Hey fam, let’s talk about something that can seriously change the game for our futures: investment accounts. There’s a lot of info out there and it can be a bit overwhelming, but we gonna break it down nice and simple. Whether you’re looking to save for retirement, buying a house, or just want your money to work harder for you, understanding these accounts is key. Let’s get into it, shall we?

Types of Investment Accounts – Just Start Investing

First off, we have various types of investment accounts available to us, and knowing which one suits your needs is crucial. You might’ve heard of these accounts: taxable brokerage accounts, retirement accounts like IRAs, and even Education Savings Accounts (ESA). Each has its own set of rules, tax implications, and benefits. Understanding where and how to put your money can make a big difference in the long run.

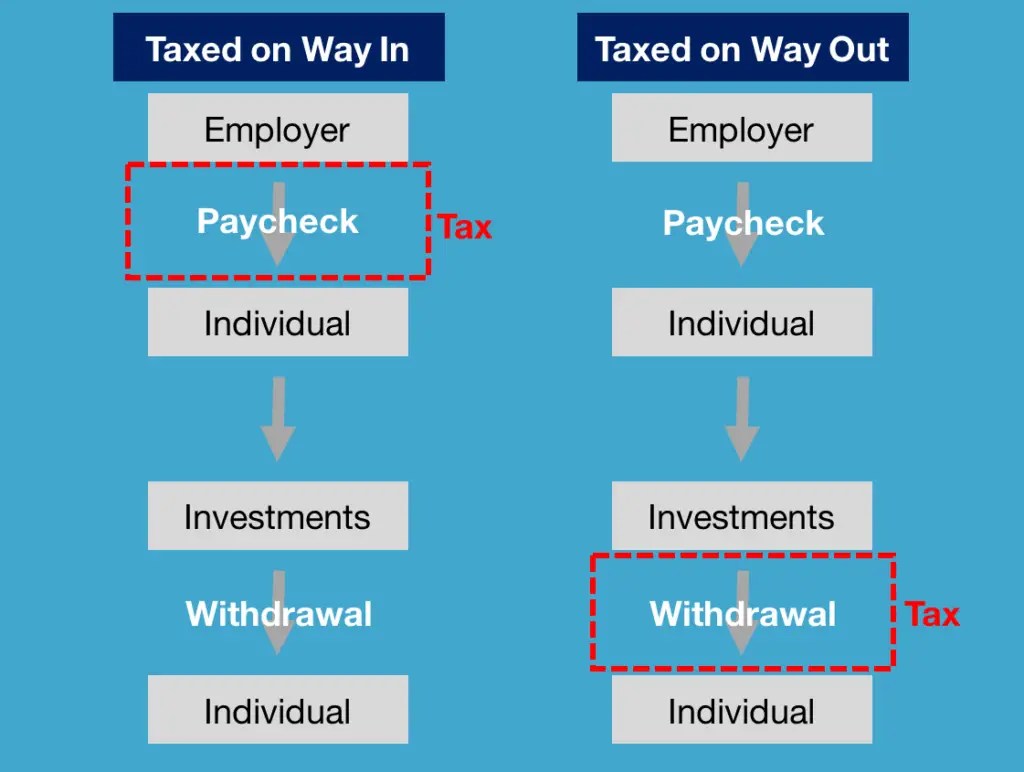

Let’s briefly touch on the key types. A taxable brokerage account is great for those looking for flexibility. You can buy and sell investments as you wish, but you’ll have to pay capital gains taxes on any profits. On the other hand, retirement accounts like a 401(k) or an IRA allow your money to grow tax-deferred until you retire, which is a significant boost.

Lastly, if you’re planning on educational expenses for the little ones, think about opening a 529 college savings plan or an ESA. Both allow you to invest with tax advantages for future educational costs. Knowing the right account type for your situation can help you maximize your savings and investments!

Unlock More Possibilities for Your Future. Open a Fidelity IRA and

Now, let’s get real about IRAs — Individual Retirement Accounts. They are super important if you’re serious about building a nest egg for the future. You have two main flavors: Traditional and Roth. A Traditional IRA lets you put money in before taxes, which means you can lower your taxable income today. But, you’ll pay taxes when you withdraw the cash in retirement.

On the flip side, a Roth IRA is funded with after-tax dollars, which means when you take money out in retirement, it’s all yours — tax-free! This can be very beneficial, especially if you expect to be in a higher tax bracket during retirement. Whichever route you choose, starting an IRA is like laying the foundation for a solid financial future.

Additionally, opening an IRA with a reputable company like Fidelity can simplify the process. They provide tools to help you learn and plan your investments wisely. It’s like having a financial coach by your side while you navigate this journey.

Investing isn’t just for the wealthy; it’s for anyone who wants to improve their financial literacy and secure their financial future. Each step you take by educating yourself and making informed decisions helps you be proactive rather than reactive with your money.

Moreover, remember that starting early is key. Time is one of your greatest allies when it comes to investing. The earlier you start, the more you benefit from compound interest. That’s when your money earns money. Let me break it down; if you invest a small amount consistently over the years, it could turn into a substantial amount by the time you need it.

Think of it as planting a seed. If you water it and give it sunlight, eventually, you’ll have a beautiful tree. So don’t wait until tomorrow. The best time to plant a tree was 20 years ago. The second-best time is today!

Lastly, let’s not forget the importance of educating ourselves about personal finance. There are countless resources, blogs, podcasts, and workshops available. Pick up a few books on investing and finance. Knowledge is power, and the more you learn, the better choices you’ll make for your money.

In conclusion, navigating the world of investment accounts doesn’t have to be daunting. By understanding the different types of accounts available and starting your journey with a solid IRA or brokerage account, you’re taking the first essential steps towards securing your financial future. Keep learning, stay proactive, and don’t forget that every little bit helps. Your future self will thank you!