When considering home improvements, one of the crucial factors that often gets overlooked is the credit score needed for a home improvement loan. Whether it’s updating your kitchen, adding a new room, or enhancing curb appeal, it’s essential to understand how your credit score can affect your ability to finance these projects successfully. Not only does your credit score play a pivotal role in loan approval, but it can also influence the interest rates and terms available to you. In this article, we will dive into everything you need to know about the credit score needed for home improvement loans and how you can enhance your creditworthiness to make your renovation dreams a reality.

The Importance of Understanding Your Credit Score Needed for Home Improvement Loan

Your credit score is a numerical representation of your creditworthiness, based on your credit history. Lenders use this score to determine the level of risk in granting you a loan. Generally speaking, a higher score indicates lower risk, which can result in better loan terms, such as lower interest rates and favorable repayment plans. Before applying for a home improvement loan, it’s crucial to know the credit score needed for a home improvement loan specific to your financial situation.

What is the Ideal Credit Score for Home Improvement Loans?

Most lenders typically expect a minimum credit score of 620 for home improvement loans. However, the ideal score may vary depending on the type of loan you’re seeking and the lender’s requirements. For example, Federal Housing Administration (FHA) loans may allow scores as low as 500 with a higher down payment, while conventional loans often prefer scores of 680 and above.

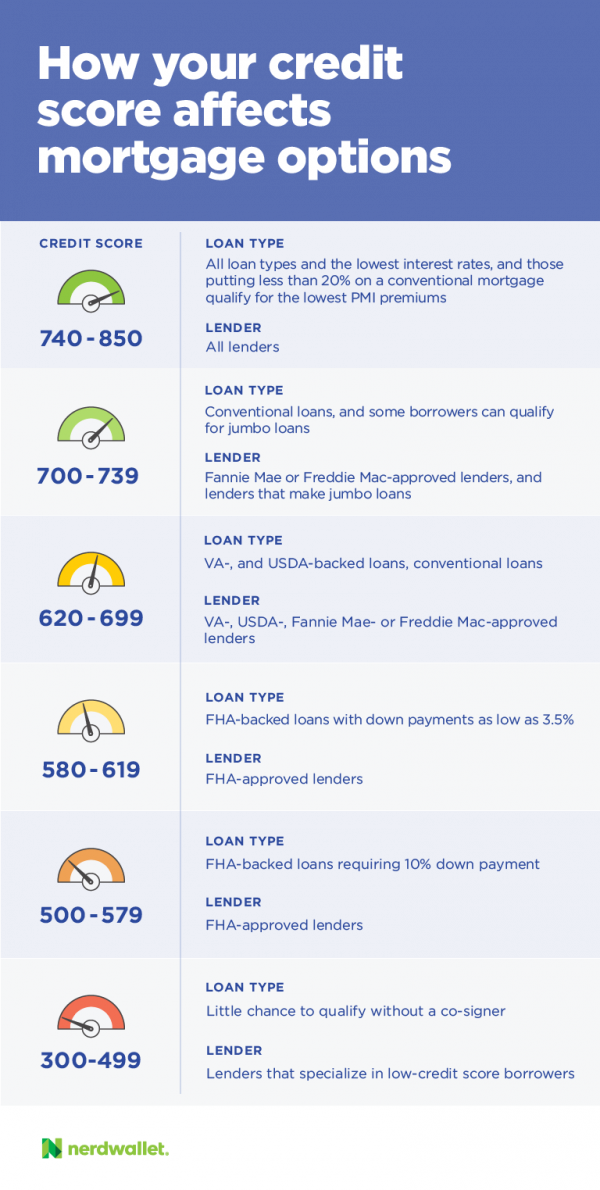

This Image Represents the Credit Score Needed for Home Improvement Loans

Visual aids like this can help summarize the data surrounding credit scores and housing loans effectively, making it easier for you to visualize your approach.

Steps to Identify Your Current Credit Score

Before embarking on your home improvement journey, it’s important to check your credit score. You may obtain your score from various online financial services, through credit card statements, or from the credit reporting agencies themselves. Each of these sources typically provides a snapshot of your score and some insights into the factors contributing to it.

Understanding Factors Affecting Your Credit Score

Many elements can influence your credit score, including your payment history, credit utilization ratio, length of credit history, types of credit accounts, and recent credit inquiries. Each factor plays a different role in calculating your overall score. Keeping your balances low, paying your bills on time, and avoiding new debt can significantly boost your chances of meeting the credit score needed for a home improvement loan.

Improving Your Credit Score Before Applying for a Home Improvement Loan

If you find your score is below the preferred threshold, don’t worry! There are practical steps you can take to improve it before applying for a loan.

1. Pay Your Bills on Time

Your payment history accounts for a majority of your credit score. Consistently paying all your monthly bills on time is vital for boosting your score.

2. Reduce Your Credit Utilization Ratio

This ratio measures how much credit you’re using compared to your total available credit. It’s wise to keep this ratio below 30%. Paying down existing debt can help you achieve a lower credit utilization ratio swiftly.

3. Avoid Opening New Credit Accounts

Each time you apply for credit, a hard inquiry is recorded on your report, potentially lowering your score slightly. Before applying for a home improvement loan, try to limit new credit inquiries for at least six months.

Choosing the Right Type of Home Improvement Loan

Understanding the various types of loans available can enable you to choose one that best fits your financial situation. There are several types of loans available for home improvements, each with varying credit score requirements.

1. Personal Loans

Personal loans generally necessitate better credit scores, typically around 680, but can offer quick access to funds without requiring home equity.

2. Home Equity Loans

Home equity loans allow homeowners to borrow against their equity. They usually have lower interest rates but require your home to be assessed, which can be affected by your credit score.

3. FHA 203(k) Loans

FHA 203(k) loans are government-backed loans specifically tailored for home renovations. They may offer more leniency regarding credit scores, extending options to those with lower scores.

Preparing Your Application for a Home Improvement Loan

Once you have improved your credit score and selected a suitable loan type, it’s time to gather the required documentation for your application. This will usually include proof of income, tax returns, and information about your debts and credit history.

Understanding How Lenders Assess Your Application

Lenders will review your credit report, assess your debt-to-income ratio, and evaluate your overall financial health. A solid understanding of the credit score needed for a home improvement loan can make all the difference in how lenders view your application.

Final Thoughts on Credit Score Needed for Home Improvement Loan

Achieving your dream home through renovations is within reach, but understanding the credit score needed for a home improvement loan is an essential first step. By monitoring your score and taking the necessary steps to improve it, you can enhance your financing options, secure better interest rates, and bring your vision of a perfect home to life.

Your journey doesn’t have to end here. Keep researching and comparing loan options available so that you can find the best fit for your specific needs. In the end, investing time and effort into improving your credit and understanding your financing options can elevate your home and your living experience.