Building long-term wealth is a goal that many individuals strive to achieve. It requires a well-thought-out strategy, disciplined investing habits, and an understanding of various market dynamics. In this article, we delve into essential tips and insights that can guide you on your path to financial success. We will also explore some visual representations that can enhance your understanding of long-term investing. Here are some valuable tips and resources to help you build your wealth effectively.

1. Start Early

One of the most pivotal factors in wealth accumulation is the time you allow your investments to grow. The earlier you start investing, the more time your money has to compound. Even small contributions can lead to significant growth over time due to the power of compounding interest.

2. Diversify Your Investments

Diversification is a crucial strategy for minimizing risk in your investment portfolio. Spreading your investments across various asset classes—such as stocks, bonds, real estate, and commodities—can protect your portfolio from volatility in any single asset class. A well-diversified portfolio not only mitigates risks but can also optimize returns.

3. Educate Yourself

Understanding the principles of investing is key to successfully building long-term wealth. Take the time to read books, attend workshops, or follow reputable financial news sources. Knowledge empowers you to make informed investment decisions and adapt to the market.

4. Set Clear Financial Goals

Setting specific, measurable, achievable, relevant, and time-bound (SMART) financial goals will help you maintain focus and motivation. By clearly defining your financial objectives, you can create a tailored investment strategy that aligns with your aspirations.

5. Maintain a Long-Term Perspective

The financial markets are subject to fluctuations, but maintaining a long-term perspective can help you navigate the ups and downs. Avoid making impulsive decisions based on short-term market trends. Instead, focus on your long-term investment strategy and be patient.

6. Invest Regularly

Consider adopting a systematic investment approach, such as dollar-cost averaging, where you invest a fixed amount regularly. This strategy can help reduce the impact of market volatility and lower the average cost of your investments over time.

7. Review and Adjust Your Portfolio

Regularly reviewing your investment portfolio is vital to ensure it aligns with your financial goals and risk tolerance. Rebalancing your portfolio as needed will help you maintain the desired asset allocation and adapt to changes in market conditions.

8. Be Mindful of Fees

Investment fees and expenses can erode your returns over time. Be aware of the costs associated with different investment vehicles and seek low-cost options like index funds or exchange-traded funds (ETFs) to maximize your investment growth.

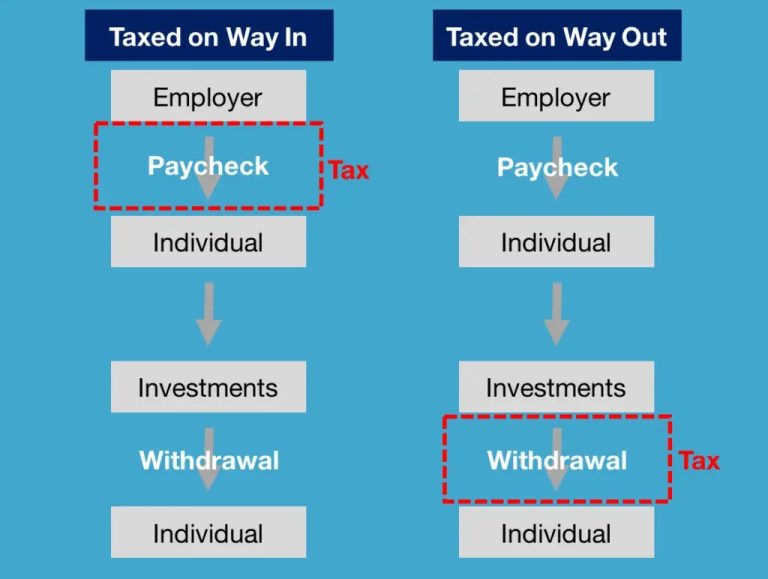

9. Understand Tax Implications

A comprehensive understanding of the tax implications of your investments is essential for optimizing your returns. Familiarize yourself with capital gains taxes, tax-advantaged accounts, and strategies for tax-efficient investing.

10. Stay Disciplined

Emotional decision-making can lead to costly mistakes in investing. Stick to your investment plan and resist the temptation to react to market noise. Staying disciplined will ultimately serve your long-term wealth-building goals.

11. Seek Professional Advice

If you are uncertain about where to start or how to develop your investment strategy, consider consulting a financial advisor. A professional can provide personalized guidance and help you navigate the complexities of the investment landscape.

12. Monitor Economic Trends

Staying informed about economic trends and market conditions will help you make proactive investment decisions. Understanding factors such as interest rates, inflation, and economic growth can provide valuable insights into potential investment opportunities.

In conclusion, building long-term wealth isn’t just about the investments you make; it’s also about understanding your financial goals, adopting a strategic mindset, and maintaining disciplined investment habits. By following these tips and leveraging the resources available, you can take significant steps toward achieving financial independence and security.

Remember, investing is a journey. Embrace the learning process, stay committed to your goals, and keep an eye on the horizon for future opportunities. Your consistent efforts will pay off in the long run, paving the way for a prosperous financial future.