Embarking on the journey of personal finance can be daunting, especially for beginners. With so much information out there, where do you even start? Understanding how to manage your finances is crucial to achieving your financial goals and securing your future. That’s why I’ve gathered some tried-and-true personal finance tips that will set you on the right path. Let’s dive in!

10 Personal Finance Tips to Start Your Journey

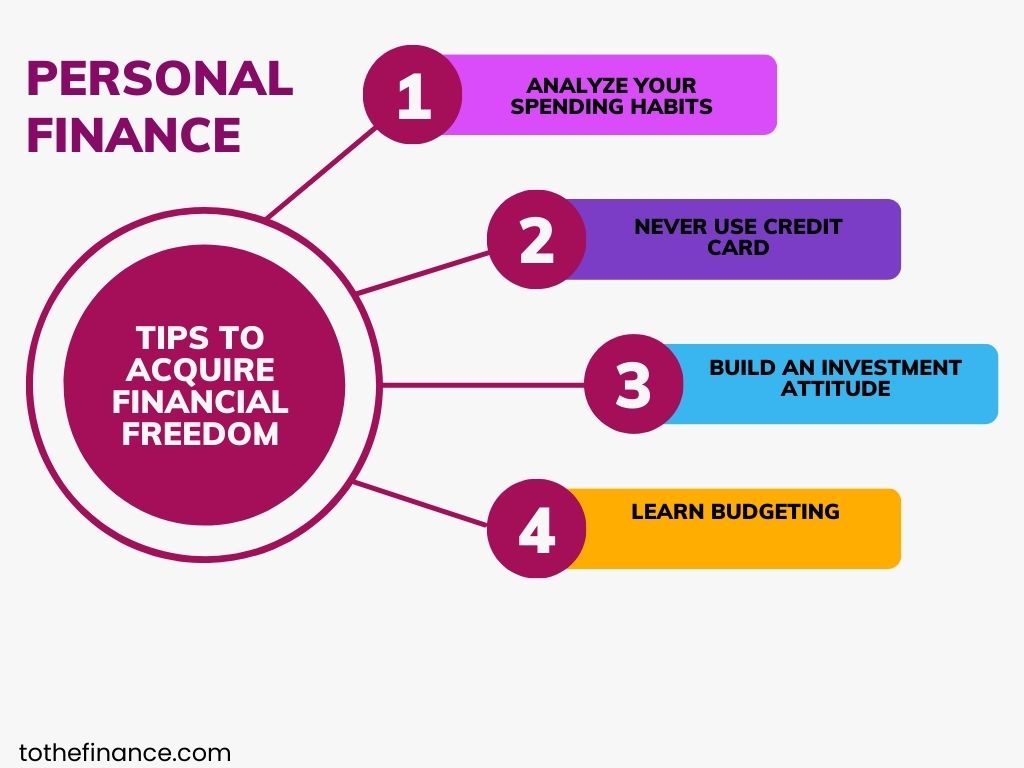

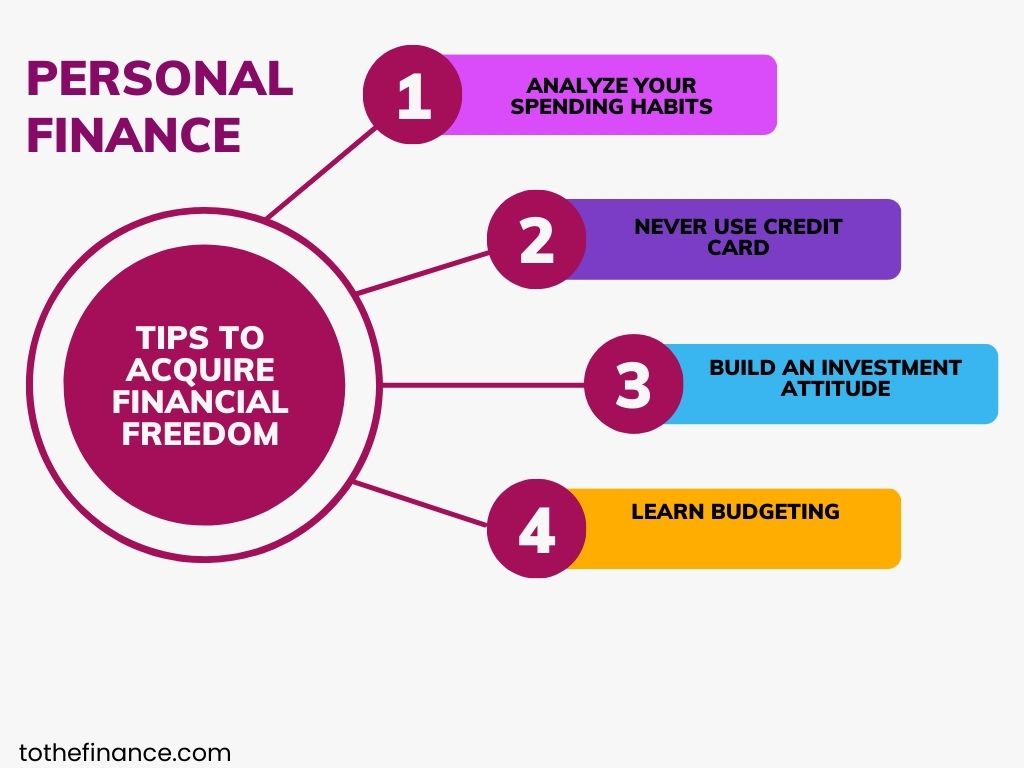

This visual encapsulates the essence of what you need to know about managing your finances more effectively. Remember, it’s not just about saving money, it’s about making your money work for you.

1. Set Clear Financial Goals

The first step in any finance journey is establishing clear financial goals. Whether you want to save for a home, pay off student loans, or build a retirement fund, having specific targets can keep you motivated. It helps you focus your attention on what’s really important, allowing you to allocate your resources effectively.

2. Establish a Budget

Creating a budget may seem daunting, but it is one of the most essential personal finance tips you’ll ever encounter. A budget helps you track your income and expenses, ensuring you’re living within your means. Start by tracking your spending for a month, categorize your expenses, and see where you can cut back. Remember, the goal is to allocate funds toward your savings and financial goals.

3. Build an Emergency Fund

An emergency fund is vital for financial security. Aim to save at least three to six months’ worth of living expenses. This fund should be easily accessible and reserved solely for unforeseen expenses such as medical emergencies or job loss. It is one of the best ways to prevent going into debt when life throws unexpected challenges your way.

4. Pay Off Debt Strategically

If you have debt, it’s crucial to create a strategy to pay it off. Focus on high-interest debt first, such as credit card balances, while making minimum payments on others. Consider tactics like the snowball method or avalanche method to stay motivated and effectively tackle your debt. Reducing debt will free up cash that can be reallocated toward savings or investments.

5. Understand the Basics of Investing

Investing is a powerful tool to grow your wealth over time. You don’t need to be a financial expert to start investing; just be sure to educate yourself about the basics. Learn about stocks, bonds, mutual funds, and real estate, and find an investment strategy that aligns with your financial goals and risk tolerance. Investing early, even in small amounts, can lead to significant returns over time.

6. Take Advantage of Retirement Accounts

It’s never too early to start saving for retirement. Take advantage of employer-sponsored retirement plans, such as a 401(k), especially if they offer matching contributions. This is essentially free money! Additionally, consider opening an Individual Retirement Account (IRA) to explore further tax-advantaged savings options.

7. Keep Your Credit in Check

Your credit score plays a big role in many financial aspects of your life, from loan approvals to interest rates. Regularly check your credit report, pay bills on time, and keep your credit utilization low. Establishing a good credit score will help you save money in the long run.

8. Educate Yourself on Personal Finance

Knowledge is power when it comes to personal finance. Regularly read articles, watch videos, and listen to podcasts about managing money. Consider seeking advice from reliable financial sources. The more you know, the better prepared you will be to make informed financial decisions.

9. Review Your Financial Situation Regularly

Life is constantly changing, so it’s essential to review your financial situation regularly. Are you on track to meet your financial goals? Are your spending habits changing? Schedule a monthly check-in to adjust your budget, track your progress toward your goals, and make any necessary adjustments.

10. Surround Yourself with Financially Savvy People

Finally, the people you surround yourself with can impact your financial habits. Engage with financially responsible individuals who prioritize saving and investing. You can learn a lot just by observing how they handle their finances and can gain encouragement on your journey as well.

With these 10 personal finance tips in mind, as daunting as it may seem, remember that every little step you take enhances your financial well-being. The journey to financial literacy is ongoing, and each decision helps shape your future. Commit to continually learning and adapting, and you’ll find your finances increasingly under control. Good luck on your financial journey!