Ah, financial independence age! The holy grail of adulting. When you finally master the complex math of *not* working while still enjoying life’s little pleasures, you might just find yourself asking, “When will I get to kick my daily grind to the curb and sip piña coladas on a beach somewhere?” Well, my friend, you’re not alone! To understand this much-coveted number, let’s take a comedic dive into the world of financial independence.

Understanding Your Financial Independence Age

First off, let’s break it down. Your financial independence age is kind of like trying to figure out when you’ll finally get the hang of adulting. Spoiler alert: just like adulting, it’s not as easy as it sounds!

Imagine you’re sitting in a coffee shop sipping your overpriced caramel macchiato—because let’s face it, you’re fancy like that. You overhear a conversation about stocks, bonds, and geo-political market trends, and suddenly you start sweating. That’s when you know you need a financial muse (no, a $15 latte is NOT the answer).

The Math Behind Your Financial Independence Age

Calculating your financial independence age is simple in theory but can feel like rocket science when you’re elbow-deep in bill statements or those pesky investment spreadsheets. So grab your favorite calculator (or just your phone, this isn’t the 90s), and let’s tackle this together!

Is Your Financial Independence Age All Just Numbers?

Yes and no. The cold, hard facts involve crunching numbers like your favorite cereal, but the real magic happens in your mindset. You see, financial independence age isn’t just a number you can find by Googling—trust me, if it were that simple, we wouldn’t be sitting here with a caramel macchiato!

To hit that glorious milestone where you can finally pull the plug on your 9-to-5, you need to factor in your savings rate, investment returns, and a sprinkle of your future lifestyle aspirations. Do you want to travel to Bali or just spend every weekend at home arrays of pajamas? Your financial independence age will hinge on these choices!

Why Your Financial Independence Age Matters

Now that you’ve decided to take the plunge into this fascinating world, why does your financial independence age really matter? Picture this: You’re sipping a fancy drink, toes in the sand, not a care in the world—all thanks to the wise decisions made in your 20s. In other words, knowing your magic number gives you the power to make better choices, thus giving you more time for margaritas and less time for pointless eight-hour meetings!

Setting Realistic Expectations About Your Financial Independence Age

Don’t set yourself up for an epic fail! While most financial gurus might suggest embracing frugality like a best friend, it’s important to have realistic expectations about your financial independence age. Save aggressively, yes, but if you start living off ramen and twinkies just to “save for retirement,” you may find yourself cranky and craving real food rather than sipping mojitos on the Mediterranean.

Calculating Your Cheeky Financial Independence Age

Look at This Inspiration!

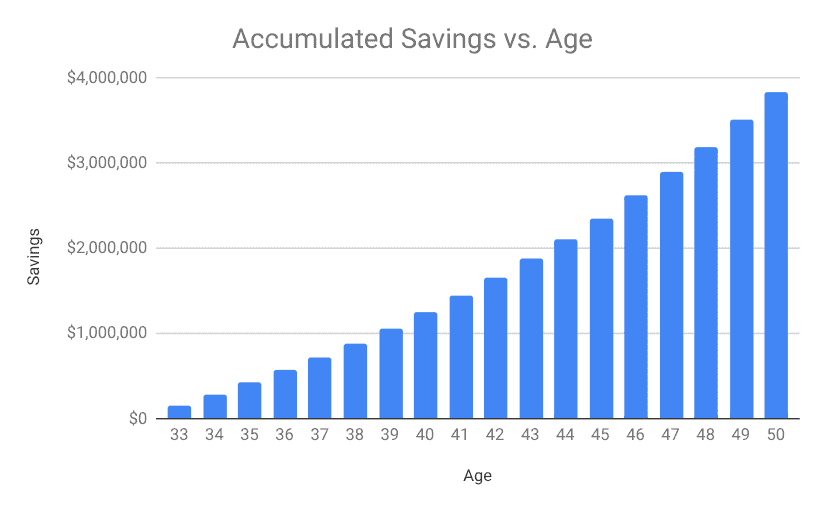

See? Even the universe believes in the idea of financial independence age! Just look at that image! It’s inspiration, encouragement, and maybe even a friendly nudge from the cosmos, telling you to get serious about that financial planning.

Deciding What Financial Independence Means to You

Financial independence can look different for everyone, and guess what? That’s okay! There’s no “one-size-fits-all” approach to finding your financial independence age. Maybe your dream involves living on a yacht sailing through the Caribbean, or perhaps you just want to retire to a cozy cabin in the woods. Whatever floats your boat, just be sure it aligns with not only your dreams but also your budget. Glass half-full, folks!

Reaping the Rewards of Knowing Your Financial Independence Age

Okay, so you did your homework, crunched your numbers, and came up with a potential age where you can finally send your boss a cheerful goodbye and live life the way YOU want. But, it’s not all just sunshine and rainbows. Knowing your financial independence age means holding yourself accountable, potentially sacrificing some fun (sorry, but the avocado toast might have to go), and making smarter financial decisions.

Implementation: Taking the Leap Towards Your Financial Independence Age

Now it’s time to put those dreams into action! Stick those post-it notes of your goals on your fridge (next to your takeout menus), share with friends, and maybe even start a blog to document the hilarity of your journey! Who knows, you could inspire countless others—and probably make them laugh while doing it.

Your financial independence age is not just about reaching a number; it’s about creating that ultimate lifestyle you’ve always envisioned. It’s about those sun-soaked afternoons lounging by the pool without a single thought of work crossing your mind. But remember, this glorious destiny requires planning, hard work, and possibly some adulting along the way.

Final Thoughts on Your Financial Independence Age

As we conclude our ramble through the enchanting woodland of financial independence age, remember this: navigation through the financial jungle doesn’t have to be dull or utterly soul-crushing. Embrace the process, have a sense of humor, and enjoy a few spontaneous adventures along the way—just perhaps skip the impulsive purchases at your local coffee shop, okay?

As you forge ahead on this journey, take pride in every saving and investment decision. You’re not just trying to hit a financial independence age; you’re crafting the life you want with laughter, joy, and perhaps a few embarrassing stories to tell your friends. Cheers to that!