For many young adults, the journey to financial independence can feel daunting. With student loans, rising living costs, and the pressures of adulthood, it’s easy to become overwhelmed. However, achieving financial independence is not only possible but also essential for securing a stable future. This article will guide you through key strategies to help you gain financial independence and take control of your life and finances.

Understanding Financial Independence for Young Adults

Before delving into specific strategies, let’s clarify what financial independence means for young adults. Simply put, it’s the ability to live life on your own terms without being dependent on financial support from family or friends. This independence enables you to make choices based on your values rather than financial constraints.

Why Financial Independence Matters

Financial independence allows young adults to pursue education, travel, or start their own businesses without worrying about immediate financial implications. It fosters confidence and self-sufficiency, traits that are crucial for navigating adulthood. Additionally, the earlier you begin to focus on financial independence, the more time you will have to build a stable financial foundation.

Steps Toward Achieving Financial Independence Young Adults Must Consider

To achieve financial independence, one must approach their finances with a clear plan. Here are several crucial steps to take:

1. Create a Realistic Budget

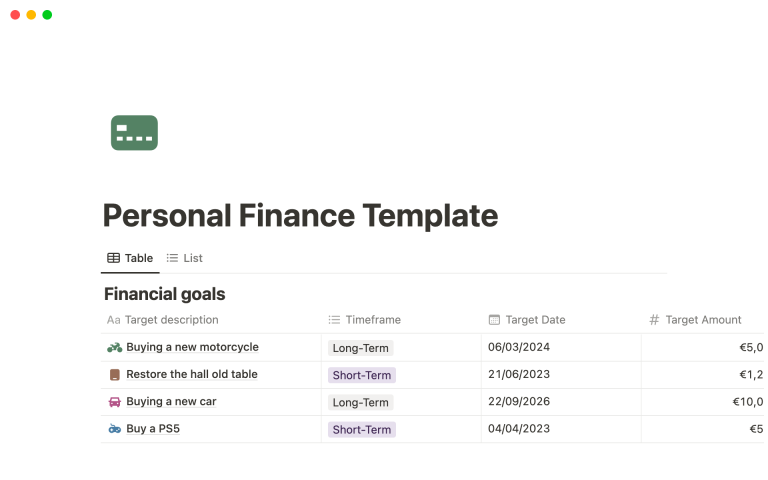

Budgeting is the cornerstone of financial independence for young adults. Track your income and expenses meticulously to understand where your money is going. Utilize budgeting apps or spreadsheets to simplify this process. Aim to allocate your funds toward essentials, savings, and discretionary spending.

Visual Steps to Financial Independence

Incorporating visuals into your financial strategy can make the journey toward financial independence more engaging and relatable. It’s all about understanding the flow of money and visualizing the goals you’re working toward.

2. Establish an Emergency Fund

An emergency fund acts as your safety net, shielding you from unexpected financial crises. Aim to save at least three to six months’ worth of living expenses in an easily accessible account. This fund will grant you peace of mind and facilitate your pursuit of financial independence.

Investing for Financial Independence Young Adults

3. Start Investing Early

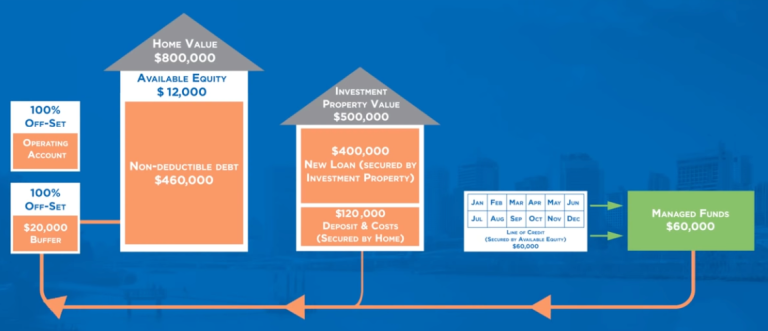

Investing is one of the most effective ways to grow wealth over time. As a young adult, you have the advantage of time on your side. Consider low-cost index funds or retirement accounts like a 401(k) or IRA. The earlier you start, the more your investments can compound, helping you reach financial independence more swiftly.

4. Educate Yourself About Finances

Knowledge is power when it comes to financial independence. Read books, listen to podcasts, and attend workshops focused on personal finance and investment strategies. The more informed you are, the better choices you can make for your financial future.

Mastering Financial Independence Young Adults Can Achieve

5. Reduce Debt

Debt can be a significant barrier to achieving financial independence. Prioritize paying down high-interest debts, and avoid accumulating new debt when possible. Consider strategies such as the snowball method or avalanche method for effective debt repayment. The goal is to minimize your liabilities and maximize your freedom.

6. Consider Side Hustles

In today’s gig economy, side hustles have become a popular means of supplementing income. Whether it’s freelancing, tutoring, or monetizing a hobby, additional income streams can accelerate your path to financial independence. Use your skills and passions to create opportunities for yourself outside your primary job.

Financial Independence Young Adults: The Importance of Networking

7. Build a Strong Professional Network

Your network can significantly impact your career growth and financial trajectory. Attend networking events, join professional organizations, and engage with others in your field. A strong network can provide job opportunities, mentorship, and valuable insights, all contributing to your financial independence.

8. Set Long-term Financial Goals

Having clear, attainable financial goals is crucial for staying motivated on your journey toward financial independence. Outline where you want to be in five, ten, or twenty years and create a plan for how to get there. These goals could range from homeownership to starting a business or even retiring comfortably.

The Road to Financial Independence Young Adults Should Follow

9. Stay Disciplined and Flexible

Discipline is vital when it comes to achieving financial goals. Stick to your budget, continue saving and investing, and stay focused on your long-term objectives. However, be flexible—life can throw unexpected challenges your way. Adaptability is important for recalibrating your plans while maintaining your ultimate goal of financial independence.

10. Celebrate Milestones

Each step you take towards financial independence is worth celebrating. Acknowledge your progress, whether it’s paying off a debt, achieving a savings goal, or reaching an investment milestone. Recognizing your achievements can motivate you to continue forging ahead.

Conclusion: Embrace Your Journey to Financial Independence Young Adults

Achieving financial independence is a journey that requires planning, discipline, and perseverance. By employing these strategies, young adults can not only gain financial independence but also enrich their lives with the freedom that comes with it. Remember, the choices you make today will pave the way for your tomorrow. So take charge of your finances, and embrace the thrilling opportunity to shape your future!