When it comes to planning for retirement, making smart investment choices is crucial. With so many options available, it can be overwhelming to know where to begin. That’s why we’re breaking down some of the best investment options that can help you secure a bright and comfortable future. Let’s dive into the world of retirement investments and explore how you can make the most of your money.

Understanding Your Retirement Needs

Before we get into the nitty-gritty of investment options, it’s essential to understand your retirement needs. Consider things like your lifestyle, where you plan to live, your healthcare costs, and your desired activities during retirement. By assessing these factors, you can create a clearer picture of how much money you’ll need.

Image of Investment Options

Investing for retirement is all about making your money work for you. There are various avenues to explore, each with its own set of advantages and risks. Let’s take a look at some of the best options available to you.

Stocks: The Classic Investment

When we think of investments, stocks usually come to mind first. Buying shares in a company can yield significant returns if the company performs well. However, stocks come with volatility. It’s essential to research and select companies that align with your values and have a strong market presence. Investing in index funds or exchange-traded funds (ETFs) can also be a wise choice, offering you a diversified portfolio without you having to pick individual stocks.

Real Estate: A Solid Investment

Investing in real estate can generate passive income and build equity over time. You could buy rental properties that provide monthly cash flow or invest in real estate investment trusts (REITs) if you’re not ready to manage properties directly. The key is to assess the market carefully and ensure the property or REIT you choose has a solid history of growth.

Image of Retirement Investments

Another key aspect of real estate investment is location. Areas experiencing growth or development can lead to significant increases in property value. Always evaluate trends in employment, population growth, and local amenities when considering real estate investments.

Bonds: Stability and Security

If you’re looking for a more stable investment, bonds can be the way to go. They offer fixed interest over a specified period and can provide a steady income stream. Government bonds, municipal bonds, and corporate bonds are popular choices. While bonds typically have a lower rate of return than stocks, they are less risky and can add stability to your overall portfolio.

Mutual Funds: Professional Management

Mutual funds can be an excellent option for those who prefer a hands-off approach. These funds pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. A professional manager oversees the fund, making decisions based on market conditions and the fund’s investment objectives. This can be a smart way to invest if you want diversity without the stress of managing individual investments.

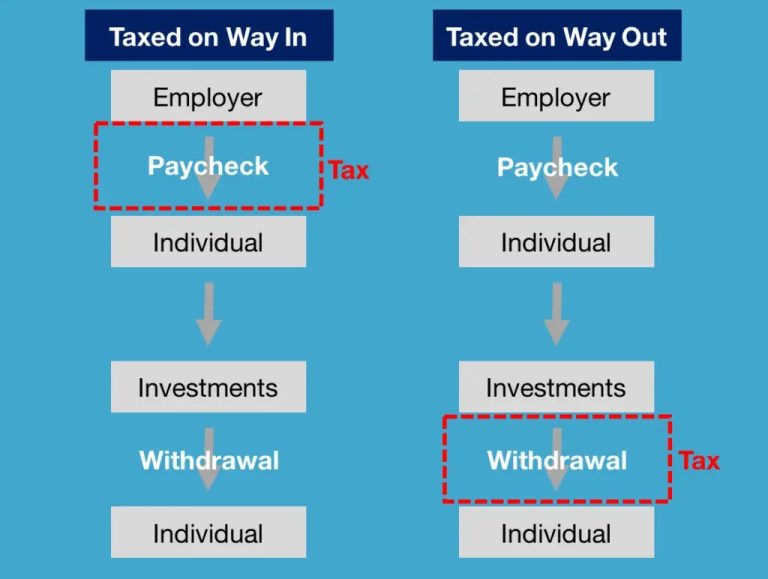

Retirement Accounts: Maximize Your Savings

Utilizing retirement accounts like 401(k)s or IRAs (Individual Retirement Accounts) is one of the best ways to save for retirement. Contributions to these accounts can often reduce your taxable income, and many employers offer matching contributions to 401(k)s, giving you free money to invest. Make sure to maximize your contributions to these accounts to get the most benefit.

Alternative Investments: Think Outside the Box

If you’re feeling a bit adventurous, consider alternative investments. These can include anything from precious metals, cryptocurrencies, to peer-to-peer lending and collectible items such as art or vintage cars. While these investments can be riskier and are less liquid, they can offer substantial returns and diversify your portfolio beyond traditional investments.

Emergency Fund: Your Safety Net

Before diving into aggressive investments, it’s smart to have a solid emergency fund. This fund, typically covering 3 to 6 months of living expenses, acts as a safety net for unexpected situations like job loss or medical emergencies. Having this fund in place allows you to take more calculated risks with your investments without fearing financial devastation.

Consult a Financial Advisor

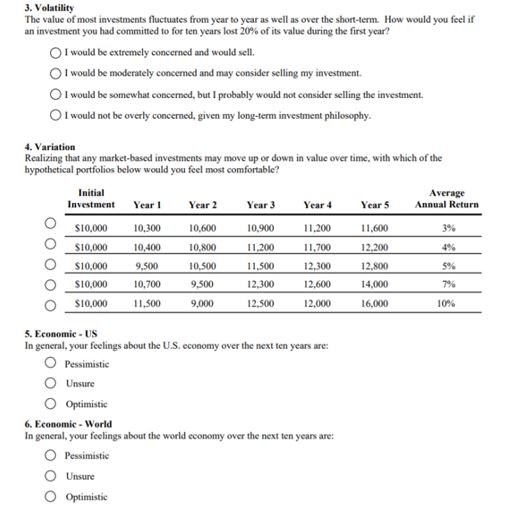

Making investment decisions for your retirement doesn’t have to be a solo mission. Consulting a financial advisor can provide valuable insights and tailor a plan that suits your individual situation. They can help you understand your risk tolerance, create a diversified portfolio, and keep you on track to meet your retirement goals.

Regularly Review Your Portfolio

As you move closer to retirement, it’s essential to regularly review your investment portfolio. The market changes constantly, and what worked yesterday may not work tomorrow. Regular evaluations allow you to adjust your investments according to your evolving needs and market conditions. Make it a habit to assess and rebalance your portfolio as required.

The Importance of Staying Informed

The world of investment is always evolving, and staying informed can give you an edge. Follow financial news, read investment books, listen to podcasts, and engage with knowledgeable individuals in the community. This knowledge can significantly impact your investment decisions and help you navigate the complexities of retirement savings.

Remember: Start Now

The best time to start investing for retirement is now. Time is your greatest ally when it comes to building wealth. The earlier you begin contributing to your retirement accounts and investments, the more you can benefit from compound interest. Don’t delay—get started today!

In conclusion, preparing for retirement requires careful thought and strategic investment choices. Whether you opt for stocks, bonds, mutual funds, or even real estate, ensure each choice aligns with your long-term goals. Set a plan, stay informed, and build a diverse portfolio that sings to your financial goals. Your future self will thank you for the hard work and smart decisions you make today!