Welcome, fellow financial wizards and accidental money mismanagers! Are you ready to explore the whimsical world of personal finance? Buckle up, because we’re diving headfirst into the fun and games of budgeting, saving, and not resorting to hiding cash under your mattress—trust me, that’s so last century!

How to Manage Your Personal Finance Without Losing Your Mind

First things first, if you’re anything like me, the mere mention of “personal finance” might make you break into a cold sweat. But fear not! Managing your finances doesn’t have to feel like trying to assemble IKEA furniture without the manual (and we all know how that ends, right?). So let’s turn this daunting task into a delightful experience!

Step 1: Make a Budget, Not a Burden

Think of a budget as your personal financial GPS. You wouldn’t want to drive cross country without directions, right? Start by mapping out your income and expenses. Lists help! Grab some snacks and a notepad (or, you know, an app for the tech-savvy among us)—it’s like a treasure hunt, but instead of gold, you’re hunting for ways to keep your finances afloat.

Step 2: Save Like it’s a Sport

Who knew saving money could be as exhilarating as watching the final seconds of a championship game? When it comes to how to manage your personal finance, consider setting savings goals. Create a system where saving feels less like a chore and more like a challenge. For every small victory, treat yourself! That $5 coffee can turn into a motivational pep talk for your savings account.

How to Manage Your Personal Finance: Finding Your Inner Frugalista

Speaking of saving, let’s talk about the deliciously delightful art of being frugal. Frugal doesn’t mean cheap; it means you’re a savvy spender. Embrace couponing, shop sales like your life depends on it, and discover that you can have fun entertaining friends without spending half your paycheck on overpriced apps.

A Little Help from Technology

Did you know there are apps that can help you manage your finances too? Yep, we live in the future, my friends! From tracking expenses to finding the best deals nearby, there’s something for everyone. You can even set reminders for when your bills are due—so no more late fees, which are basically the tax you pay for being forgetful. No one wants that!

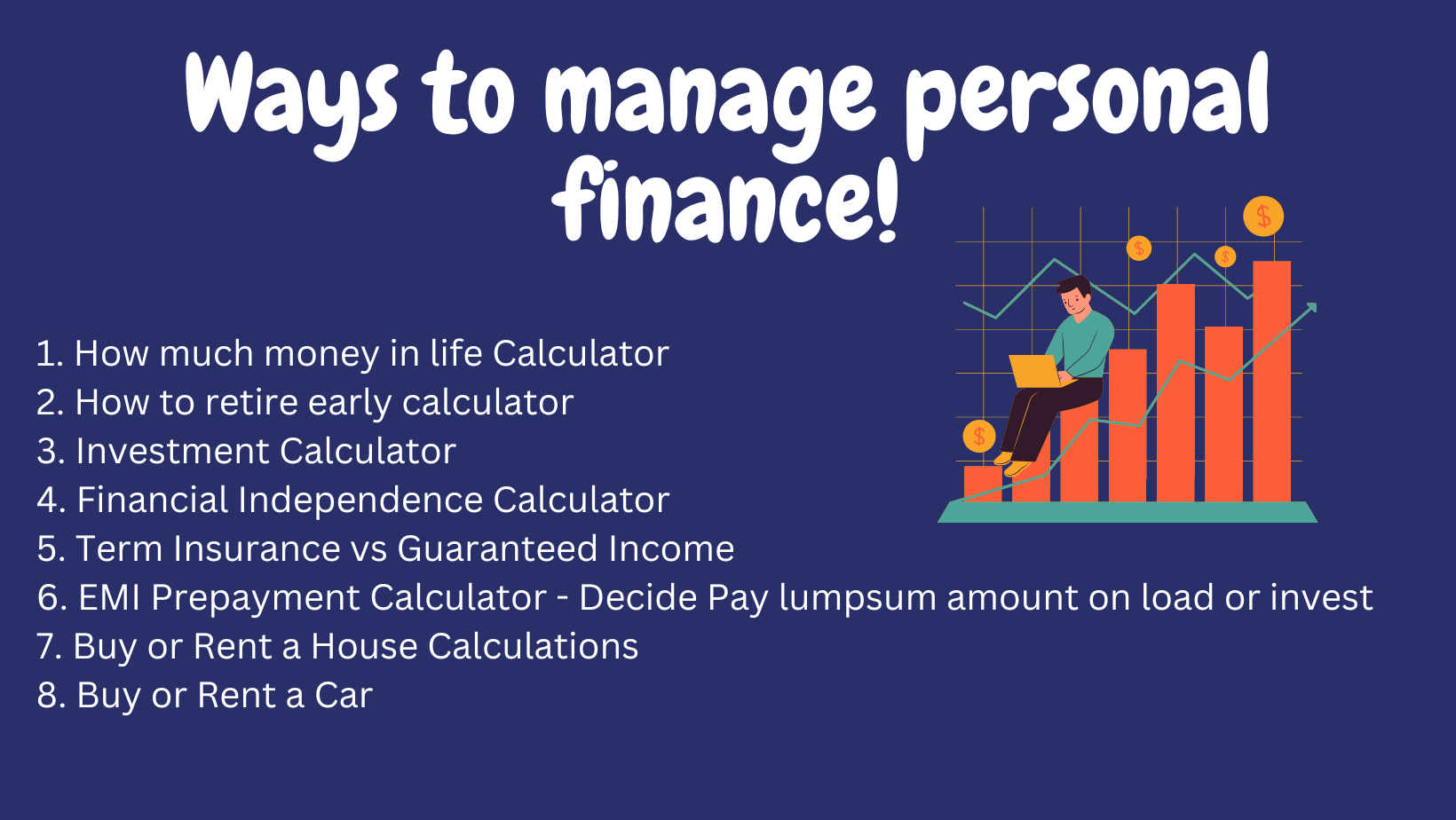

Visual Treat: Saving Success!

Just like this image, your finances can bloom beautifully! It all starts with a little planning and a healthy dose of reality-checking. Remember, you don’t need to give up your lattes—just think of them as an occasional treat instead of a daily ritual.

Step 3: Track Your Progress Like an Olympic Relay

Once you start saving and budgeting, it’s crucial to keep an eye on your progress. Visualize it! Create graphs, charts, or even a scrapbook if you are feeling particularly artistic. Celebrate milestones; they’re just as important as the finish line. It’s not about perfection but about improvement!

Now, let’s take a moment to address the elephant in the room—the emergency fund. If you don’t have one yet, you should! It’s like a safety net for your finances. Unexpected expenses pop up all the time, like that tricky squirrel that pops into your yard when you’re having a picnic. Keep a stash of cash so you’re never caught off guard. Plus, it gives you peace of mind!

How to Manage Your Personal Finance: Spending Wisely and Reveling in Living

Now that we’ve discussed savings, budgets, and the lovely safety net of an emergency fund, let’s chat about spending wisely. While it’s easy to stare longingly at the latest gadgets or designer bags, remember that every time you spend, you’re choosing to invest in something. Ensure your choices align with your values—would you rather have that snazzy gadget or the experience of a weekend trip with friends? With each decision, ask yourself what will bring you more joy.

Revising Your Outgoing

Regularly revising your outgoing expenses can help you determine where you might be leaking money like an old faucet. Consider subscriptions you may not use (I’m looking at you, gym membership alleys in the corner of the internet!) or those automatic payments to those ‘that’ll only be $5’ apps that turned into $50 a month. If you’re not using it, toss it like a fake invite to a dull party!

Confessions of a Personal Finance Explorer

It’s time to reveal my biggest secret: investing isn’t just for the Wall Street wizards in suits. Anyone can invest; even you can learn how to manage your personal finance in this arena. Start small; even a few bucks can yield returns over time. Just keep in mind that investing can be just as risky as trying out that spicy dish you saw online—you want to taste success, not regret!

And don’t forget, friends are worth investing in, too: plan a potluck dinner where everyone brings a dish! This way, you can enjoy great food while keeping your finances in check!

Getting the Whole Picture

To wrap it all up, managing personal finances is like a journey of self-discovery. You laugh, you cry, and every now and then, you find a forgotten $20 bill in your jacket pocket. Remember to check in with yourself regularly and ensure your financial goals are still aligned with your life goals.

In conclusion, how to manage your personal finance isn’t just about crunching numbers. It is about living the life you want while ensuring your wallet doesn’t feel as light as a feather! So go forth, plan ahead, save a little, and most importantly—enjoy the journey. Happy saving!