When it comes to diving into the world of stock market investing, many of us seek a guiding light—something or someone to help us navigate the ever-changing waters. That’s where the Stock Investing Mastermind book shines brightly. This book serves as a foundation for anyone looking to build a solid understanding of how to invest wisely and effectively in the stock market.

Understanding the Stock Investing Mastermind Book

For those new to investing, the insights shared in the Stock Investing Mastermind book provide invaluable strategies that can transform your approach to stock market trading. This book is not just a collection of stock tips; it’s a comprehensive guide crafted to empower readers with knowledge, confidence, and actionable strategies.

Essential Lessons from the Stock Investing Mastermind Book

The Stock Investing Mastermind book comprises several key lessons aimed at demystifying stock market investing. Here are a few of the essential takeaways:

1. Fundamentals of Stock Market Investing

One of the primary focuses of the Stock Investing Mastermind book is the introduction to the fundamentals of investing. Understanding the basic concepts—from how stocks are traded to the significance of market trends—lays the groundwork for smart investment decisions. It’s crucial to grasp the difference between various types of stocks, such as common and preferred stocks, and to understand critical financial metrics that influence stock prices.

2. Importance of Research

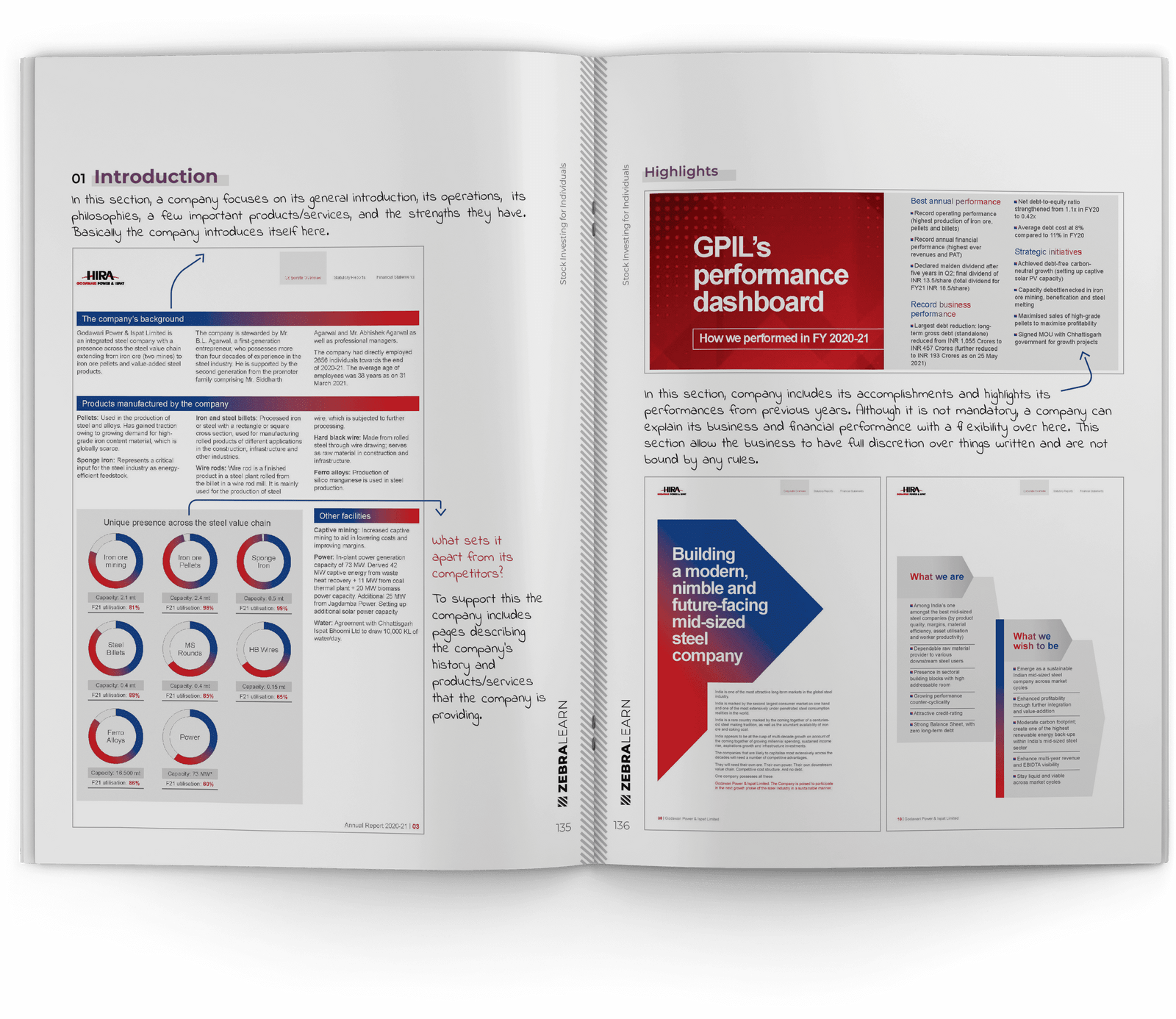

Research is a recurring theme throughout the Stock Investing Mastermind book. The authors stress the importance of conducting thorough background checks on companies before making investment choices. This includes analyzing financial statements, understanding business models, and staying updated on market news. Informed investors are those who can turn research insights into profitable decisions.

3. Risk Management Strategies

Risk is an inherent part of stock market investing, but the Stock Investing Mastermind book teaches how to manage it effectively. It discusses techniques such as diversification and setting stop-loss orders as means to safeguard your portfolio. Creating a solid risk management strategy allows you to minimize losses while maximizing potential gains.

Developing a Mindset for Success

Investing is not just about numbers; it’s also about mindset. The Stock Investing Mastermind book encourages readers to cultivate a long-term investment mindset rather than chasing short-term gains. This mindset allows for better decision-making during market fluctuations and helps investors remain resilient in the face of adversity.

The Psychological Aspects of Investing

A critical section of the book discusses the psychological factors that influence investor behavior. Fear and greed can lead to irrational decisions, and the authors argue that understanding these emotions can lead to better financial outcomes. Adopting a disciplined approach to investing is essential for long-term success.

Building a Winning Portfolio

Building a portfolio is often seen as the ultimate goal for investors. The Stock Investing Mastermind book provides a detailed roadmap for constructing a robust investment portfolio tailored to individual risk tolerance, time horizon, and financial objectives. Through strategic asset allocation, an investor can create a diversified portfolio that balances risk and reward appropriately.

Criteria for Selecting Stocks

In the journey of stock market investing, knowing how to select stocks is paramount. The Stock Investing Mastermind book outlines practical criteria for stock selection, including qualitative and quantitative factors. By evaluating company performance indicators alongside industry trends, investors can identify potential winners in the stock market.

Monitoring and Rebalancing Your Portfolio

As market conditions evolve, so should your investment portfolio. Regular monitoring and rebalancing ensure that investments align with your strategy and risk tolerance. The Stock Investing Mastermind book emphasizes the need to assess your portfolio regularly, making adjustments as required to stay on track towards achieving your investment goals.

A Community of Investors

The Stock Investing Mastermind book is also a call to engage with a community of like-minded investors. Networking and learning from others can provide fresh perspectives and insights. Forums, clubs, and social media platforms dedicated to investing are great places to share experiences and strategies, fostering a collaborative environment.

The Value of Continuing Education

Investing is a lifelong journey, and the pursuit of knowledge never ends. The Stock Investing Mastermind book reinforces the importance of continuous learning. Whether through books, podcasts, or online courses, staying educated about market trends, new strategies, and innovations in investing can significantly enhance your proficiency.

Conclusion: Take the Next Step in Your Investment Journey

The Stock Investing Mastermind book serves as a vital resource for anyone looking to dive deeper into the complexities of stock market investing. It equips readers with essential tools, strategies, and a supportive mindset to navigate the often turbulent investment landscape. By embracing the lessons from this book, you’re taking the first step toward mastering the art of stock market investing, positioning yourself for a successful and fulfilling investing experience.

Are you ready to transform your investment journey? Dive into the Stock Investing Mastermind book today and unlock the keys to smart investing!