In today’s fast-paced business world, effective financial management is crucial for success. Entrepreneurs and business owners often find themselves navigating a complex landscape of expenses, revenues, and investments. Managing business finances can seem daunting, but with the right approach, it can be simplified into actionable steps that ensure your financial health. Let’s delve into some essential strategies to help you manage your business finances easily and effectively.

Understanding the Basics of Managing Business Finances

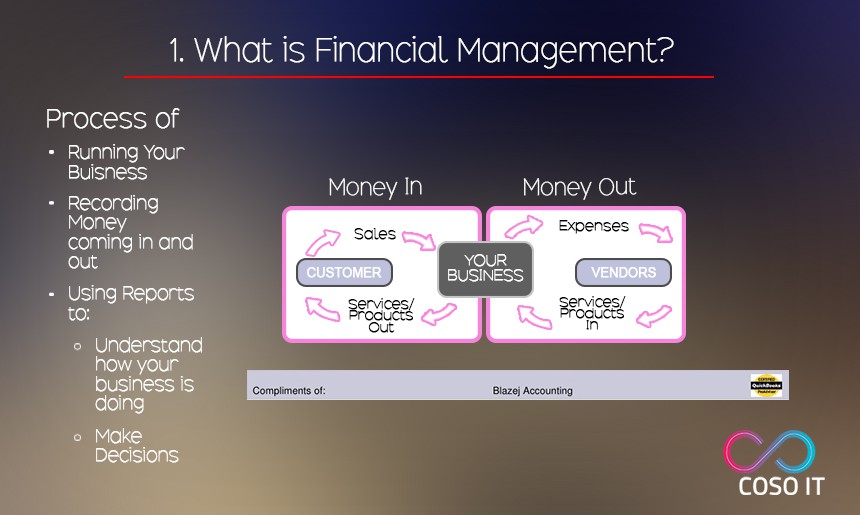

Before we dive into the practical steps, it’s important to grasp the fundamental concepts that underpin effective financial management. Managing business finances begins with understanding the flow of cash, budgeting, and maintaining accurate records. These elements are the foundation upon which all other financial decisions are made.

Establish a Solid Budget

The first step to managing business finances is creating a comprehensive budget. A budget serves as a financial roadmap that helps you plan for future expenses and allocate resources accordingly. Here are some steps to create an effective budget:

- Estimate your income: Consider all possible revenue streams and project your earnings for the upcoming period.

- List all expenses: Include both fixed costs (like rent and utilities) and variable costs (such as marketing and supplies).

- Set financial goals: Determine what you want to achieve financially, such as increasing savings, reducing expenses, or funding growth initiatives.

- Review and adjust regularly: A budget is not static; it should be revisited and adjusted based on actual performance and changing circumstances.

A Financial Snapshot: Managing Business Finances with a Balanced Sheet

Understanding your financial position is an integral part of managing business finances. One effective way to visualize your business’s financial health is by creating a balance sheet. This sheet provides a snapshot of your assets, liabilities, and equity at a specific point in time. You can gauge your ability to settle debts, strategize for future investments, and ultimately make informed decisions about your finances.

Track Your Cash Flow

Cash flow management is another critical component of managing business finances. It’s essential to ensure that your business has enough liquidity to meet its short-term obligations. Consider these tips for effective cash flow management:

- Monitor your cash inflows and outflows: Utilize accounting software or spreadsheets to track your daily cash transactions.

- Implement prompt invoicing: Encourage clients to pay promptly by sending invoices quickly after a service or product is delivered.

- Forecast your cash needs: Anticipate future cash requirements to avoid shortfalls. This can include seasonal fluctuations or unexpected expenses.

- Build a reserve: If possible, set aside a cash reserve to navigate financial challenges without resorting to credit options.

The Importance of Accountability in Managing Business Finances

Accountability in financial decision-making can make a significant difference when it comes to managing business finances. Establishing a system for tracking and reviewing your financial practices fosters an environment of responsibility and transparency. Below are some methods to promote accountability:

- Regular financial reviews: Conduct monthly or quarterly reviews of your financial statements to assess progress towards your goals.

- Engage your team: Involve team members in financial discussions. Their insights and contributions can lead to more informed decision-making.

- Seek professional advice: Consulting with financial advisors or accountants can provide valuable guidance and ensure compliance with regulations.

Visualizing Financial Health: Managing Business Finances with Reports and Analytics

Tracking financial performance is essential for effective management. Leverage tools that allow you to generate reports and perform analyses on your financial data. This practice not only enhances your understanding of your business’s financial position but also aids in making strategic decisions based on factual insights. Below is an illustrative snapshot of a report we recommend:

Monthly Financial Reports

A monthly financial report provides an overview of your business’s financial activities. Include the following elements in your report:

- Profit and loss statement: A summary of revenues, costs, and expenses during the specified period.

- Balance sheet: As previously discussed, showing your business’s financial position.

- Cash flow statement: Details the inflow and outflow of cash over the month.

Reinforcing Financial Literacy Among Team Members

One of the often-overlooked aspects of managing business finances is the need for financial literacy among employees. A team that understands the financial dynamics of your business can contribute more effectively to your financial goals. Here are some ideas to promote financial literacy:

- Provide training and workshops: Invest in workshops that cover budgeting, financial record-keeping, and cash flow management.

- Encourage discussion: Foster an environment where employees feel comfortable discussing financial matters and asking questions.

A Holistic Approach: Managing Business Finances for Long-Term Success

Managing business finances is not just about keeping the books balanced; it involves a holistic approach that considers future growth, sustainability, and adaptability. Business owners should aim for a balance between the present needs and future aspirations. Embrace flexibility in your financial strategy to navigate challenges swiftly.

Moreover, consider the impact of external factors such as market trends, consumer behavior, and economic changes. Being adaptable and responsive can set your business apart from competitors and lead to long-term sustainability.

Utilizing Technology for Efficient Financial Management

In our technology-driven world, leveraging financial management tools can significantly ease the burden of managing business finances. Invest in accounting software that automates processes, generates reports, and improves accuracy. Technologies like cloud computing offer real-time access to your financial data, facilitating better decision-making.

Maximizing Efficiency in Managing Business Finances

By implementing these tools, not only do you enhance efficiency, but you also free up time to focus on other critical aspects of your business.

Final Thoughts on Managing Business Finances

In conclusion, managing business finances doesn’t have to be a complex task. By establishing clear budgets, tracking cash flow, and fostering an accountable financial environment, you can simplify financial decision-making. Embrace education, technology, and strategic foresight as you navigate the financial waters of entrepreneurship. With determination and the right practices, you’re well on your way to mastering the art of managing business finances and steering your business toward success.

Remember, the key to effective financial management lies not just in following guidelines but in adapting and evolving those practices as your business grows and changes. Happy managing!