In today’s fast-paced world, managing personal finances can often feel overwhelming. However, with the right tools, budgeting and tracking expenses can become straightforward and efficient. One such tool that has gained recognition for simplifying the process is Microsoft’s ‘Money in Excel.’ This powerful feature integrates with Excel and offers a comprehensive way to manage your personal finances. In this article, we will explore practical strategies and tips on how to manage personal finances in Excel, allowing you to take control of your financial future.

Understanding ‘Money in Excel’ and Its Benefits

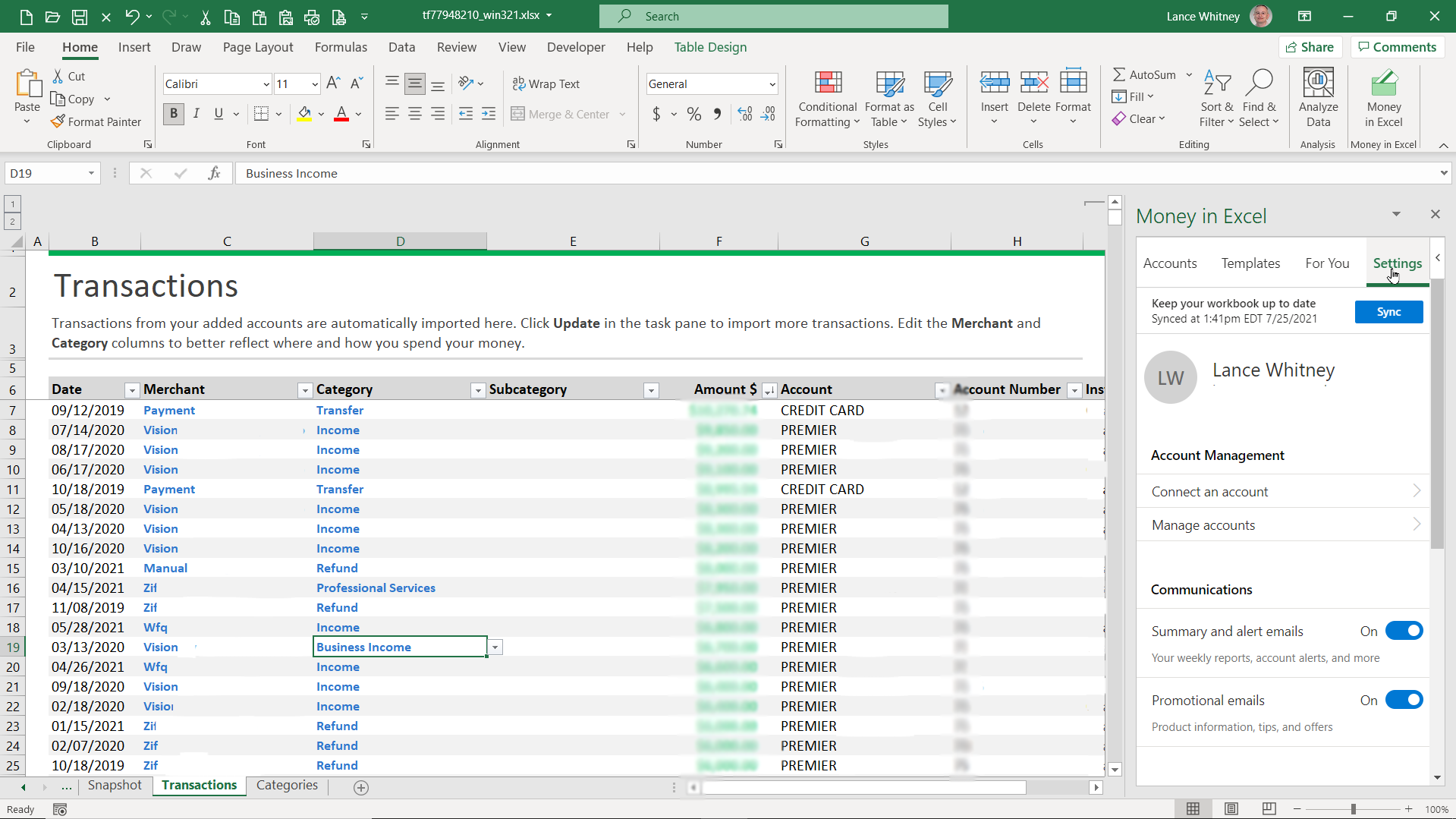

Microsoft’s ‘Money in Excel’ is a robust financial management tool designed for users who want to take charge of their financial situation. This tool allows users to link their bank accounts and credit cards and automatically download transactions into an Excel spreadsheet. Such functionality not only saves time but also provides a clear view of income and expenses, which is critical in understanding your financial health. By learning how to manage personal finances in Excel using this tool, users can achieve more organized budgeting, better expense tracking, and ultimately, informed financial decisions.

Setting Up ‘Money in Excel’

To begin your journey in mastering how to manage personal finances in Excel, you must first set up ‘Money in Excel.’ If you are an Excel subscriber, this feature can be accessed through your Microsoft 365 subscription. Installation and setup are straightforward:

- Open Excel and look for the ‘Money in Excel’ template in the template gallery.

- Download and install the template, which integrates seamlessly into your Excel environment.

- Link your bank accounts and credit card accounts following the prompts provided in the template.

Tracking Expenses Effectively

Once you’ve set up ‘Money in Excel,’ it’s time to harness its full potential by effectively tracking your expenses. The ability to categorize and analyze spending patterns is one of the key advantages of this tool. It allows you to establish a clear understanding of where your money goes each month. Here are some steps on how to manage personal finances in Excel by tracking expenses:

- Utilize the categorization feature to organize your transactions. Common categories include groceries, housing, transportation, and entertainment.

- Set monthly spending limits for each category, which can help you stay within your budget.

- Regularly review your spending against your budget. This will help you identify any areas where you may be overspending and need to adjust.

Visualizing Your Finances

A crucial part of managing personal finances is visualization. ‘Money in Excel’ allows you to create visual representations of your financial data, enhancing your understanding of your financial situation. Visual aids like graphs and charts can highlight your spending habits over time and provide insights into your financial progress. Using Excel’s built-in charting tools, you can transform data into informative visuals:

Creating Spending Graphs

Follow these steps to visualize where your money is going:

- Select the data range for your expenses.

- Navigate to the ‘Insert’ menu and choose the type of chart that best represents your spending data (pie charts, bar graphs, etc.).

- Customize your charts by adding titles and labels, which can provide context for the data being displayed.

Budgeting Using ‘Money in Excel’

Budgeting is a critical element of personal finance management. With ‘Money in Excel,’ you can streamline the budgeting process significantly. By already having your expenses and income imported into the spreadsheet, budgeting becomes less of a chore and more of a straightforward task. Here’s how you can establish a functional budget:

- List all sources of income and all expected expenses for the month.

- Compare total income versus total expenses to identify potential surpluses or deficits.

- Adjust your budget to ensure that your expenses do not exceed your income.

Setting Financial Goals

Another essential aspect of how to manage personal finances in Excel is setting financial goals. Whether it’s saving for a vacation, purchasing a new car, or planning for retirement, having clear financial goals is paramount. With the insights gained from ‘Money in Excel,’ you can create actionable plans to achieve these goals:

- Identify your financial goals and quantify how much money you need to reach them.

- Use your expense data to identify areas where you can reduce spending.

- Create a savings plan in Excel that outlines how much you’ll set aside each month.

Syncing an ‘Expense Tracker’

A valuable feature of ‘Money in Excel’ is its ability to sync with various bank accounts. This means you can automatically import transactions and ensure your expense tracker is always up-to-date. To get the most out of syncing:

- Regularly check your transactions to make sure everything is correct.

- Use the reconciliation feature to compare your bank statements with your tracked expenses.

Review and Adjust Your Financial Plan

Financial management is not a ‘set it and forget it’ endeavor. Regularly reviewing and adjusting your financial plan is vital to success. Monthly or quarterly reviews of your financial goals, budget, and expense tracking will allow you to make informed adjustments. Experts recommend:

- Assess your financial position: Are your expenditures aligned with your budget? Are you reaching your savings goals?

- Identify any new areas for improvement to enhance your financial literacy.

- Adapt your financial strategies based on changes in your life circumstances or goals.

A More Advanced Approach to Managing Finances in Excel

For those looking to delve deeper into financial management, consider learning some advanced Excel features that can enhance your experience with ‘Money in Excel.’ Formulas, pivot tables, and conditional formatting can elevate your workings from simple tracking to powerful analytics. By integrating these tools, you can streamline processes like forecasting future budgets or analyzing historical spending trends.

Leveraging Formulas for Enhanced Analysis

Formulas in Excel can automate calculations to save you time. For example, use functions like SUM, AVERAGE, and IF to analyze your financial patterns rapidly. Keeping your spreadsheet dynamic means you’ll always have the latest insights into how to manage personal finances in Excel effectively.

The Road Ahead: Continuing Your Financial Education

Managing personal finances is a lifelong learning process. Continuing to enhance your understanding of financial tools, through online courses, webinars, and communities, will only strengthen your financial acumen. Moreover, engaging with peers can provide support and unique insights that can be invaluable on the journey.

As we wrap up our discussion on how to manage personal finances in Excel, remember that the goal is to develop a structured approach to budgeting, tracking, and educating oneself in the vast world of finances. With persistence and the effective use of tools like ‘Money in Excel,’ achieving financial proficiency is within reach.

Learn More: Additional Resources for ‘Money in Excel’

Start your journey today, and take control of your personal finances like never before!