Understanding the concept of Compound Interest Explained is crucial for anyone looking to manage their finances effectively. While many may grasp the basics of interest, the power of compounding can elevate your understanding and financial outcomes significantly. This article dives deep into the intricacies of compound interest—what it is, how it works, and practical applications to enhance your financial literacy.

What is Compound Interest Explained?

Compound interest is the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods. In simpler terms, it means earning interest on interest. This phenomenon is where the true power of compound interest lies, creating exponential growth over time compared to simple interest, where interest is calculated only on the principal amount.

The Formula Behind Compound Interest Explained

The formula used to calculate compound interest is:

A = P(1 + r/n)^(nt)

Where:

- A = the amount of money accumulated after n years, including interest.

- P = the principal amount (the initial amount of money).

- r = the annual interest rate (decimal).

- n = the number of times that interest is compounded per year.

- t = the time the money is invested for in years.

Understanding this formula is fundamental for grasping how compound interest can work in your favor over time. Let’s break down these components further to emphasize how they interact.

The Mechanics of Compound Interest Explained

To illustrate the concept of compound interest explained, let’s consider a basic example. Suppose you invest $1,000 at an annual interest rate of 5%, compounded annually. Here’s how the investment grows:

- After 1 year: $1,000 * (1 + 0.05/1)^(1*1) = $1,050

- After 2 years: $1,000 * (1 + 0.05/1)^(1*2) = $1,102.50

- After 3 years: $1,000 * (1 + 0.05/1)^(1*3) = $1,157.63

With each passing year, the interest accumulates on the total amount, including previously earned interest. This is why compound interest is often referred to as earning ‘interest on interest’. The longer the money is invested, the more pronounced the effect of compounding becomes.

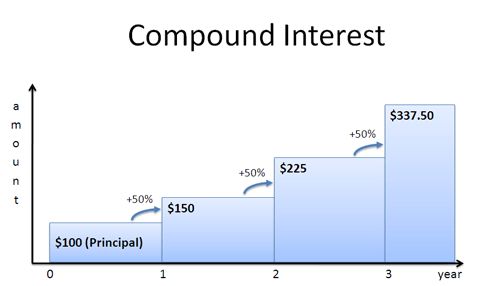

Visualizing Compound Interest Explained

The Growth of Compound Interest

This graph visually represents the growth trajectory of an investment utilizing compound interest. As the years progress, the amount of interest accrued begins to spiral upwards, showcasing its exponential nature. The earlier you start investing, the more substantial your gains can be due to compounding.

The Importance of Time in Compound Interest Explained

One of the most critical aspects of compound interest explained is the factor of time. The longer you allow your money to sit and compound, the greater your returns. For instance, if you were to increase the investment duration from 10 years to 20 years, the difference in growth may be shocking.

Let’s say you invest $10,000 at a 6% annual interest rate compounded annually. Here’s how your investment would grow:

- After 10 years: $10,000 * (1 + 0.06/1)^(1*10) = $17,908.48

- After 20 years: $10,000 * (1 + 0.06/1)^(1*20) = $31,384.98

The difference of over $13,000 in just an additional ten years shows how powerful time can be when harnessing the potential of compound interest.

Financial Strategies Utilizing Compound Interest Explained

Incorporating strategies that leverage compound interest can significantly enhance your financial health. Here are a few strategies to consider:

- Start Early: The sooner you start investing, the more time your money has to grow exponentially.

- Reinvest Earnings: Instead of cashing out on the interest, reinvest it! This creates a snowball effect on your investment amount.

- Choose Higher Interest Rates: Opt for accounts or investment vehicles that offer better interest rates to maximize your returns.

By carefully planning your investments and consulting financial advisors, you can effectively take advantage of compound interest to secure your financial future.

Common Misconceptions Regarding Compound Interest Explained

While the idea of compound interest is straightforward, several misconceptions can lead to an inadequate understanding:

- Misunderstanding the Power of Compounding: Some may believe that small amounts invested over time won’t make much difference. In reality, even modest investments can grow substantially over decades.

- Neglecting Early Investments: Many young individuals delay investing, thinking they have time. Starting early is crucial to maximizing compound interest benefits.

- Ignoring Fees and Taxes: Unfortunately, some might forget that fees and tax obligations can reduce overall returns, so always calculate net gains.

Recognizing these misconceptions can help you navigate the complex world of finance more carefully and make informed decisions about your investments.

How to Calculate Future Value with Compound Interest Explained

To determine how much your investment will grow with compound interest over time, you’ll need to explore the future value of your investments. By substituting values in the previously mentioned formula and applying future scenarios, you can forecast outcomes effectively.

For instance, if you wanted to know the future value after 30 years for a $5,000 investment at 7% compound interest:

- After 30 years: $5,000 * (1 + 0.07/1)^(1*30) = $38,696.44

Such calculations not only empower your financial planning but also highlight the incredible impact of compound interest when applied wisely.

The Conclusive Takeaway on Compound Interest Explained

To wrap up, recognizing the importance of compound interest explained can lead to wiser financial choices. With the right amount of information and planning, you can use the principles of compounding to your advantage, helping to ensure financial stability and the potential for wealth generation over time. By educating yourself about how compound interest works, you pave the way for better investment practices, more lucrative returns, and the financial security that comes with it.

Ultimately, the earlier you start applying these concepts and the more diligently you plan your financial future, the more successful you will be in harnessing the power of compound interest for a financially sustainable life.