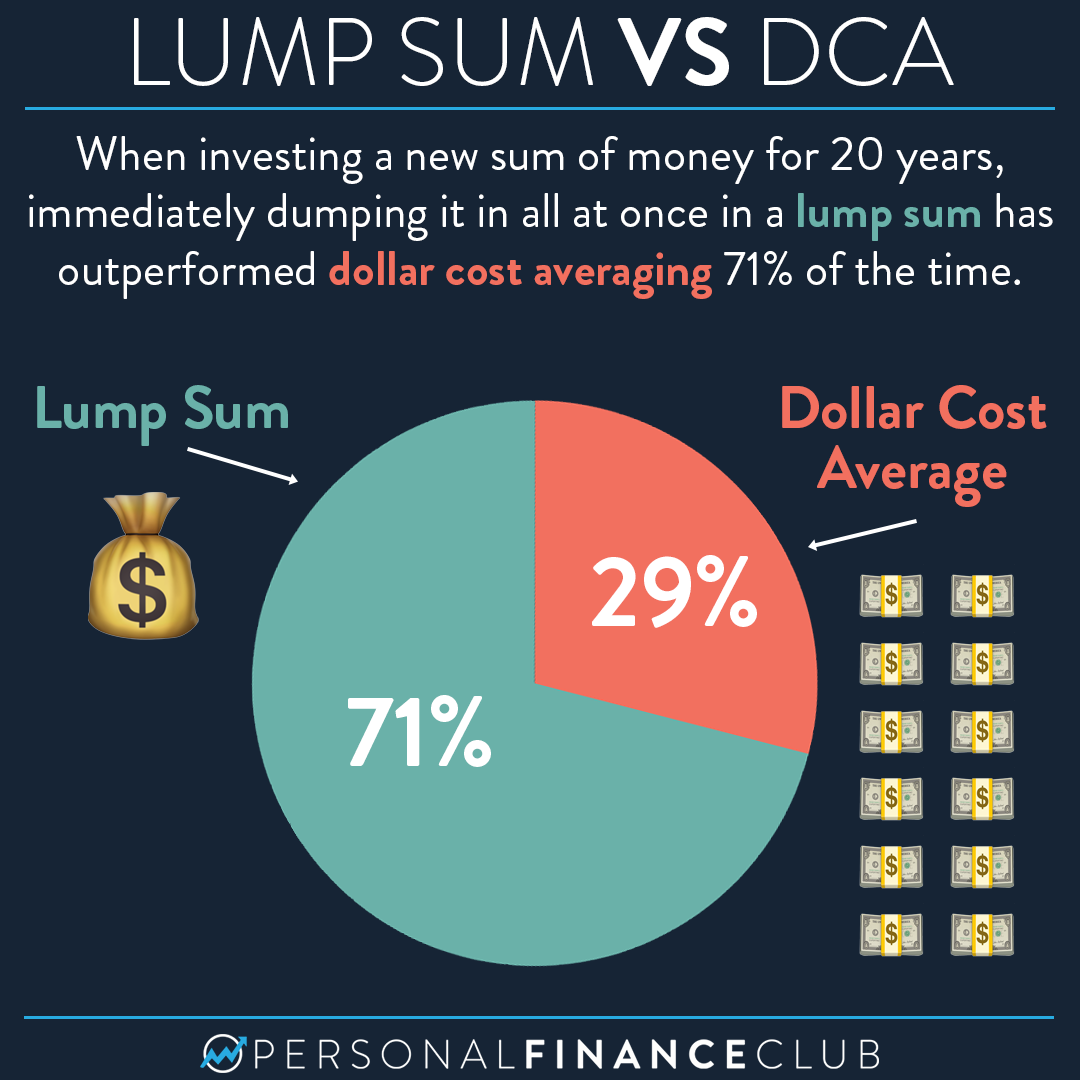

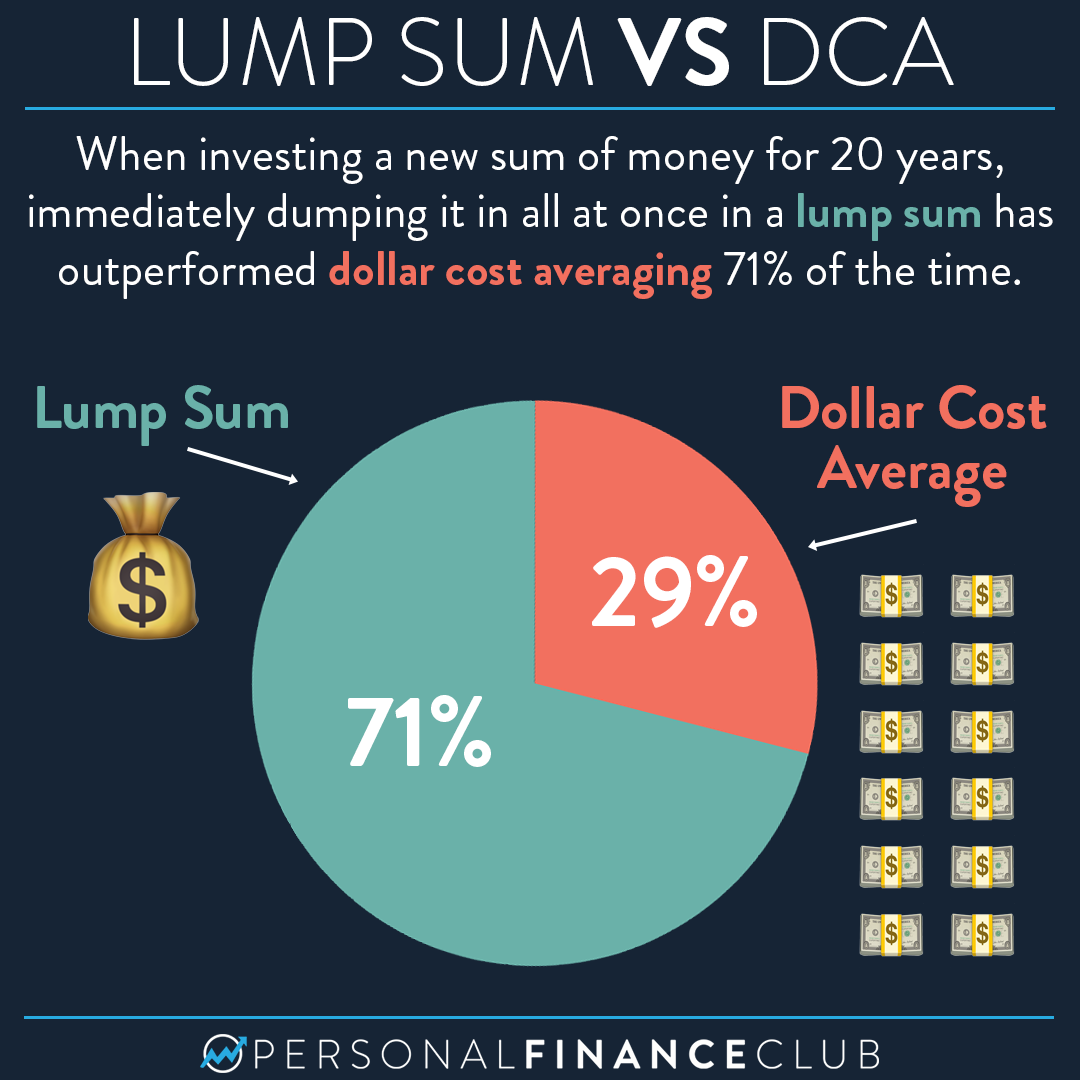

Investing can often feel like navigating a vast ocean of financial strategies, with multiple paths leading to success. Two popular methods that investors consider are lump sum investing and dollar cost averaging. In this post, we’ll explore the nuances of these approaches, comparing their advantages and potential drawbacks, while illustrating key points with relevant images.

What Performs Better: Lump Sum Investing or Dollar Cost Averaging?

Before delving deeper into the analysis, it’s essential to understand both terminologies. Lump sum investing refers to putting a large sum of money into an investment all at once, while dollar cost averaging involves investing a fixed amount at regular intervals regardless of market conditions. Each strategy has its proponents and key scenarios in which they may excel.

Understanding Lump Sum Investing

One of the primary advantages of lump sum investing is that it allows investors to take advantage of market conditions immediately. By investing a larger sum at once, there is potential for significant growth, especially if the market is on an upward trajectory. Historical data suggests that, in many cases, lump sum investing outperforms dollar cost averaging over the long term because the investment is able to benefit fully from market gains right from the outset.

However, this strategy is not without its risks. The market can be unpredictable, and investing a large sum all at once could lead to substantial losses if the timing isn’t right. Therefore, investors often need a higher risk tolerance when opting for lump sum investing. It may not be suitable for those who prefer gradual exposure to market fluctuations.

The Appeal of Dollar Cost Averaging

On the other hand, dollar cost averaging offers a more conservative approach to investing. By distributing the investment over a period, this strategy mitigates the risk associated with market volatility. When markets dip, the fixed investment amount allows investors to purchase more shares, effectively lowering their overall cost basis. Conversely, when the market is up, they may buy fewer shares, which balances out the purchasing strategy.

This approach is particularly advantageous for novice investors or those with a lower risk appetite, as it alleviates the pressure of attempting to time the market. Additionally, dollar cost averaging can help people remain disciplined about investing. This consistency can lead to habit formation, encouraging regular savings and investments over time.

When to Use Each Strategy

Choosing between lump sum investing and dollar cost averaging largely depends on personal financial situations, market conditions, and individual comfort with risk. For example, individuals who come into a significant windfall—such as an inheritance or a bonus—may consider lump sum investing to maximize early returns. Conversely, those with smaller, recurring income sources might find it easier to commit to dollar cost averaging, aligning their investment strategy with their budgeting practices.

Market conditions also play a critical role in determining which strategy might be better suited for a given investor. If the market is experiencing a significant downturn, dollar cost averaging might offer the advantage of buying at lower prices—potentially increasing future returns when the market recovers. Yet, if the market is on a steady incline, lump sum investments could be more lucrative.

The Psychological Factor

Psychology plays a significant role in personal finance. Emotions can drive decision-making, sometimes leading to poor investing choices. Lump sum investing can provoke anxiety, particularly if an investor worries about market timing. In contrast, dollar cost averaging might provide peace of mind since the investment is spread out over time, allowing the investor to avoid making impulsive decisions based on short-term market fluctuations.

Conclusion: Finding the Right Strategy for You

Ultimately, the decision between lump sum investing and dollar cost averaging should be based on individual financial goals, risk tolerance, and market conditions. Many seasoned investors suggest a hybrid approach, employing elements of both strategies based on specific circumstances. For example, one might invest a portion of their capital as a lump sum while dollar cost averaging the remaining balance over time. This combination can help to balance immediate market opportunity with the security of gradual investment.

As you consider your investment strategy, keep in mind that financial markets are constantly evolving. Staying informed about market trends, personal financial goals, and economic conditions can guide you towards making the best choice for your financial future. Whether you choose to invest all at once or spread your investments over time, remember that the most critical factor is to start investing as soon as you can to leverage the power of compounding returns over the long term.

In a world where investing can often feel overwhelming, understanding the options available to you is empowering. Whether it’s through lump sum investments or dollar cost averaging, the important thing is to make informed decisions that align with your financial aspirations and comfort level. With patience and a thoughtful approach, you can navigate the complexities of investing and work towards achieving your financial goals.