In today’s fast-paced financial landscape, understanding personal finance ratios is vital for anyone looking to take control of their finances. These ratios serve as metrics that can help you gauge your financial health, allowing you to make informed decisions about budgeting, investing, and savings. By incorporating these essential ratios into your financial strategy, you can cultivate a clearer picture of where you stand and what steps you need to take to thrive financially.

Understanding Personal Finance Ratios

At the core of effective financial management are personal finance ratios, which can simplify the complexities of your financial situation. Whether you’re managing household finances or plotting your investment strategies, a solid grasp of these ratios can illuminate the paths you might take towards improvement. Personal finance ratios provide crucial insights into debt levels, liquidity, and overall financial stability. Let’s break down some of the most important ratios you need to know.

1. Debt-to-Income Ratio

The debt-to-income (DTI) ratio is a key measure used by lenders to assess your ability to manage monthly payments and repay debts. This ratio is calculated by dividing your total monthly debt payments by your gross monthly income. A lower DTI suggests a healthier financial situation, as it indicates that a smaller portion of your income is consumed by debt. Aim for a DTI ratio of 36% or less to be considered a low-risk borrower.

2. Current Ratio

The current ratio is an essential indicator of financial health, particularly for short-term financial obligations. It is determined by dividing current assets by current liabilities. A current ratio of 1 or higher indicates that you possess enough assets to cover your short-term liabilities, signaling liquidity and financial stability. Monitoring this ratio enables individuals to maintain a sufficient cushion for unexpected expenses, an important aspect of effective personal finance ratios management.

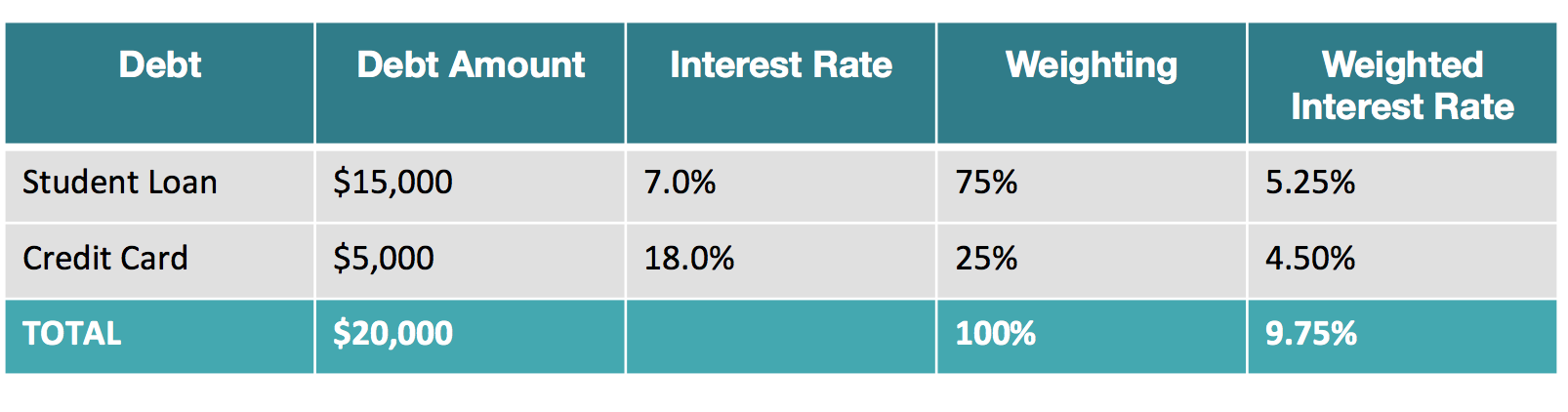

Visualizing Personal Finance Ratios

This image illustrates nine personal finance ratios that are fundamental for anyone aiming to improve their financial literacy and decision-making capability. By familiarizing yourself with these ratios, you can make smarter financial choices that align with your goals.

3. Return on Investment (ROI)

ROI is a metric often used by investors to evaluate the profitability of an investment. This ratio can also apply to personal finance decisions, allowing you to assess whether the time and money spent on a specific expense yield satisfactory returns. To calculate ROI, subtract the cost of the investment from its current value, divide by the cost, and multiply by 100. A positive ROI indicates that the investment is worthwhile, while a negative ROI serves as a caution signal to rethink your approach.

Building a Balanced Financial Future through Personal Finance Ratios

Understanding and effectively fluctuating personal finance ratios can bolster your long-term approach to financial stability. These ratios provide a strategic framework for allocating resources and prioritizing your financial objectives. By keeping tabs on these metrics, you can uncover opportunities to streamline your budget and enhance your investment strategies.

4. Savings Rate

Your savings rate, expressed as a percentage of your income that you set aside for future use, plays a crucial role in personal finance management. To calculate your savings rate, divide your total savings by your gross income. A higher savings rate suggests a proactive approach to financial planning. Aiming for a savings rate of at least 20% is advisable to build a robust financial cushion for emergencies and retirement.

5. Net Worth Ratio

The net worth ratio helps illuminate your overall financial situation by measuring the difference between your assets and liabilities. This ratio provides a snapshot of your financial health and serves as an excellent indicator of wealth accumulation over time. Monitoring your net worth regularly allows you to identify trends and set concrete goals for growth.

Utilizing Personal Finance Ratios Effectively

To maximize the benefits of personal finance ratios, it’s essential to integrate them into your regular financial planning routines. By reviewing these metrics consistently, you can gain clarity on your financial progress and make necessary adjustments to your strategies. Numerous financial and budgeting software tools can assist you in tracking these ratios and visualizing your financial trends effectively.

6. Expense Ratio

The expense ratio measures the efficiency of your budget. It encapsulates all your expenses as a percentage of your income, with a lower expense ratio indicating that you are spending less compared to your earnings. By maintaining an eye on your expense ratio, you can uncover penny-pinching opportunities and enhance your savings capabilities.

7. Debt Service Coverage Ratio (DSCR)

This ratio evaluates your ability to service your debt obligations based on your income. Calculated by dividing your net operating income by your total debt service, a DSCR of greater than 1 indicates that you have sufficient income to cover your debt payments. A ratio lower than 1 can be alarming as it suggests potential difficulties in meeting debt requirements.

The Importance of Keeping Personal Finance Ratios in Check

Keeping personal finance ratios in check is not merely about assessing your financial state but also enhancing your financial literacy. As you dive deeper into these metrics, you become empowered to make proactive changes that promote your financial wellbeing. As your knowledge and awareness of personal finance ratios increase, you’ll be better equipped to navigate the complexities of financial planning and investment.

8. Working Capital Ratio

The working capital ratio, calculated by subtracting current liabilities from current assets, provides insight into your company’s short-term financial health. Understanding this ratio ensures that you can meet your financial obligations while also investing in growth opportunities. A well-managed working capital ratio bolsters investor confidence and supports overall financial stability.

9. Price-to-Earnings Ratio (P/E)

For those interested in the investment side of personal finance, the price-to-earnings (P/E) ratio is vital. It compares a company’s share price to its earnings, providing insights into whether a stock is undervalued or overvalued. An informed assessment of the P/E ratio can guide your investment decisions, allowing you to build a well-rounded portfolio that maximizes returns while mitigating risks.

As you can see, mastering personal finance ratios is essential to achieving financial freedom and security. Whether indulging in leisurely spending or preparing for retirement, understanding how these figures impact your life provides the groundwork for making educated financial choices. By diving into the specifics of each ratio, you can craft a comprehensive strategy that steers your financial journey towards success.

In conclusion, personal finance ratios are not just numbers; they are integral tools that represent your financial state and guide your decision-making processes. Whether you’re a fresh graduate just beginning your career or someone nearing retirement, these ratios offer critical information that can help you make informed choices about spending, saving, and investing. Your financial future is ultimately in your hands—understanding the power of these personal finance ratios ensures that you are well-prepared for whatever lies ahead.