overwhelming, but breaking it down into manageable steps can simplify the process. By understanding and calculating your financial independence number, establishing good budgeting habits, and investing strategically, you can create a solid foundation for your future.

Keep your financial independence number in sight as a guiding star. Continually educate yourself, adapt your plans as circumstances change, and celebrate your successes along the way. Your path to financial independence is not just about the destination; it’s also about how you grow, learn, and thrive throughout the journey.

In conclusion, achieving financial independence is possible for anyone willing to put in the planning and discipline required. As you navigate this journey, remember that every small step counts towards reaching your financial independence number, allowing you to enjoy the freedom that comes with true financial security.